Evening Star Candlestick Pattern

The Evening Star Candlestick Pattern is the combination of three candlesticks, creating a unique pattern that can be observed on a chart. The Evening Star candlestick pattern consists of three candles: a large green candle, a small star or Doji-like candle (which can be of any colour) resembling the evening star, and a third red candle.

When these three candles are combined, they create a distinct pattern known to traders as the Evening Star candlestick pattern. Traders have found that Evening Stars tend to occur in particular market conditions.

This observation is based on a probability study, indicating that there is a higher likelihood of stock prices following a specific pattern. It is a visual analysis that does not rely on mathematical calculations for interpretation.

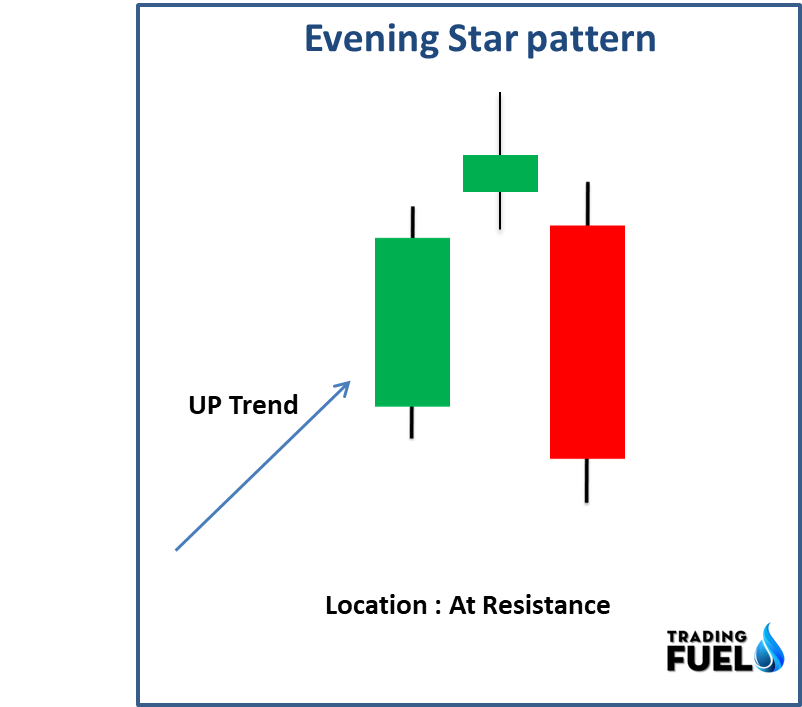

Structure of Evening Star Candlestick

The image below shows the structural components of an ideal Evening Star candlestick pattern.

Image

- The first candle in the Evening Star pattern is typically larger in size and represents a strong bullish sentiment. It is characterized by a long wick and shadow.

- This candle is often observed at the peak of an uptrend. It appears as a green (or white/blue) candle, indicating a bullish market sentiment. Additionally, the first candle has a substantial body.

- The second candle in the Evening Star pattern is relatively small in size. It looks like a long wick and shadow, but its body is quite small.

- The opening and closing prices of this candle are closely situated. There is typically a gap between this candle and the preceding larger candle.

- The colour of the second candle can be either green or red, or in the case of a Doji, it may have no colour at all. It opens with a gap-up price and maintains this gap until the candle close.

- The third candle of the Evening Star pattern opens with a gap-down price compared to the second candle. Following the opening, the stock price continues to decline significantly and eventually closes well below the opening price. This candle is characterized by its large size and red colour, indicating a bearish sentiment in the market.

You aslo like: What Is a Morning Star Candlestick Pattern?

How to Trade Using the Evening Star Candlestick Pattern?

The chart below shows the presence of the Evening Star pattern, which occurs after a well-established uptrend.

- After completion of the Evening Star Candlestick Pattern on the chart, traders have the option to enter a trade at the closing below the pattern.

- Alternatively, traders may choose to delay their entry and observe if the price continues to move lower. It’s important to note that waiting too long may result in entering the trade at a less favourable price, particularly in rapidly changing markets.

- To set target levels for a trade based on the Evening Star pattern, traders can consider previous support levels or areas of consolidation as potential targets.

- For risk management, stop-loss orders can be placed above the recent swing high, as a breaking of this level would invalidate the expected reversal.

- It is important for traders to implement effective risk management strategies and maintain a positive risk-to-reward ratio, as there are no guarantees in the stock market.

Limitations of Evening Star Candlestick Pattern

The Evening Star Candlestick Pattern is not always a foolproof indicator of a trend reversal. Like any trading pattern, it can generate false signals, particularly in highly volatile markets or during strong uptrends.

Only depending on the pattern without considering other factors and confirmation indicators can result in inaccurate predictions and potential loss of profits.

Therefore, it is suggested for traders to take caution, do a comprehensive analysis, and use additional tools to validate the potential reversal indicated by the Evening Star pattern.

It is important to note that the Evening Star pattern should not be taken as the only bearish reversal indicator. To confirm the trend reversal, traders should consider other indicators as well. By examining additional indicators and factors, traders can strengthen their analysis and enhance the overall confirmation of the bearish reversal.

You also read: Top 10 Candlestick Pattern

Download Candlestick Pattern Finder For Amibroker (AFL)

// Downloaded From https://www.TradingFuel.com

SetChartOptions(0,chartShowArrows|chartShowDates);

/*Body Colors*/

whiteBody=C>=O;

blackBody=O>C;

/*Body Size*/

smallBodyMaximum=0.0025;//less than 0.25%

LargeBodyMinimum=0.01;//greater than 1.0%

smallBody=(O>=C*(1-smallBodyMaximum) AND whiteBody) OR (C>=O*(1-smallBodyMaximum) AND blackBody);

largeBody=(C>=O*(1+largeBodyMinimum) AND whiteBody) OR C<=O*(1-largeBodyMinimum) AND blackBody;

mediumBody=NOT LargeBody AND NOT smallBody;

identicalBodies=abs(abs(Ref(O,-1)-Ref(C,-1))-abs(O-C)) < abs(O-C)*smallBodyMaximum;

realBodySize=abs(O-C);

/*Shadows*/

smallUpperShadow=(whiteBody AND H<=C*(1+smallBodyMaximum)) OR (blackBody AND H<=O*(1+smallBodyMaximum));

smallLowerShadow=(whiteBody AND L>=O*(1-smallBodyMaximum)) OR (blackBody AND L>=C*(1-smallBodyMaximum));

largeUpperShadow=(whiteBody AND H>=C*(1+largeBodyMinimum)) OR (blackBody AND H>=O*(1+largeBodyMinimum));

largeLowerShadow=(whiteBody AND L<=O*(1-largeBodyMinimum)) OR (blackBody AND L<=C*(1-largeBodyMinimum));

/*Gaps*/

upGap= IIf(Ref(blackBody,-1)AND whiteBody AND O>Ref(O,-1),1,

IIf(Ref(blackbody,-1) AND blackBody AND C>Ref(O,-1),1,

IIf(Ref(whiteBody,-1) AND whiteBody AND O>Ref(C,-1),1,

IIf(Ref(whiteBody,-1) AND blackBody AND C>Ref(C,-1),1,0))));

downGap=IIf(Ref(blackBody,-1)AND whiteBody AND C<Ref(C,-1),1,

IIf(Ref(blackbody,-1) AND blackBody AND O<Ref(C,-1),1,

IIf(Ref(whiteBody,-1) AND whiteBody AND C<Ref(O,-1),1,

IIf(Ref(whiteBody,-1) AND blackBody AND O<Ref(O,-1),1,0))));

/*Maximum High Today - (MHT)

Today is the maximum High in the last 5 days*/

MHT= HHV(H,5)==H;

/*Maximum High Yesterday - (MHY)

Yesterday is the maximum High in the last 5 days*/

MHY= HHV(H,5)==Ref ( H, -1);

/*Minimum Low Today - (MLT)

Today is the minimum Low in the last 5 days*/

MLT= LLV(L,5)==L;

/*Minimum Low Yesterday - (MLY)

Yesterday is the minimum Low in the last 5 days*/

MLY= LLV(L,5)==Ref(L,-1);

/*DOJI definitions*/

/*Doji Today - (DT)*/

DT = abs(C-O) <= (C*smallBodyMaximum) OR (abs(O-C)<=((H-L)*0.1));

/* Doji Yesterday - (DY)*/

DY = abs(Ref ( C, -1)-Ref(O,-1)) <= Ref ( C, -1) *smallBodyMaximum OR abs (Ref ( O, -1)-Ref(C,-1)) <= (Ref ( H, -1 ) - Ref ( L, -1 ) )*0.1;

O1 = Ref(O,-1);O2 = Ref(O,-2);

H1 = Ref(H,-1);H2 = Ref(H,-2);

L1 = Ref(L,-1);L2 = Ref(L,-2);

C1 = Ref(C,-1);C2 = Ref(C,-2);

NearDoji = (abs(O-C)<= ((H-L)*0.1));

BlackCandle = (O>C);

LongBlackCandle = (O>C AND (O-C)/(0.001+H-L)>0.6);

SmallBlackCandle = ((O>C) AND ((H-L)>(3*(O-C))));

WhiteCandle = (C>O);

LongWhiteCandle = ((C>O) AND ((C-O)/(0.001+H-L)>0.6));

SmallWhiteCandle = ((C>O) AND ((H-L)>(3*(C-O))));

BlackMaubozu = (O>C AND H==O AND C==L);

WhiteMaubozu = (C>O AND H==C AND O==L);

BlackClosingMarubozu = (O>C AND C==L);

WhiteClosingMarubozu = (C>O AND C==H);

BlackOpeningMarubozu = (O>C AND O==H);

WhiteOpeningMarubozu = (C>O AND O==L);

HangingMan = (((H-L)>4*(O-C)) AND ((C-L)/(0.001+H-L)>= 0.75) AND ((O-L)/(0.001+H-L)>= 0.75));

Hammer = (((H-L)>3*(O-C)) AND ((C-L)/(0.001+H-L)>0.6) AND ((O-L)/(0.001+H-L)>0.6));

InvertedHammer = (((H-L)>3*(O-C)) AND ((H-C)/(0.001+H-L)>0.6) AND ((H-O)/(0.001+H-L)>0.6));

ShootingStar = (((H-L)>4*(O-C)) AND ((H-C)/(0.001+H-L)>= 0.75) AND ((H-O)/(0.001+H-L)>= 0.75));

BlackSpinningTop = ((O>C) AND ((H-L)>(3*(O-C))) AND (((H-O)/(0.001+H-L))<0.4) AND (((C-L)/(0.001+H-L))<0.4));

WhiteSpinningTop = ((C>O) AND ((H-L)>(3*(C-O))) AND (((H-C)/(0.001+H-L))<0.4) AND (((O-L)/(0.001+H-L))<0.4));

BearishAbandonedBaby = ((C1 == O1) AND (C2>O2) AND (O>C) AND (L1>H2) AND (L1>H));

BearishEveningDojiStar = ((C2>O2) AND ((C2-O2)/(0.001+H2-L2)>0.6) AND (C2<O1) AND (C1>O1) AND ((H1-L1)>(3*(C1-O1))) AND (O>C) AND (O<O1));

DarkCloudCover = (C1>O1 AND ((C1+O1)/2)>C AND O>C AND O>C1 AND C>O1 AND (O-C)/(0.001+(H-L)>0.6));

BearishEngulfing = ((C1>O1) AND (O>C) AND (O>= C1) AND (O1>= C) AND ((O-C)>(C1-O1)));

ThreeOutsideDownPattern = ((C2>O2) AND (O1>C1) AND (O1>= C2) AND (O2>= C1) AND ((O1-C1)>(C2-O2)) AND (O>C) AND (C<C1));

BullishAbandonedBaby = ((C1 == O1) AND (O2>C2) AND (C>O) AND (L2>H1) AND (L>H1));

BullishMorningDojiStar = ((O2>C2) AND ((O2-C2)/(0.001+H2-L2)>0.6) AND (C2>O1) AND (O1>C1) AND ((H1-L1)>(3*(C1-O1))) AND (C>O) AND (O>O1));

BullishEngulfing = ((O1>C1) AND (C>O) AND (C>= O1) AND (C1>= O) AND ((C-O)>(O1-C1)));

ThreeOutsideUpPattern = ((O2>C2) AND (C1>O1) AND (C1>= O2) AND (C2>= O1) AND ((C1-O1)>(O2-C2)) AND (C>O) AND (C>C1));

BullishHarami = ((O1>C1) AND (C>O) AND (C<= O1) AND (C1<= O) AND ((C-O)<(O1-C1)));

ThreeInsideUpPattern = ((O2>C2) AND (C1>O1) AND (C1<= O2) AND (C2<= O1) AND ((C1-O1)<(O2-C2)) AND (C>O) AND (C>C1) AND (O>O1));

PiercingLine = ((C1<O1) AND (((O1+C1)/2)<C) AND (O<C) AND (O<C1) AND (C<O1) AND ((C-O)/(0.001+(H-L))>0.6));

BearishHarami = ((C1>O1) AND (O>C) AND (O<= C1) AND (O1<= C) AND ((O-C)<(C1-O1)));

ThreeInsideDownPattern = ((C2>O2) AND (O1>C1) AND (O1<= C2) AND (O2<= C1) AND ((O1-C1)<(C2-O2)) AND (O>C) AND (C<C1) AND (O<O1));

ThreeWhiteSoldiers = (C>O*1.01) AND (C1>O1*1.01) AND (C2>O2*1.01) AND (C>C1) AND (C1>C2) AND (O<C1) AND (O>O1) AND (O1<C2) AND (O1>O2) AND (((H-C)/(H-L))<0.2) AND (((H1-C1)/(H1-L1))<0.2) AND (((H2-C2)/(H2-L2))<0.2);

DarkCloudCover = (C1>O1*1.01) AND (O>C) AND (O>H1) AND (C>O1) AND (((C1+O1)/2)>C) AND (C>O1) AND (MA(C,13)-Ref(MA(C,13),-4)>0);

ThreeBlackCrows = (O>C*1.01) AND (O1>C1*1.01) AND (O2>C2*1.01) AND (C<C1) AND (C1<C2) AND (O>C1) AND (O<O1) AND (O1>C2) AND (O1<O2) AND (((C-L)/(H-L))<0.2) AND (((C1-L1)/(H1-L1))<0.2) AND (((C2-L2)/(H2-L2))<0.2);

eveningStar=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND Ref(upGap,-1) AND NOT Ref(largeBody,-1) AND blackBody AND NOT smallBody AND (MHT OR MHY);

morningStar =Ref(largeBody,-2) AND Ref(blackBody,-2) AND Ref(downGap,-1) AND whiteBody AND LargeBody AND C>Ref(C,-2) AND MLY;

Doji = (O == C);

MATCHLOW = LLV(Low,8)==LLV(Low,2) AND Ref(Close,-1)<=Ref(Open,-1)*.99 AND abs(Close-Ref(Close,-1))<=Close*.0025 AND Open>Ref(Close,-1) AND Open<=(High-((High-Low)*.5));

GapUpx = GapUp();

GapDownx = GapDown();

BigGapUp = L>1.01*H1;

BigGapDown = H<0.99*L1;

HugeGapUp = L>1.02*H1;

HugeGapDown = H<0.98*L1;

DoubleGapUp = GapUp() AND Ref(GapUp(),-1);

DoubleGapDown = GapDown() AND Ref(GapDown(),-1);

c_Status =

WriteIf(HangingMan, "Hanging Man",

WriteIf(ShootingStar, "Shooting Star",

WriteIf(DarkCloudCover, "Dark Cloud Cover",

WriteIf(BearishEngulfing, "Bearish Engulfing",

WriteIf(BearishHarami, "Bearish Harami",

WriteIf(eveningStar, "Evening Star",

WriteIf(Hammer, "Hammer",

WriteIf(InvertedHammer, "Inverted Hammer",

WriteIf(PiercingLine, "Piercing Line",

WriteIf(BullishEngulfing, "Bullish Engulfing",

WriteIf(BullishHarami, "Bullish Harami",

WriteIf(morningStar, "Morning Star",

WriteIf(NearDoji, "Near Doji",

WriteIf(Doji, "Doji",

WriteIf(MATCHLOW,"MATCHING LOW",

"Zilch" )))))))))))))));

P_status =

WriteIf(GapUpx, "Gap Up",

WriteIf(GapDownx, "Gap Down",

WriteIf(BigGapUp, "Big Gap Up",

WriteIf(BigGapDown, "Big Gap Down",

WriteIf(HugeGapUp, "Huge Gap Up",

WriteIf(HugeGapDown, "Huge Gap Down",

WriteIf(DoubleGapUp, "Double Gap Up",

WriteIf(DoubleGapDown, "DoubleGapDown",

"Zilch" ))))))));

/*Tweezer Top*/

TweezerTop=abs(H-Ref(H,-1))<=H*0.0025 AND O >C AND (Ref(C,-1) > Ref(O,-1))AND (MHT OR MHY);

/*Tweezer Bottom*/

tweezerBottom= (abs(L-Ref(L,-1))/L<0.0025 OR

abs(L-Ref(L,-2))/L<0.0025) AND O < C AND (Ref( O,-1) > Ref(C,-1)) AND (MLT OR MLY);

PATTERN = WriteIf(tweezerTop, "Tweezer Top",

WriteIf(tweezerBottom, "Tweezer Bottom","Zilch" ));

Filter = tweezerTop OR tweezerBottom;

/*Body Colors*/

whiteBody=C>=O;

blackBody=O>C;

/*Body Size*/

smallBodyMaximum=0.0025;//less than 0.25%

LargeBodyMinimum=0.01;//greater than 1.0%

smallBody=(O>=C*(1-smallBodyMaximum) AND whiteBody) OR (C>=O*(1-smallBodyMaximum) AND blackBody);

largeBody=(C>=O*(1+largeBodyMinimum) AND whiteBody) OR C<=O*(1-largeBodyMinimum) AND blackBody;

mediumBody=NOT LargeBody AND NOT smallBody;

identicalBodies=abs(abs(Ref(O,-1)-Ref(C,-1))-abs(O-C)) < abs(O-C)*smallBodyMaximum;

realBodySize=abs(O-C);

/*Shadows*/

smallUpperShadow=(whiteBody AND H<=C*(1+smallBodyMaximum)) OR (blackBody AND H<=O*(1+smallBodyMaximum));

smallLowerShadow=(whiteBody AND L>=O*(1-smallBodyMaximum)) OR (blackBody AND L>=C*(1-smallBodyMaximum));

largeUpperShadow=(whiteBody AND H>=C*(1+largeBodyMinimum)) OR (blackBody AND H>=O*(1+largeBodyMinimum));

largeLowerShadow=(whiteBody AND L<=O*(1-largeBodyMinimum)) OR (blackBody AND L<=C*(1-largeBodyMinimum));

/*Gaps*/

upGap= IIf(Ref(blackBody,-1)AND whiteBody AND O>Ref(O,-1),1,

IIf(Ref(blackbody,-1) AND blackBody AND C>Ref(O,-1),1,

IIf(Ref(whiteBody,-1) AND whiteBody AND O>Ref(C,-1),1,

IIf(Ref(whiteBody,-1) AND blackBody AND C>Ref(C,-1),1,0))));

downGap=IIf(Ref(blackBody,-1)AND whiteBody AND C<Ref(C,-1),1,

IIf(Ref(blackbody,-1) AND blackBody AND O<Ref(C,-1),1,

IIf(Ref(whiteBody,-1) AND whiteBody AND C<Ref(O,-1),1,

IIf(Ref(whiteBody,-1) AND blackBody AND O<Ref(O,-1),1,0))));

/*Maximum High Today - (MHT)

Today is the maximum High in the last 5 days*/

MHT= HHV(H,5)==H;

/*Maximum High Yesterday - (MHY)

Yesterday is the maximum High in the last 5 days*/

MHY= HHV(H,5)==Ref ( H, -1);

/*Minimum Low Today - (MLT)

Today is the minimum Low in the last 5 days*/

MLT= LLV(L,5)==L;

/*Minimum Low Yesterday - (MLY)

Yesterday is the minimum Low in the last 5 days*/

MLY= LLV(L,5)==Ref(L,-1);

/*DOJI definitions*/

/*Doji Today - (DT)*/

DT = abs(C-O) <= (C*smallBodyMaximum) OR (abs(O-C)<=((H-L)*0.1));

/* Doji Yesterday - (DY)*/

DY = abs(Ref ( C, -1)-Ref(O,-1)) <= Ref ( C, -1) *smallBodyMaximum OR abs (Ref ( O, -1)-Ref(C,-1)) <= (Ref ( H, -1 ) - Ref ( L, -1 ) )*0.1;

O1 = Ref(O,-1);O2 = Ref(O,-2);

H1 = Ref(H,-1);H2 = Ref(H,-2);

L1 = Ref(L,-1);L2 = Ref(L,-2);

C1 = Ref(C,-1);C2 = Ref(C,-2);

NearDoji = (abs(O-C)<= ((H-L)*0.1));

BlackCandle = (O>C);

LongBlackCandle = (O>C AND (O-C)/(0.001+H-L)>0.6);

SmallBlackCandle = ((O>C) AND ((H-L)>(3*(O-C))));

WhiteCandle = (C>O);

LongWhiteCandle = ((C>O) AND ((C-O)/(0.001+H-L)>0.6));

SmallWhiteCandle = ((C>O) AND ((H-L)>(3*(C-O))));

BlackMaubozu = (O>C AND H==O AND C==L);

WhiteMaubozu = (C>O AND H==C AND O==L);

BlackClosingMarubozu = (O>C AND C==L);

WhiteClosingMarubozu = (C>O AND C==H);

BlackOpeningMarubozu = (O>C AND O==H);

WhiteOpeningMarubozu = (C>O AND O==L);

HangingMan = (((H-L)>4*(O-C)) AND ((C-L)/(0.001+H-L)>= 0.75) AND ((O-L)/(0.001+H-L)>= 0.75));

Hammer = (((H-L)>3*(O-C)) AND ((C-L)/(0.001+H-L)>0.6) AND ((O-L)/(0.001+H-L)>0.6));

InvertedHammer = (((H-L)>3*(O-C)) AND ((H-C)/(0.001+H-L)>0.6) AND ((H-O)/(0.001+H-L)>0.6));

ShootingStar = (((H-L)>4*(O-C)) AND ((H-C)/(0.001+H-L)>= 0.75) AND ((H-O)/(0.001+H-L)>= 0.75));

BlackSpinningTop = ((O>C) AND ((H-L)>(3*(O-C))) AND (((H-O)/(0.001+H-L))<0.4) AND (((C-L)/(0.001+H-L))<0.4));

WhiteSpinningTop = ((C>O) AND ((H-L)>(3*(C-O))) AND (((H-C)/(0.001+H-L))<0.4) AND (((O-L)/(0.001+H-L))<0.4));

BearishAbandonedBaby = ((C1 == O1) AND (C2>O2) AND (O>C) AND (L1>H2) AND (L1>H));

BearishEveningDojiStar = ((C2>O2) AND ((C2-O2)/(0.001+H2-L2)>0.6) AND (C2<O1) AND (C1>O1) AND ((H1-L1)>(3*(C1-O1))) AND (O>C) AND (O<O1));

DarkCloudCover = (C1>O1 AND ((C1+O1)/2)>C AND O>C AND O>C1 AND C>O1 AND (O-C)/(0.001+(H-L)>0.6));

BearishEngulfing = ((C1>O1) AND (O>C) AND (O>= C1) AND (O1>= C) AND ((O-C)>(C1-O1)));

ThreeOutsideDownPattern = ((C2>O2) AND (O1>C1) AND (O1>= C2) AND (O2>= C1) AND ((O1-C1)>(C2-O2)) AND (O>C) AND (C<C1));

BullishAbandonedBaby = ((C1 == O1) AND (O2>C2) AND (C>O) AND (L2>H1) AND (L>H1));

BullishMorningDojiStar = ((O2>C2) AND ((O2-C2)/(0.001+H2-L2)>0.6) AND (C2>O1) AND (O1>C1) AND ((H1-L1)>(3*(C1-O1))) AND (C>O) AND (O>O1));

BullishEngulfing = ((O1>C1) AND (C>O) AND (C>= O1) AND (C1>= O) AND ((C-O)>(O1-C1)));

ThreeOutsideUpPattern = ((O2>C2) AND (C1>O1) AND (C1>= O2) AND (C2>= O1) AND ((C1-O1)>(O2-C2)) AND (C>O) AND (C>C1));

BullishHarami = ((O1>C1) AND (C>O) AND (C<= O1) AND (C1<= O) AND ((C-O)<(O1-C1)));

ThreeInsideUpPattern = ((O2>C2) AND (C1>O1) AND (C1<= O2) AND (C2<= O1) AND ((C1-O1)<(O2-C2)) AND (C>O) AND (C>C1) AND (O>O1));

PiercingLine = ((C1<O1) AND (((O1+C1)/2)<C) AND (O<C) AND (O<C1) AND (C<O1) AND ((C-O)/(0.001+(H-L))>0.6));

BearishHarami = ((C1>O1) AND (O>C) AND (O<= C1) AND (O1<= C) AND ((O-C)<(C1-O1)));

ThreeInsideDownPattern = ((C2>O2) AND (O1>C1) AND (O1<= C2) AND (O2<= C1) AND ((O1-C1)<(C2-O2)) AND (O>C) AND (C<C1) AND (O<O1));

ThreeWhiteSoldiers = (C>O*1.01) AND (C1>O1*1.01) AND (C2>O2*1.01) AND (C>C1) AND (C1>C2) AND (O<C1) AND (O>O1) AND (O1<C2) AND (O1>O2) AND (((H-C)/(H-L))<0.2) AND (((H1-C1)/(H1-L1))<0.2) AND (((H2-C2)/(H2-L2))<0.2);

DarkCloudCover = (C1>O1*1.01) AND (O>C) AND (O>H1) AND (C>O1) AND (((C1+O1)/2)>C) AND (C>O1) AND (MA(C,13)-Ref(MA(C,13),-4)>0);

ThreeBlackCrows = (O>C*1.01) AND (O1>C1*1.01) AND (O2>C2*1.01) AND (C<C1) AND (C1<C2) AND (O>C1) AND (O<O1) AND (O1>C2) AND (O1<O2) AND (((C-L)/(H-L))<0.2) AND (((C1-L1)/(H1-L1))<0.2) AND (((C2-L2)/(H2-L2))<0.2);

eveningStar=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND Ref(upGap,-1) AND NOT Ref(largeBody,-1) AND blackBody AND NOT smallBody AND (MHT OR MHY);

morningStar =Ref(largeBody,-2) AND Ref(blackBody,-2) AND Ref(downGap,-1) AND whiteBody AND LargeBody AND C>Ref(C,-2) AND MLY;

Doji = (O == C);

MATCHLOW = LLV(Low,8)==LLV(Low,2) AND Ref(Close,-1)<=Ref(Open,-1)*.99 AND abs(Close-Ref(Close,-1))<=Close*.0025 AND Open>Ref(Close,-1) AND Open<=(High-((High-Low)*.5));

GapUpx = GapUp();

GapDownx = GapDown();

BigGapUp = L>1.01*H1;

BigGapDown = H<0.99*L1;

HugeGapUp = L>1.02*H1;

HugeGapDown = H<0.98*L1;

DoubleGapUp = GapUp() AND Ref(GapUp(),-1);

DoubleGapDown = GapDown() AND Ref(GapDown(),-1);

c_Status =

WriteIf(HangingMan, "Hanging Man",

WriteIf(ShootingStar, "Shooting Star",

WriteIf(DarkCloudCover, "Dark Cloud Cover",

WriteIf(BearishEngulfing, "Bearish Engulfing",

WriteIf(BearishHarami, "Bearish Harami",

WriteIf(eveningStar, "Evening Star",

WriteIf(Hammer, "Hammer",

WriteIf(InvertedHammer, "Inverted Hammer",

WriteIf(PiercingLine, "Piercing Line",

WriteIf(BullishEngulfing, "Bullish Engulfing",

WriteIf(BullishHarami, "Bullish Harami",

WriteIf(morningStar, "Morning Star",

WriteIf(NearDoji, "Near Doji",

WriteIf(Doji, "Doji",

WriteIf(MATCHLOW,"MATCHING LOW",

"Zilch" )))))))))))))));

P_status =

WriteIf(GapUpx, "Gap Up",

WriteIf(GapDownx, "Gap Down",

WriteIf(BigGapUp, "Big Gap Up",

WriteIf(BigGapDown, "Big Gap Down",

WriteIf(HugeGapUp, "Huge Gap Up",

WriteIf(HugeGapDown, "Huge Gap Down",

WriteIf(DoubleGapUp, "Double Gap Up",

WriteIf(DoubleGapDown, "DoubleGapDown",

"Zilch" ))))))));

/*Tweezer Top*/

TweezerTop=abs(H-Ref(H,-1))<=H*0.0025 AND O >C AND (Ref(C,-1) > Ref(O,-1));

/*Tweezer Bottom*/

tweezerBottom= (abs(L-Ref(L,-1))/L<0.0025 OR

abs(L-Ref(L,-2))/L<0.0025) AND O < C AND (Ref( O,-1) > Ref(C,-1));

PATTERN = WriteIf(tweezerTop, "Tweezer Top",

WriteIf(tweezerBottom, "Tweezer Bottom","Zilch" ));

Filter = tweezerTop OR tweezerBottom;

//AddTextColumn(PATTERN, "Tweezer Pattern", 5.6, colorWhite, IIf(TweezerTop, colorRed,

//IIf(TweezerBottom, colorGreen, colorLightGrey)));

//AddTextColumn(C_Status, "Candle Pattern", 5.6, colorWhite, IIf(HangingMan OR ShootingStar OR DarkCloudCover OR BearishEngulfing OR BearishHarami OR eveningStar, colorRed,

//IIf(Hammer OR InvertedHammer OR PiercingLine OR BullishEngulfing OR BullishHarami OR morningStar OR MATCHLOW, colorGreen, IIf( NearDoji OR Doji, colorBlue, colorLightGrey))));

AddTextColumn(P_Status, "Price Pattern", 5.6, colorWhite, IIf(GapDownx OR BigGapDown OR HugeGapDown OR DoubleGapDown, colorRed,

IIf(GapUpx OR BigGapUp OR HugeGapUp OR DoubleGapUp, colorGreen, colorLightGrey)));

AddTextColumn(PATTERN + " And " + C_Status, "Tweezer Pattern" , 5.6, colorWhite, IIf(TweezerTop, colorRed,

IIf(TweezerBottom, colorGreen, colorLightGrey)));

AddColumn(C," CURRENT PRICE",1.2, IIf(C >Ref(C,-1),colorGreen,colorRed));

AddColumn(V," VOL TODAY ",1.2, IIf(V > MA(V,20),colorGreen, colorLightGrey));

/************************************************** *****

Candlestick Commentary

Load this file into the Commentary Option of the Analysis tab. Green arrows indicate bullish candles.

Red arrows indicate bearish candles. Scroll down the commentary for comments.

This is a work in progress. Thanks to all on this forum whose code I may have incorporated into this file. Comments are from Steve Nison "Japanese Candlestick Charting Techniques" and the LitWick web site.

************************************************** ********/

/*Body Colors*/

whiteBody=C>=O;

blackBody=O>C;

/*Body Size*/

smallBodyMaximum=0.0025;//less than 0.25%

LargeBodyMinimum=0.01;//greater than 1.0%

smallBody=(O>=C*(1-smallBodyMaximum) AND whiteBody)

OR (C>=O*(1-smallBodyMaximum) AND blackBody);

largeBody=(C>=O*(1+largeBodyMinimum) AND whiteBody)

OR C<=O*(1-largeBodyMinimum) AND blackBody;

mediumBody=NOT LargeBody AND NOT smallBody;

identicalBodies=abs(abs(Ref(O,-1)-Ref(C,-1))-abs(O-C)) <

abs(O-C)*smallBodyMaximum;

realBodySize=abs(O-C);

/*Shadows*/

smallUpperShadow=(whiteBody AND H<=C*(1+smallBodyMaximum))

OR (blackBody AND H<=O*(1+smallBodyMaximum));

smallLowerShadow=(whiteBody AND L>=O*(1-smallBodyMaximum))

OR (blackBody AND L>=C*(1-smallBodyMaximum));

largeUpperShadow=(whiteBody AND H>=C*(1+largeBodyMinimum))

OR (blackBody AND H>=O*(1+largeBodyMinimum));

largeLowerShadow=(whiteBody AND L<=O*(1-largeBodyMinimum))

OR (blackBody AND L<=C*(1-largeBodyMinimum));

/*Gaps*/

upGap= IIf(Ref(blackBody,-1)AND whiteBody AND O>Ref(O,-1),1,

IIf(Ref(blackbody,-1) AND blackBody AND C>Ref(O,-1),1,

IIf(Ref(whiteBody,-1) AND whiteBody AND O>Ref(C,-1),1,

IIf(Ref(whiteBody,-1) AND blackBody AND C>Ref(C,-1),1,0))));

downGap=IIf(Ref(blackBody,-1)AND whiteBody AND C<Ref(C,-1),1,

IIf(Ref(blackbody,-1) AND blackBody AND O<Ref(C,-1),1,

IIf(Ref(whiteBody,-1) AND whiteBody AND C<Ref(O,-1),1,

IIf(Ref(whiteBody,-1) AND blackBody AND O<Ref(O,-1),1,0))));

/*Candle Definitions*/

spinningTop=mediumBody;

doji=CdDoji(threshold=0.05);/*abs(C-O) <= (C*smallBodyMaximum) OR

(abs(O-C)<=((H-L)*0.1));*/

dojiStar=doji AND (upgap OR downgap)AND Ref(LargeBody,-1);

marabuzu=LargeBody AND smallUpperShadow AND smallLowerShadow;

shootingStar=/*(NOT largeBody AND smallLowerShadow AND LargeUpperShadow) OR*/

smallLowerShadow AND NOT doji AND

((blackBody AND abs(O-H)>2*realBodySize) OR

(whiteBody AND abs(H-C)>2*realBodySize));

Hammer=smallUpperShadow AND NOT doji AND

((blackBody AND abs(C-L)>2*realBodySize) OR

(whiteBody AND abs(L-O)>2*realBodySize));

tweezerTop=abs(H-Ref(H,-1))<=H*0.0025;

tweezerBottom=abs(L-Ref(L,-1))<=L*0.0025;

engulfing=

IIf(blackBody AND Ref(blackbody,-1) AND C<Ref(C,-1) AND O>Ref(O,-1),1,

IIf(blackBody AND Ref(whiteBody,-1) AND O>Ref(C,-1) AND C<Ref(O,-1),1,

IIf(whitebody AND Ref(whitebody,-1) AND C>Ref(C,-1) AND O<Ref(O,-1),1,

IIf(whiteBody AND Ref(blackBody,-1) AND C>Ref(O,-1)AND O<Ref(C,-1),1,0))));

Harami=

IIf(blackbody AND Ref(blackBody,-1) AND O<Ref(O,-1) AND C>Ref(C,-1),1,

IIf(blackBody AND Ref(whiteBody,-1) AND C>Ref(O,-1) AND O<Ref(C,-1),1,

IIf(whiteBody AND Ref(whiteBody,-1) AND C<Ref(C,-1) AND O>Ref(O,-1),1,

IIf(whiteBody AND Ref(blackBody,-1) AND O>Ref(C,-1) AND C<Ref(O,-1),1,0))));

/*Maximum High Today - (MHT)

Today is the maximum High in the last 5 days*/

MHT= HHV(H,5)==H;

/*Maximum High Yesterday - (MHY)

Yesterday is the maximum High in the last 5 days*/

MHY= HHV(H,5)==Ref ( H, -1);

/*Minimum Low Today - (MLT)

Today is the minimum Low in the last 5 days*/

MLT= LLV(L,5)==L;

/*Minimum Low Yesterday - (MLY)

Yesterday is the minimum Low in the last 5 days*/

MLY= LLV(L,5)==Ref(L,-1);

/*DOJI definitions*/

/*Doji Today - (DT)*/

DT = abs(C-O) <= (C*smallBodyMaximum) OR

(abs(O-C)<=((H-L)*0.1));

/* Doji Yesterday - (DY)*/

DY = abs(Ref ( C, -1)-Ref(O,-1)) <= Ref ( C, -1) *smallBodyMaximum OR

abs (Ref ( O, -1)-Ref(C,-1)) <= (Ref ( H, -1 ) - Ref ( L, -1 ) )*0.1;

/**************************************************

BULLISH CANDLESTICKS

************************************************** * */

/* Abandoned Baby Bullish*/

abandonedBabybullish =Ref(largeBody,-2) AND Ref(blackBody,-2)//Large black candle

AND Ref(GapDown(),-1)

AND whiteBody AND LargeBody AND GapUp();//Large white candle

/* Belt Hold*///Bad formula

beltHoldBullish = largeBody AND smallLowerShadow AND whiteBody AND MLT;

/*BreakAway Bullish*/

breakAwayBullish=Ref(Largebody,-4) AND Ref(blackBody,-4)

AND Ref(blackBody,-3) AND Ref(O,-3)<Ref(C,-4)

AND Ref(smallbody,-2) AND Ref(C,-2)<Ref(C,-3)

AND Ref(C,-1)<Ref(C,-2)

AND LargeBody AND whiteBody AND C>Ref(O, -3)

AND C<Ref(C,-4);

/*Concealing Baby Swallow only one trade */

ConcealingBabySwallow=Ref(marabuzu,-3) AND Ref(blackbody,-3) AND

Ref(MArabuzu,-2) AND Ref(blackBody,-2) AND

Ref(blackBody,-1) AND Ref(downGap,-1) AND

Ref(H,-1)>Ref(C,-2)AND Ref(blackbody,-1)AND

blackBody AND engulfing;

/*Doji Star Bullish*/

dojiStarBullish=(dojiStar AND (MLT OR MLY))OR

(doji AND (C<Ref(C,-1) OR O<Ref(C,-1))AND Ref(blackBody,-1)

AND Ref(LargeBody,-1));

/*Engulfing Bullish*/

engulfingBullish =

engulfing AND largeBody AND whiteBody AND

(Ref(blackbody,-1) OR Ref(Doji,-1)) AND MLT;

/*Hammer Bullish*/

hammerBullish=Hammer AND (MLT OR MLY);

/*Dragonfly Doji Bullish*/

dragonflyDoji=smallBody AND LargeLowerShadow AND smallUpperShadow AND MLT;

/* Harami Bullish*/

haramiBullish = harami AND Ref (LargeBody,-1) AND Ref(blackBody,-1) AND

NOT LargeBody AND whiteBody;

/*Harami Cross*/

HaramiCross=harami AND Ref(LargeBody,-1) AND Ref(blackBody,-1) AND doji;

/* Homing Pigeon*/

homingPigeon = Ref(largeBody,-1) AND Ref(blackBody,-1) AND

H<= Ref ( O, -1 ) AND L>=Ref( C, -1) AND C<O AND MLY;

/*Inverted Hammer*/

invertedHammer=shootingStar AND (MLT OR MLY);

/* Meeting LinesBullish*/

meetingLinesbullish= Ref(LargeBody,-1) AND Ref(blackBody,-1) AND

LargeBody AND whiteBody AND

C>Ref(C,-1)*0.9975 AND C< Ref(C,-1)*1.0025;

/*Morning Doji Star*/

morningDojiStar= Ref(LargeBody,-2) AND Ref(blackBody,-2) AND

Ref(doji,-1) AND Ref(O,-1)<Ref(C,-2) AND

whiteBody AND C>Ref(C,-2) AND MLY;

/* Morning Star*/

morningStar =Ref(largeBody,-2) AND Ref(blackBody,-2)//Large black candle

AND Ref(downGap,-1)//Gap down yesterday

AND whiteBody AND LargeBody AND C>Ref(C,-2)//Large white candle today

AND MLY; //Yesterday was the low

/* Piercing Line*/

piercingLine= Ref(largeBody,-1) AND Ref(blackBody,-1)AND

O<Ref(L,-1) AND C>=(Ref(O,-1)+Ref(C,-1))/2 AND C<Ref(O,-1) AND MLT;

/* Stick Sandwich*/

stickSandwich=Ref(largeBody,-2) AND Ref(blackbody,-2) AND

Ref(largeBody,-1) AND Ref(whiteBody,-1) AND

Ref(O,-1)>=Ref(C,-2) AND O>=Ref(C,-1) AND

abs(C-Ref(C,-2))<=C*0.0025;

/*Three Inside Up harami confirming*/

threeInsideUp =Ref(Haramibullish,-1) AND whiteBody AND

largeBody AND C>Ref(C,-1);

/* Three Outside Up Engulfing confirmation*/

threeOutsideUp =Ref(engulfingBullish,-1) AND whiteBody AND C>Ref(C,-1);

/* Three Stars in the South*///Rewrite???

threeStarsInTheSouth=

Ref(LargeBody,-2) AND Ref(blackBody,-2) AND Ref(largelowerShadow,-2)

AND Ref(blackBody,-1) AND Ref(largeLowerShadow,-1) AND

Ref(L,-1)>Ref(L,-2) AND blackBody AND smallUpperShadow AND

smallLowerShadow AND L>Ref(L,-1) AND H<Ref(H,-1);

/* Tri-Star Bullish*/

triStarBullish=Ref(doji,-2) AND Ref(doji,-1) AND doji AND MLY AND

Ref(downgap,-1) AND upGap;

/* Three River Bottom Bad formula*/

threeriverBottom=Ref(largeBody,-2) AND Ref(blackBody,-2) AND

Ref(blackbody,-1) AND Ref(Largelowershadow,-1) AND

Ref(O,-1)<Ref(O,-2) AND Ref(C,-1)>Ref(C,-2) AND

whiteBody AND C<Ref(C,-1) AND MLY;

/* Mat Hold Bullish*/

MAtHoldBullish=Ref(LargeBody,-4) AND Ref(whiteBody,-4)//1st day

AND Ref(blackBody,-3) AND Ref(upGap,-3) AND NOT Ref(LargeBody,-3)

AND NOT Ref(LargeBody,-2) AND Ref(C,-2)<Ref(C,-3) AND Ref (O,-2)<Ref(O,-3) AND

Ref(C,-2)>Ref(O,-4) AND NOT Ref(LargeBody,-1) AND Ref(C,-1)<Ref(C,-2)

AND LargeBody AND whiteBody AND C>Ref(C,-4);

/*RisingThreeMethods*/

risingThreeMethods=Ref(LargeBody,-4) AND Ref(whiteBody,-4) AND NOT

Ref(LargeBody,-3) AND NOT Ref(LargeBody,-2)AND NOT Ref(LargeBody,-1) AND

Ref(C,-3)<Ref(C,-4) AND Ref(C,-2)<Ref(C,-3) AND Ref(C,-1)<Ref(C,-2) AND

LargeBody AND whitebody AND C>Ref(C,-4);

/* Seperating Lines Bullish*/

separatingLinesBullish=Ref(blackBody,-1) AND whiteBody AND LargeBody AND

smallLowerShadow AND MHT AND abs(O-Ref(O,-1))<=O*0.0025;

/*Side by Side White Lines*/

sideBySideWhiteLines=NOT Ref(smallBody,-2) AND Ref(whiteBody,-2)

AND Ref(upGap,-1) AND Ref(whitebody,-1)AND whiteBody AND

identicalBodies AND abs(O-Ref(O,-1))<O*0.0025;

/*Three White Soldiers*/

threeWhiteSoldiers=NOT Ref(smallbody,-2) AND Ref(whiteBody,-2) AND NOT

Ref(smallBody,-1) AND Ref(whiteBody,-1) AND NOT

smallBody AND whiteBody AND C>Ref(C,-1) AND Ref(C,-1)>Ref(C,-2) AND

Ref(O,-1)>Ref(O,-2) AND Ref(O,-1)<Ref(C,-2) AND O<Ref(C,-1) AND

O>Ref(O,-1) AND Ref(smallUpperShadow,-2) AND

Ref(smallUpperShadow,-1) AND smallUppershadow AND LLV(L,12)==Ref(L,-2);

/*Upside Gap Three Methods not very good*/

upsideGapThreeMethods=Ref(Largebody,-2) AND Ref(whiteBody,-2) AND

Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND Ref(upGap,-1) AND

blackBody AND O>Ref(O,-1) AND C<Ref(C,-2)AND C>Ref(O,-2) AND

MHY;

/*Three Line Strike not good signals*/

threeLineStrike=NOT Ref(smallBody,-3) AND NOT Ref(smallBody,-2) AND

NOT Ref(smallBody,-1) AND Ref(whiteBody,-3) AND Ref(whiteBody,-2) AND

Ref(whiteBody,-1) AND Ref(C,-1)>Ref(C,-2) AND Ref(C,-2)>Ref(C,-3) AND

blackBody AND O>Ref(C,-1) AND C<Ref(O,-3);

/*Tweezer Bottom*/

tweezerBottom= (abs(L-Ref(L,-1))/L<0.0025 OR

abs(L-Ref(L,-2))/L<0.0025) AND O < C AND (Ref( O,-1) > Ref(C,-1));

/*Upside Tasuki Gap*/

upsideTasukiGap=Ref(largeBody,-2) AND Ref(largeBody,1) AND

Ref(whiteBody,-2) AND Ref(whiteBody,-1) AND Ref(upGap,-1) AND

blackBody AND O>Ref(O,-1) AND C<Ref(O,-1) AND C>Ref(C,-2) AND

identicalBodies AND O<Ref(C,-1);

//AND HHV(H,5)==Ref(H,-1); Do not use this line

/*****************************************

BEARISH CANDLESTICKS

******************************************/

/*Abandoned Baby Bearish*/

AbandonedBabyBearish=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND

Ref(smallBody,-1) AND Ref(GapUp(),-1) AND GapDown() AND

NOT smallBody AND blackBody AND MHY;

/*Advance Block Bearish*/

AdvanceBlockBearish=Ref(LargeBody,-2) AND Ref(whiteBody,-2)

AND Ref(whiteBody,-1) AND

whiteBody AND Ref(O,-1)>Ref(O,-2) AND Ref(O,-1)<Ref(C,-2) AND

Ref(C,-1)>Ref(C,-2) AND C>Ref(C,-1) AND

O<Ref(C,-1) AND O>Ref(O,-1) AND Ref(LargeUpperShadow,-1) AND LargeUpperShadow

AND C-O<Ref(C,-1)-Ref(O,-1) AND Ref(C,-1)-Ref(O,-1) < Ref(C,-2)-Ref(O,-2);

/*Belt Hold Bearish*/

beltHoldBearish=LargeBody AND BlackBody AND smalluppershadow AND MHT;

/*Breakaway Bearish*/

breakAwayBearish=Ref(LargeBody,-4) AND Ref(whiteBody,-4) AND

Ref(GapUp(),-3) AND Ref(whiteBody,-3) AND

Ref(smallbody,-2) AND Ref(smallBody,-1) AND

blackBody AND O>Ref(O,-3) AND C<Ref(C,-4);

/*Dark Cloud Cover*/

darkCloudCover=Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND

blackBody AND O>Ref(H,-1) AND C>Ref(O,-1) AND C<(Ref(O,-1)+Ref(C,-1))/2

AND MHT;

/*Deliberation Bearish: needs confirmation*/

deliberationBearish=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND

Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND Ref(C,-1)>Ref(C,-2) AND

smallbody AND upGap;

/*CounterAttackBearish*/

CounterAttackBearish=MHT AND LargeBody AND blackbody AND

Ref(largeBody,-1) AND Ref(whiteBody,-1) AND

C<Ref(C,-1)*1.0025 AND C>Ref(C,-1)*0.9975;;

/*Doji Star Bearish*/

dojiStarBearish=(dojiStar AND (MHT OR MHY))OR

(doji AND (C>Ref(C,-1) OR O>Ref(C,-1))AND Ref(whiteBody,-1)

AND Ref(LargeBody,-1));

/*Engulfing Bearish*/

engulfingBearish=engulfing AND largeBody AND blackBody AND

(Ref(whitebody,-1) OR Ref(Doji,-1))AND (MHT OR MHY);

/*Evening Doji Star check formula???*/

eveningDojiStar=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND

Ref(dojiStar,-1) AND Ref(GapUp(),-1) AND (MHY OR MHT);

/*Evening Star*/

eveningStar=Ref(LargeBody,-2) AND Ref(whiteBody,-2) AND

Ref(upGap,-1) AND NOT Ref(largeBody,-1) AND blackBody AND NOT smallBody AND

(MHT OR MHY);

/*Hammer Bearish*/

HammerBearish=Hammer AND HHV(H,8)==H;

/*hangingMan*/

HangingMan=NOT largeBody AND smallUpperShadow AND LargeLowerShadow AND MHT;

/*dragonfly Doji Bearish*/

dragonflyDojiBearish=doji AND smallUpperShadow AND LargeLowerShadow AND MHT;

/*Harami Bearish-*/

HaramiBearish=harami AND Ref(Largebody,-1) AND Ref(whiteBody,-1)AND blackBody

AND (MHY OR MHT);

/*HaramiCross Bearish*/

HaramiCrossBearish=harami AND doji AND Ref(whiteBody,-1) AND Ref(Largebody,-1);

/*Identical three black crows*/

idendicalThreeBlackCrows=Ref(blackBody,-2) AND Ref(blackBody,-1) AND blackBody AND

abs(Ref(C,-2)-Ref(O,-1))<Ref(C,-1)*0.0025 AND abs(Ref(C,-1)-O)<O*0.0025 AND

HHV(H,20)==Ref(H,-2) AND NOT Ref(doji,-2) AND NOT Ref(doji,-1) AND NOT doji AND

Ref(smallLowerShadow,-2) AND Ref(smallLowerShadow,-1) AND smallLowerShadow;

/*Kicking Bearish No trades*/

kickingBearish=Ref(whiteBody,-1) AND Ref(MArabuzu,-1) AND blackBody AND MArabuzu AND GapDown();

/*Meeting Lines Bearish*/

MeetingLinesBearish=Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND

HHV(C,8)==Ref(C,-1) AND LargeBody AND blackBody AND

abs(C-Ref(C,-1))<C*0.0025;

/*ShootingStar*/

shootingStarGap=shootingStar AND GapUp() AND MHT;

/*Gravestone Doji*/

gravestoneDoji=doji AND largeUpperShadow AND smallLowerShadow AND GapUp()AND MHT;

/*Three Inside Down Bearish*/

threeInsideDownBearish=Ref(HaramiBearish,-1) AND blackBody AND C<Ref(C,-1)AND smallUpperShadow;

/*Three Outside Down Bearish*/

threeoutsideDownBearish=Ref(engulfingBearish,-1) AND blackBody AND C<Ref(C,-1)AND

NOT LargeUpperShadow;

/*Tri Star Bearish*/

triStarBearish=Ref(doji,-2) AND Ref(doji,-1) AND doji AND MHY AND Ref(upGap,-1)AND downGap;

/*Two Crows Bearish*/

twoCrows=Ref(whiteBody,-2) AND Ref(LargeBody,-2) //first day

AND Ref(blackBody,-1) AND Ref(upGap,-1)//Second Day

AND blackBody AND O<Ref(O,-1) AND O>Ref(C,-1)AND C<Ref(C,-2) AND

C>Ref(O,-2) AND MHY;//Third day

/*Upside Gap Two Crows*/

upsideGapTwoCrows= Ref(whiteBody,-2) AND Ref(LargeBody,-2)// first day

AND Ref(upGap,-1) AND Ref(blackBody,-1) // 2nd day

AND blackbody AND O>Ref(O,-1) AND C<Ref(C,-1) AND C>Ref(C,-2);

/*Doji Star Bearish needs confirmation

dojiStarBearish=Ref(LargeBody,-1) AND Ref(whiteBody,-1) // first day

AND doji AND upGap AND MHT;*/

/* Downside Gap Three Methods*/

downsideGapThreeMethods=

Ref(LargeBody,-2) AND Ref(blackBody,-2) AND Ref(downGap,-2) //first day

AND Ref(LargeBody,-1) AND Ref(blackBody,-1)//2nd day

AND whitebody AND O<Ref(O,-1) AND C>Ref(C,-2)

AND LLV(L,8)==Ref(L,-1);

/*Downside Tasuki Gap*/

downsideTasukiGap=

Ref(blackBody,-2)//first day

AND Ref(blackbody,-1) AND Ref(downgap,-1) //2nd day

AND whiteBody AND O<Ref(O,-1) AND O>Ref(C,-1) AND C>Ref(O,-1) AND C<Ref(C,-2)

AND Ref(identicalBodies,-1)

AND LLV(L,15)==Ref(L,-1);

/*Falling Three Meothods*/

fallingThreeMethods=Ref(LargeBody,-4) AND Ref(blackBody,-4) AND

/*Ref(doji,-3) AND Ref(doji,-2) AND Ref(doji,-1) AND*/ Ref(C,-1)>Ref(C,-2)

AND Ref(C,-2)>Ref(C,-3) AND LargeBody AND blackBody AND O>Ref(C,-4) AND

O<Ref(O,-4) AND C<Ref(O,-4)AND C<Ref(C,-4);

/*In Neck Bearish not good*/

inNeckBearish=Ref(LargeBody,-1) AND Ref(blackBody,-1) AND

whiteBody AND O<Ref(L,-1) AND C<Ref(C,-1)*1.0005 AND C>=Ref(C,-1);

/*On Neck Bearish not good*/

OnNeckBearish=Ref(LargeBody,-1) AND Ref(blackBody,-1) AND

whiteBody AND O<Ref(L,-1) AND C<Ref(L,-1)*1.0025 AND C>=Ref(L,-1)*0.9975;

/*separating Lines Bearish*/

separatingLinesBearish=Ref(LargeBody,-1) AND Ref(whiteBody,-1) AND

blackBody AND O>Ref(O,-1)*0.9975 AND O<=Ref(O,-1)*1.0025;

/*Side By Side White Lines Bearish*/

sideBySideWhiteLinesBearish=NOT Ref(smallBody,-2) AND Ref(blackBody,-2) AND

Ref(whiteBody,-1) AND whiteBody AND Ref(downGap,-1) AND identicalBodies

AND abs(C-Ref(C,-1)<C*0.0025);

/*Three Black Crows*/

threeBlackCrows=Ref(blackBody,-2) AND Ref(blackBody,-1) AND blackBody AND Ref(C,-1)<Ref(C,-2) AND C<Ref(C,-1) AND HHV(H,8)==Ref(H,-2) AND NOT Ref(doji,-2) AND NOT Ref(doji,-1) AND NOT doji;;

/*Three Line Strike no trades*/

threeLineStrike=threeBlackCrows AND whiteBody AND O<Ref(C,-1) AND C>Ref(O,-3);

/*Thrusting Bearish*/

thrustingBearish=Ref(blackBody,-1) AND Ref(LargeBody,-1) AND LargeBody AND

whitebody AND O<Ref(L,-1) AND C<(Ref(O,-1)+Ref(C,-1))/2 AND C>Ref(C,-1);

/*Tweezer Top*/

TweezerTop=abs(H-Ref(H,-1))<=H*0.0025 AND O >C AND (Ref(C,-1) > Ref(O,-1));

/* ***********************************************

Buy Rules

**************************************************/

Buy=

abandonedBabybullish OR

beltHoldBullish OR

breakAwayBullish OR

ConcealingBabySwallow OR

engulfingBullish OR

hammerBullish OR

dragonflyDoji OR

dojiStarBullish OR

haramiBullish OR

HaramiCross OR

homingPigeon OR

invertedHammer OR

meetingLinesbullish OR

morningDojiStar OR

morningStar OR

piercingLine OR

stickSandwich OR

threeInsideUp OR

threeOutsideUp OR

threeStarsInTheSouth OR

triStarBullish OR

threeriverBottom OR

MAtHoldBullish OR

risingThreeMethods OR

separatingLinesBullish OR

sideBySideWhiteLines OR

threeWhiteSoldiers OR

upsideGapThreeMethods OR

threeLineStrike OR

tweezerBottom OR

upsideTasukiGap;

/************************************

Sell Rules

*************************************/

Sell=

AbandonedBabyBearish OR

advanceBlockBearish OR

beltHoldBearish OR

breakAwayBearish OR

darkCloudCover OR

deliberationBearish OR

CounterAttackBearish OR

engulfingBearish OR

eveningDojiStar OR

eveningStar OR

HangingMan OR

dragonflyDojiBearish OR

HammerBearish OR

HaramiBearish OR

HaramiCrossBearish OR

idendicalThreeBlackCrows OR

kickingBearish OR

MeetingLinesBearish OR

shootingStarGap OR

gravestoneDoji OR

threeInsideDownBearish OR

threeoutsideDownBearish OR

triStarBearish OR

twoCrows OR

upsideGapTwoCrows OR

dojiStarBearish OR

downsideGapThreeMethods OR

downsideTasukiGap OR

fallingThreeMethods OR

inNeckBearish OR

OnNeckBearish OR

separatingLinesBearish OR

sideBySideWhiteLinesBearish OR

threeBlackCrows OR

threeLineStrike OR

thrustingBearish OR

tweezerTop;

/***************************************

Commentary

***************************************

Bullish Candles

****************************************/

C_sta =

WriteIf(abandonedBabybullish,"Abandoned Baby Bullish. A reversal pattern.\nLiWick reliability : High.",

WriteIf(beltHoldBullish,"Belt Hold Bullish. A reversal pattern.\nNison:The larger the candlestick, the more significant it is.\nLitWick Reliability: Low.",

WriteIf(breakAwayBullish,"Break Away Bullish. A reversal pattern.\nLitWick reliability: moderate.",

WriteIf(ConcealingBabySwallow,"Concealing Baby Swallow. A reversal pattern.\n LitWick reliability: high.",

WriteIf(dojiStarBullish,"Bullish doji Star. A reversal pattern.\nNison: Needs confirmation. Better at calling tops.\nLitWick reliability: moderate.",

WriteIf(engulfingBullish,"Bullish Engulfing. a reversal pattern.\nNison: Factors increasing the pattern's effectiveness are\n1) The first day has a small real body and the second day has a large real body.\n2) Pattern appears after protracted or very fast move.\n3) Heavy volume on second real body.\n4) The second day engulfs more than one real body.\nLitWick reliability: moderate",

WriteIf(hammerBullish,"Bullish Hammer. A reversal pattern.\nNison: The longer the lower shadow, the smaller the upper shadow, and the smaller the real body, the more significant the pattern.White real body more bullish than black body.\nLitWick reliability: low.",

WriteIf(dragonflyDoji,"Dragonfly Doji. LitWick reliability: moderate.",

WriteIf(haramiBullish, "Harami Bullish. A reversal pattern.\nNison: Less significant. Pattern needs confirmation.\nLitWick reliability: low.",

WriteIf(HaramiCross,"Harami Cross. A reversal pattern.\nNison: Better indicator than Harami. Better at calling tops than bottoms.\nLitWick reliability: low.",

WriteIf(homingPigeon,"Homing Pigeon. A reversal pattern.\nLitWick reliability: moderate.",

WriteIf(invertedHammer,"Inverted Hammer. A reversal pattern.\nNison:Needs bullish verification.\nLitWick reliability: low.",

WriteIf(meetingLinesbullish,"Meeting Lines bullish. A reversal pattern.\nLitWick reliability: moderate.",

WriteIf(morningDojiStar,"Morning Doji Star. A reversal pattern.\nImportant reversal signal.\nLitWick reliability: high.",

WriteIf(morningStar,"Morning Star. A reversal pattern.\nNison: The stronger the white third body the better.\nLitWick reliability: high.",

WriteIf(piercingLine,"Piercing Line. A reversal pattern.\nNison: A stron reversal pattern.\nLitWick reliability: moderate.",

WriteIf(stickSandwich,"Stick Sandwich. A reversal pattern.\nLitWick reliability: moderate.",

WriteIf(threeInsideUp,"3 Inside Up. A reversal pattern.\nLitWick reliability: high.",

WriteIf(threeOutsideUp,"3 Outside Up. A reversal pattern.\nLitWick reliability: high.",

WriteIf(threeStarsInTheSouth,"3 Stars in the South. A reversal pattern.\nLitWick reliability: moderate.",

WriteIf(triStarBullish,"Tri-Star Bullish. A reversal pattern.\nNison: Significant reversal pattern.\nLitWick reliability: moderate.",

WriteIf(threeriverBottom,"3 River Bottom. A reversal pattern.\nNison: Selling pressure drying up.\nLit Wick reliability: moderate.",

WriteIf(MAtHoldBullish,"Mat Hold Bullish. A continuation pattern.\nNison: May have 2-4 black candles.\nLitWick reliability: high. ",

WriteIf(risingThreeMethods,"Rising Three Methods. A continuation pattern>\nNison: Has more significance if volume of white candle sticks is greater than on black candlesticks.\nLitWick reliability: high.",

WriteIf(separatingLinesBullish,"Separating Lines Bullish. A continuation pattern.\nNison: \nLitWick reliability: low.",

WriteIf(sideBySideWhiteLines,"Side by Side White Lines. A continuation pattern.\nNison: If occurring during a downtrend may only be short covering.\nLitWick reliability: high.",

WriteIf(threeWhiteSoldiers,"3 White Soldiers. A continuation pattern.\nNison: Positive, but be aware of negative similar stalled pattern and advance block pattern.\nLitWick reliability: high.",

WriteIf(upsideGapThreeMethods,"Upside Gap 3 Methods. A continuation pattern.\nLitWick reliability: moderate.",

WriteIf(threeLineStrike,"3 Line Strike. A continuation pattern.\nLitWick reliability: low.",

WriteIf(tweezerBottom,"Tweezer Bottom.a reversal pattern. With other reversal candles it could indicate a support level.\nNison: Needs confirmation.",

WriteIf(upsideTasukiGap,"Upside Tasuki Gap. A continuation pattern.\nNison: the real bodies of the two candlesticks in the gap should be about the same size.\nLitWick reliability: moderate.",

"No Commentary..." )))))))))))))))))))))))))))))));

/***************************************

Bearish Candles

********************************************/

C_be =

WriteIf(AbandonedBabyBearish,"Abandoned Baby Bearish. A reversal pattern.\nNison: Extremely rare.\nLitWick reliability: high.",

WriteIf(advanceBlockBearish,"Advancing Block Bearish. A reversal pattern.\nNison: Rally is in trouble. Signs of weakening could be progressively smaller white read bodies or relatibvely long upper shadows on the last two white candlesticks.Not necessarily a reversal pattern.\nLitWick Reliability: moderate.",

WriteIf(beltHoldBearish,"Belt Hold Bearish. A reversal pattern.\nNison: The longer the height of the belt-hold candle the more significant the pattern.\nLitWick reliability: low.",

WriteIf(breakAwayBearish,"Break Away Bearish. A reversal pattern.\nLitWick reliability: moderate.",

WriteIf(darkCloudCover,"Dark Cloud Cover. A reversal pattern.\nNison: Factors indicating the importance of this signal are/n1)The greater the penetration of the first candle by the second.\n2)Both candles are marabozus.\n3)The second body opens above a major resistance level.\n4)High volume on the second day.\nLitWick Reliability: high.",

WriteIf(deliberationBearish,"Deliberation Bearish. A reversal pattern.\nNison: Not a reversal pattern, but a sign the rally is weakening.\nLitWick reliability: moderate.",

WriteIf(CounterAttackBearish,"Counter Attack Bearish.\nNison: A potential stalling of the rally.",

WriteIf(engulfingBearish,"Engulfing Bearish. A reversal pattern.\nNison: Major reversal signal. Factors increasing patterns importance are\n1) The first day has a very small real body and the second day a very large real body.\n2) The pattern apears after a protracted or very fast move.\n3) Heavy volume on the second day.\n4) The second day engulfs more than one real body.\nLitWick reliability: moderate.",

WriteIf(eveningDojiStar,"Evening Doji Star A reversal pattern.\nNison: Must be confirmed by long black candle.\nLit Wick reliability: high",

WriteIf(eveningStar,"Evening Star. a reversal pattern.\nNison: Gap between second and third bodies does not always occur.\nLitWick reliability: high.",

WriteIf(HammerBearish,"Bearish Hammer. a reversal pattern.\nNison: More bearish if hammer is black. Needs bearish confirmation. A large gap down on the following day would be a good confirmation.",

WriteIf(HangingMan,"Hanging Man. A reversal pattern.\nNison: Same as bearish hammer with a large gap down the following day.\nLitWick reliability: low.",

WriteIf(dragonflyDojiBearish,"Dragonfly Bearish. A reversal pattern.\nNison: Same as Hanging Man.\nLitWick reliability: moderate.",

WriteIf(HaramiBearish,"Harami Bearish. A reversal pattern.\nNison: Not as significant a reversal pattern as hanging man or engulfing.\nLitWick reliability: low.",

WriteIf(HaramiCrossBearish,"Harami Cross Bearish. A reversal pattern.\nNison: More significant reversal pattern than Harami. Second day can be white or black.\nLitWick reliability: moderate.",

WriteIf(idendicalThreeBlackCrows,"Identical 3 Black Crows. A reversal pattern in an uptrend.\nNison:Very bearish.\nLitWick reliability: high. ",

WriteIf(kickingBearish,"Kicking Bearish. A reversal pattern.\nLitWick reliability: high.",

WriteIf(MeetingLinesBearish,"Meeting Lines Bearish. A reversal pattern.\nNison: \nLitWick reliability: moderate, but not as strong as Dark cloud Cover.",

WriteIf(shootingStarGap,"Shooting Star. a reversal pattern.\nNison:Not major reversal signal as evening star. Ideally real body would gap away from previous body. Needs to appear after an uptrend.\nLitWick reliability: low.",

WriteIf(gravestoneDoji,"Gravestone Doji A reversal pattern.\nNison: more significant if it hits new high.\nLitWick reliability: moderate.",

WriteIf(threeInsideDownBearish,"3 Inside Down. A reversal pattern.\nNison: \nLitWick reliability: high.",

WriteIf(threeoutsideDownBearish,"3 Outside Down. A reversal pattern.\nLitWick reliability: high.",

WriteIf(triStarBearish,"Tri-Star Bearish. A reversal pattern.\nNison: Very significant reversal pattern.\nLitWick reliability: moderate.",

WriteIf(twoCrows,"2 Crows A reversal pattern.\nLitWick reliability: moderate.",

WriteIf(upsideGapTwoCrows,"Upside Gap 2 Crows. A reversal pattern.\nNison:Needs confirmation of a continued reversal on third day.\nLitWick reliability: high.",

WriteIf(dojiStarBearish,"Doji Star Bearish. A reversal pattern.\nNison: needs confirmation.\nLitWick reliability: moderate.",

WriteIf(downsideGapThreeMethods,"Downside Gap 3 Methods. A continuation pattern.\nNison: \nLitWick reliability: moderate.",

WriteIf(downsideTasukiGap,"Downside Tasuki Gap. A continuation method.\nNison: If last day closes window, continuation pattern is negated.\nLitWick reliability: moderate.",

WriteIf(fallingThreeMethods,"Falling 3 Methods. A continuation pattern.\nNison: \nLitWick reliability: high.",

WriteIf(inNeckBearish,"In Neck Bearish. A continuatin pattern.\nNison: Similar to piercing pattern but bearish because there is no penetration of second day.\nLitWick reliability: moderate.",

WriteIf(OnNeckBearish,"On Neck Bearish. A continuation pattern. Similar to piercing pattern but bearish beccause there is no penetration of the second day.\nLitWick reliability: moderate.",

WriteIf(separatingLinesBearish,"Separating Lines Bearish",

WriteIf(sideBySideWhiteLinesBearish,"Side by Side White Lines Bearish. A continuation pattern.\nNison: very rare.\nLitWick reliability: moderate.",

WriteIf(threeBlackCrows,"3 Black Crows. A reversal pattern.\nNison: Need to appear after a mature advance.\nLitWick reliability: high.",

WriteIf(threeLineStrike,"3 Line Strike. A continuation pattern.\nLitWick reliability: low.",

WriteIf(thrustingBearish,"Thrusting. A continuation pattern.\nNison: Not a reversal day because second day does not pierce midpoint of first day.\nLitWick reliability: low.",

WriteIf(tweezerTop,"Tweezer Top. A reversal pattern.\nNison: Needs confirmation.",

"No Commentary..." )))))))))))))))))))))))))))))))))))));

/***********************************************

End Commentary

************************************************/

Plot(C,"Price", IIf(C> Ref(C,-1),colorGreen,colorRed), styleCandle );

Title = EncodeColor(colorWhite)+ FullName()+"\n"+EncodeColor(colorGold)+ " Ngay:"+ Date() +StrFormat(" - Open %g, Hi %g, Lo %g, Close %g " , O,H,L,C )+"Volume : " + V +"\n"+ "_____ Candlestick Commentary _____" +"\n"+ "_ Bullish Candles:"+

EncodeColor(colorGreen)+

C_sta + "\n"+EncodeColor(colorGold)+"_ Bearish Candles :"+EncodeColor(colorRed)+

C_be +"\n"+EncodeColor(colorBrightGreen)+ "_____ praveen _____";

Plot(EMA(C,20)," ", colorGreen,1);

Plot(EMA(C,50)," ", colorYellow,1);

Plot(EMA(C,200)," ", colorRed,1);

Plot(EMA(C,100)," ", colorWhite,1);

//PlotVAPOverlay( Param("lines",300,10,1000,1), Param("width",10,1,99,1), ParamColor("color", colorDarkBlue), Param("style",0,0,7,1) );

//PlotVAPOverlayA( Param("Lines", 300, 100, 1000, 1 ), Param("Width", 80, 1, 200, 1 ), ParamColor("Color", colorGold ), ParamToggle("Side", "Left|Right" ) | 2 * ParamToggle("Style", "Fill|Lines", 0) | 4*ParamToggle("Z-order", "On top|Behind", 1 )) ;

//Plot(segments, "", colorLightGrey, styleHistogram | styleOwnScale );

PlotVAPOverlay( Param("lines",300,10,1000,1), Param("width",10,1,99,1), ParamColor("color", colorDarkBlue), Param("style",0,0,7,1) |4*ParamToggle("Z-order", "On top|Behind", 1 ));

_SECTION_BEGIN("Background text");

GfxSelectFont("Time news roman", Status("pxheight")/6 );

GfxSetTextAlign(6 );// center alignment

GfxSetOverlayMode(1 ) ;

//GfxSetTextColor( ColorRGB( 200, 200, 200 ) );

GfxSetTextColor( ColorHSB( 42, 42, 42 ) );

GfxSetBkMode(0); // transparent

GfxTextOut( Name(), Status("pxwidth")/2, Status("pxheight")/19 );

GfxSelectFont("Time news roman", Status("pxheight")/30 );

GfxTextOut(FullName(), Status("pxwidth")/2, Status("pxheight")/3.8 );

GfxSelectFont("Time news roman", Status("pxheight")/25 );

GfxTextOut("Market: " + MarketID(1), Status("pxwidth")/2, Status("pxheight")/3 );

_SECTION_BEGIN("Volume");

Plot( Volume, _DEFAULT_NAME(), ParamColor("Color", colorLavender ), styleNoTitle | ParamStyle( "Style", styleHistogram | styleOwnScale | styleThick | styleNoLabel, maskHistogram ), 2 );

_SECTION_END(); In conclusion,

The Evening Star Candlestick Pattern serves as a bearish reversal pattern favoured by technical traders for identifying potential trend reversals in the stock market. Also, it is important to acknowledge its limitations and possible drawbacks. These include the potential for false signals, reliance on candlestick patterns, the pattern’s inability to serve as a standalone indicator, its focus on short-term predictions, and the risk of overlooking other potential opportunities. As a result, it is advisable to use the Evening Star pattern in conjunction with other indicators and analytical tools to validate the anticipated trend reversal and make more informed trading decisions.

Contain & Image ©️ Copyright By, Trading Fuel || Research Lab