Breakout Trading and Fake Out Trading: Trading breakouts may be a popular and viable trading strategy. However, as all breakout traders are aware, some breakouts won’t materialize, and the switch bent is fake or false breakouts. This can be quite frustrating, to not mention it can often end in a losing trade.

But repeatedly, a talented trader can sense what’s happening behind the scenes and react quickly to the present sort of situation within the market. False breakouts and fake outs can be profitable setups when you know how to trade them.

Breakout Trading:

As technical analyst, we keep watch on price movement and when a price reach or crosses a specific level such as support and resistance level or pivot points, trend lines, etc. Is called breakout in technical terms. Traders use this breakout to enter into a market that signals current continues in the breakout direction.

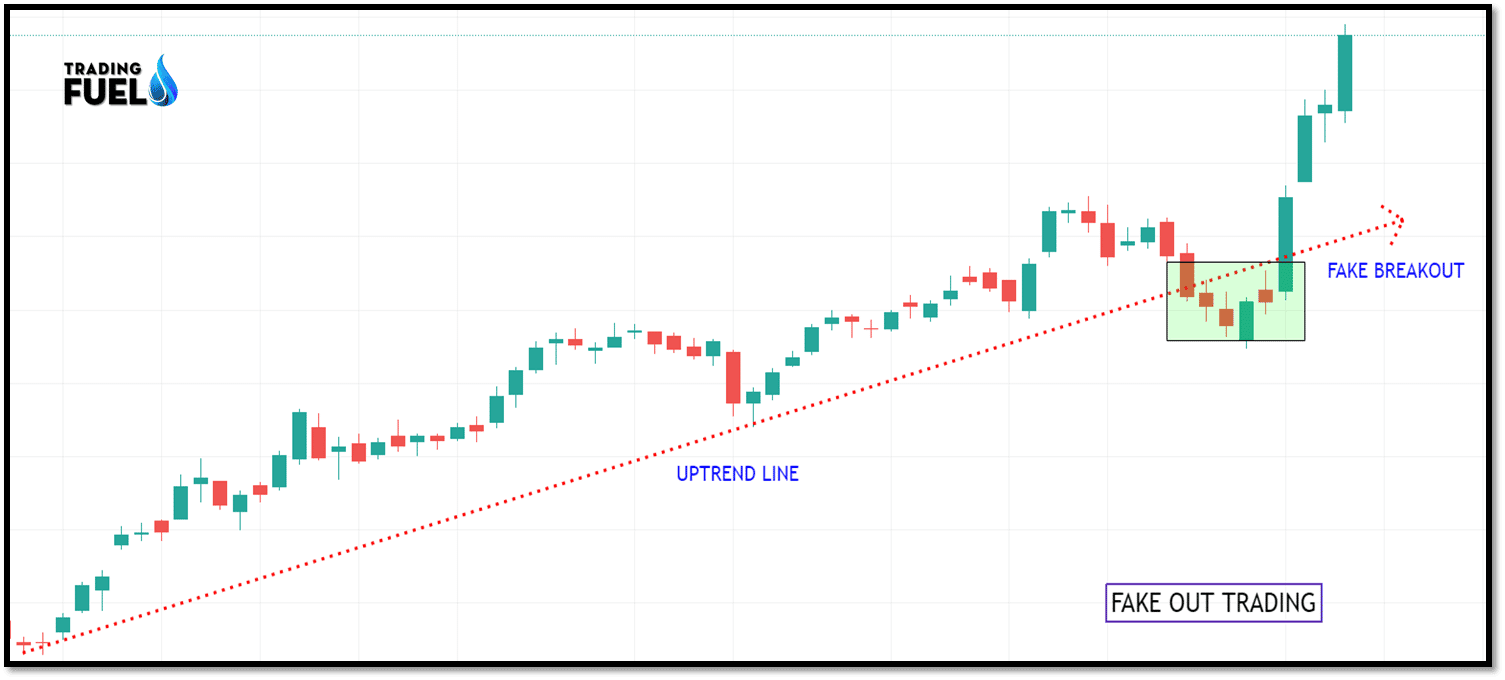

Fake Out Trading:

Fake-out occurs when the price breaks or crosses some specific level (support, resistance, triangle, trend lines, etc.) but doesn’t continue to accelerate in the breakout direction.

For breakout traders there are two main types of breakout:

- Continues breakout

- Reversal breakout

Breakout will help you to capture the big picture of the market. Breakout is very important because they indicated a change in sentiment of traders that affects supply and demand and results move in either direction.

Breakout Trading: What are False Breakouts?

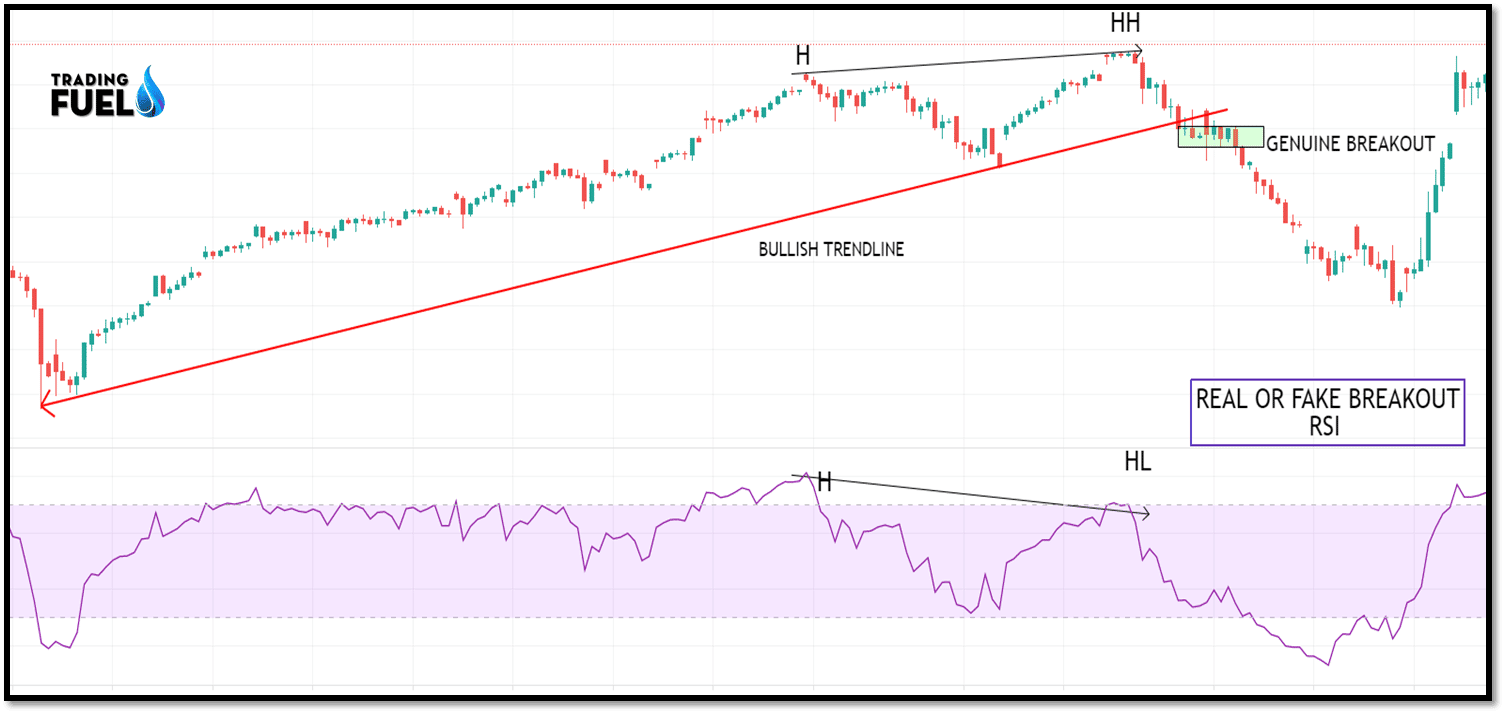

False Breakouts are occurrences on the chart when the price breaks a support/resistance level and begin its move, but then suddenly changes direction and begins a new trend in opposite direction.

When the initial breakout occurs in the share, many traders rushed to enter the trade in the direction of the breakout.

These traders become trapped when price reverses, resulting in a cascade of stop-loss orders being triggered.

The Power of the fake-out Pattern:

After you have been on the wrong side of a breakout a few times, you should begin to realize that these fake-out formations can provide high-quality tradable opportunities. If you manage to spot a false break on the chart, then you’ll cash in on those opportunities and position yourself for the reversal leg.

Some traders design their entire trading strategy around these sorts of scenarios because they are often a really powerful trading approach. Some of the simplest trades occur when market players become trapped and start to hide their losing trades.

So, if the false breakout is to the upside, you can short on the assumption that a pullback in a bearish direction is on its way. Contrary to the present, if the false breakout is to the downside, then the expected pullback is going to be bullish, creating an extended opportunity on the chart.

How to Identify False Breakout Trading Patterns:

If you don’t find out how to spot a false breakout properly, you won’t be ready to trade them profitably. for instance, there’ll be times once you misread the worth action for a false break and price returns back to the breakout point only to verify the initial breakout and continue within the direction of that initial breakout.

One way to spot false breakouts is by keeping an eye fixed on the trading volume. Real breakouts are usually amid strong trading volume readings within the direction of the breakout. When this volume is absent, there’s a better chance of the breakout not materializing. So if the trading volume is low or decreasing during a breakout, then you’re probably watching a breakout trap. Contrary to the present, if the trading volume is high or increasing, then you almost certainly have a true breakout occurring on the chart.

Entry Point when Trading Fake outs

Timing our entry is very important when trading fake breakouts moves. When you see a break out of a resistance/support level, and the volume is decreasing, you could look for better entry at the retest of the resistance/ support level. If the retest occurs at a higher momentum as compared to the breakout, then there are higher chances of price false breakout.

If the key level is broken in a bullish direction on low volume, you could short share on the bearish pullback. If the key level is broken in a bearish direction on low volume, you could buy the share on the bullish pullback.

Stop Loss on Fake Breakouts

Risk management is very important in trading fake-outs as prices can move in either direction due to the volatile moves around these areas. As mentioned earlier, in some cases a real breakout pattern can be disguised as a fake-out and test the key level and then continue in the direction of the original breakout.

Therefore, one should always follow a proper trading plan which includes the use of a Stop Loss order. This is the best way to limit your risk when trading the fake-out pattern.

The Stop Loss order must be close to your entry point, which will give you a higher risk-reward ratio. Since the price is likely to reverse sharply after the fake-out, you will be able to position the Stop loss fairly tight. After all, if the price breaks this level, then it will be very likely that price action is confirming that this is a real valid breakout.

Targets in Fake out Trading:

There is no specific target when trading fake-outs.

Chart patterns are likely to suggest a target at a distance equal to the size of the chart pattern.

If the fake breakout occurs within a chart pattern, simply measure the size of the formation and apply it from the opposite side starting from the fake-out price extreme.

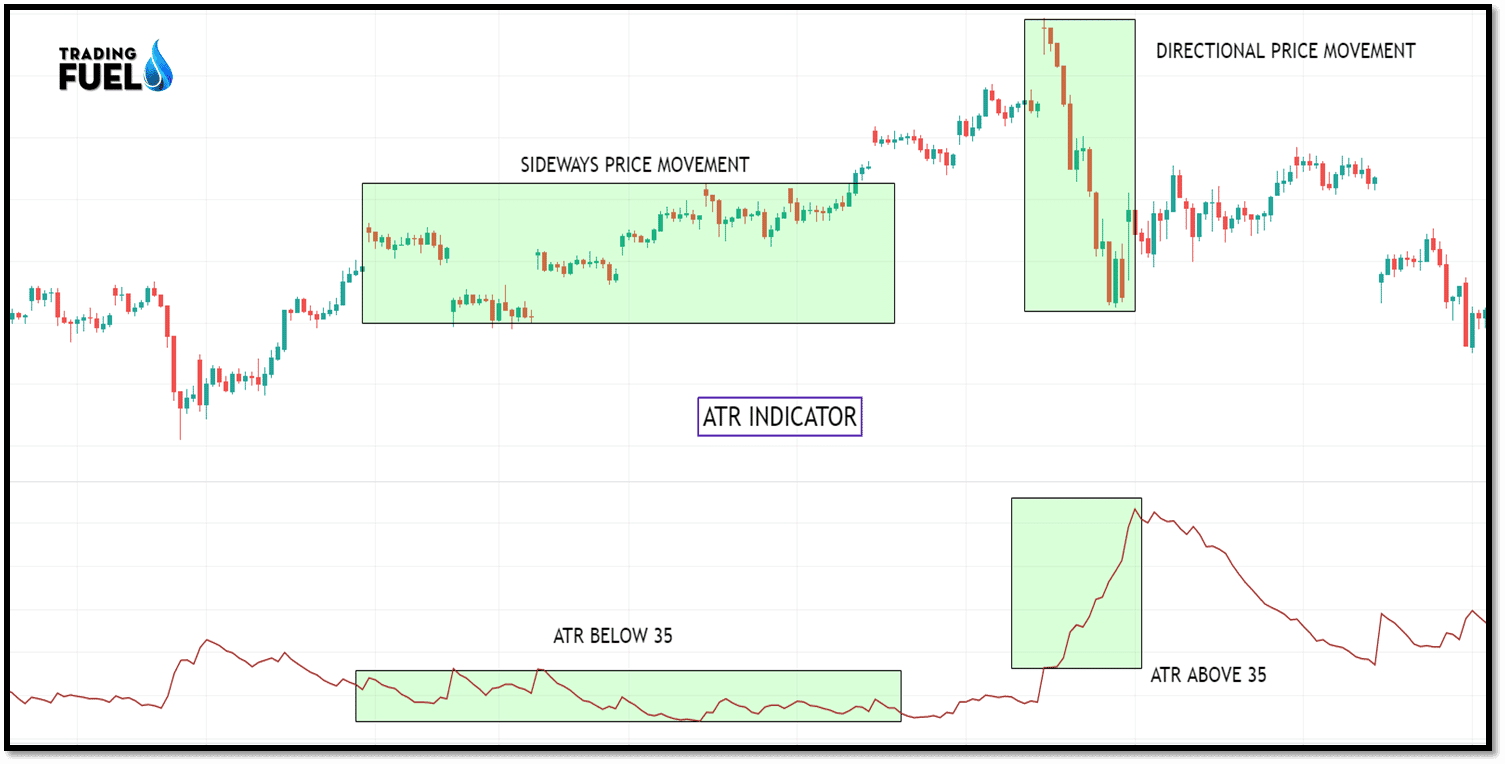

Volatility breakout

Volatility is can be used as a key factor to spot high profitable breakout trade opportunities.

Volatility measure the overall price fluctuation over a certain time and this information can be used to detect potential breakout.

There are a few indicators that can help you gauge a security current volatility. Using this indicator can help you tremendously when looking for breakout opportunities.

The ATR is a measure of the volatility of a stock and can be calculated and used on any trading instrument over any time frame.

In order to find the ATR value, you need to understand the true range of the price. The true range is defined as

- Today’s high less today’s low

- The value of today’s high minus previous close.

- The value of today’s low minus previous close.

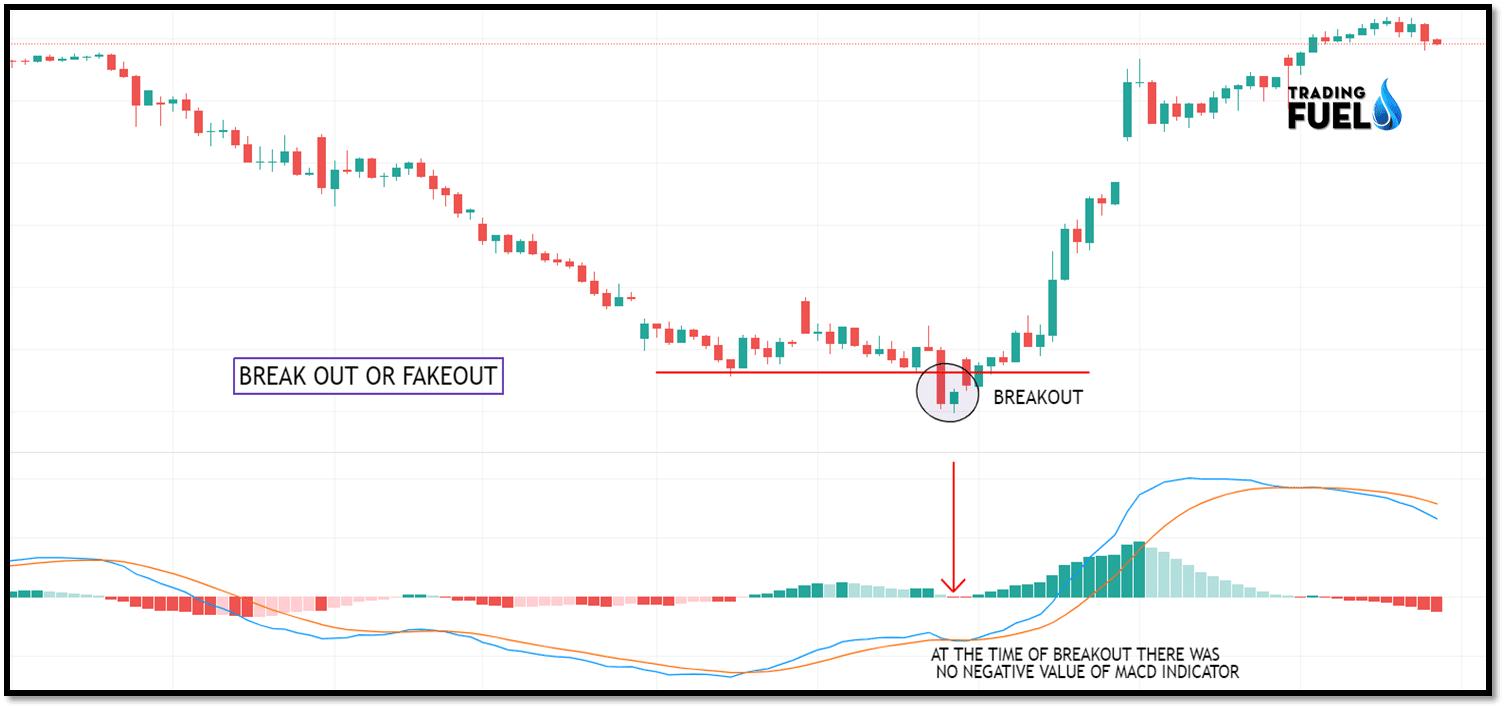

How to find breakout or fake out?

Till now we had learned that breakout is a good opportunity for short trading and to capture the next immediate move. But it would be nice if there was a way to know to confirm breakout?

There are a couple of tools to tell whether it is a breakout of fake-out

Fake-out Trading:

Fake-out trading simply means trading in the opposite direction of the breakout fake out trading=trading false breakout.

You would trade fake out if you believe that a breakout from support or resistance level is false and unable to keep moving in the same direction. Fake trading is a great short-term strategy so if you are a long-term trader avoid that.

Trading breakout appears to independent traders because of greedy mentalities they believe in trading in the direction of the breakout. They believe in huge gains on huge moves. Catch the big fish, forget the small fries.

The institutional trade prefers to fake out trading as we know to sell sometime, there must be a buyer.

Breakout Trading Key Point:

Breakout trading means trading volatility till it is lost. So always check volatility during a breakout. The breakout indicates a change in the supply and demand of the security you are trading.

A potential breakout can be easily measured by volatility. You can measure the strength of a breakout using RSI and MACD.

Institutional traders like fake-out trading, so we just have to find fake-out trading opportunities where we can make good money.

Fake-out trading simply means trading in the opposite direction as the breakout.

Fake-out trading opportunities most likely occur in the range-bound market but don’t ignore candle sentiment and news events.

Contain & Image ©️ Copyright By, Trading Fuel Research Lab