Best Share Market Tips for Beginners: Most investors profit by selling their valuable stocks and keeping all the low-performing stocks to get a bounce back from them.

Stocks that have better value will climb the market, and the low stocks will risk you in the market.

It is essential to figure out the best stocks to invest in the stock market, and eventually, this will also free investors from the stress of drawbacks.

You should select stocks that can deliver on medium to long-term needs.

They should also have the capability to have a healthy solution of both subjective as well as quantitative elements, which will impact the return of the investors in the long run.

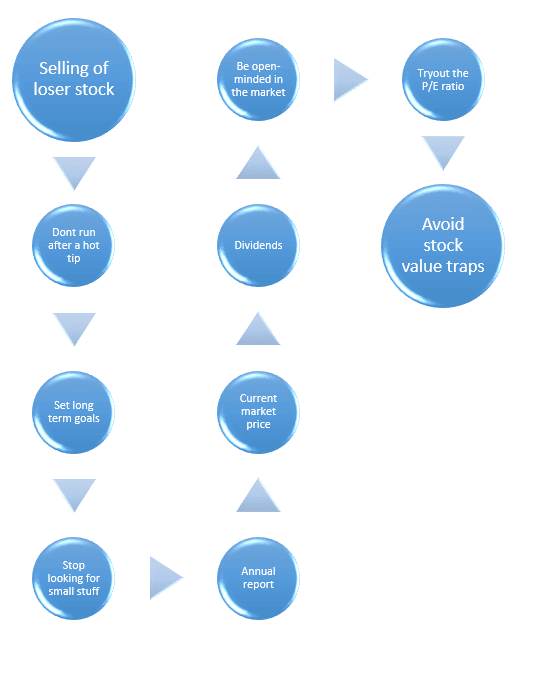

10 Best Tips for Share Market:

The following are the best share market tips:

1. Selling of loser stock:

- After a decrease in the stocks, there is no guarantee that the stocks will bounce back or not.

- You should always be ready to accept your low-performing stocks.

- You will feel a mental failure after you lose the stocks based on your mistake, but you should have no shame after knowing your mistake and later selling your investments to the stem.

Don’t forget to check: Best Intraday Trading Tips for Beginners

2. Don’t run after a hot tip:

- Never accept a stock tip from any source.

- Always conduct research before selecting and investing in stocks.

- Also, refer to the stock charts as well as technical indicators before investing in any such stock.

3. Set long-term goals:

- You should know the purpose as well as the time period for which you will wish to stay invested.

- Remember that the stock market is highly volatile and there is no certainty that you will receive your capital when you need it.

- Thus, we can consider the stock market to be a very lucrative investment asset for the long run.

4. Stop looking for the small stuff:

- Always look for investments to fulfill your long-term goals instead of looking for some short-term profit.

- It is always better to have a big picture as well as a long-term vision.

- Don’t allow the little things to ruin your big investments, and always be confident in your own investments.

Also Like: How to Make Profits in Intraday Trading?

5. Annual report:

- This will tell you about your client or the company that you wish to invest in.

- This report will tell you about everything related to the company and how it has performed over the past few years.

- With this, you will be able to learn about the company and its growth.

- You should have to read the report before investing.

6. Current market price:

- After studying the annual report, you should buy at the current market price.

- Traders will often hike up the price, and the volatility will be seen clearly by observing the trends.

- Always wait for the chart to be stable before investing.

7. Dividends:

- As per the reports, 75% of the genuine companies will pay you a dividend.

- This is not much in numbers but is very small.

- You should not rely solely on capital appreciation; instead, look for companies that will provide you with some level of comfort.

- They work as a backup for your stocks.

8. Be open-minded in the market:

- The majority of the companies have household names, but there are many good companies that are not aware of the brands.

- There are many underrated companies that have the potential to become the shining stars of tomorrow.

- There are times when small stocks give you more returns than large stocks.

Also Check: What is Intraday Trading? – Fresher to Expert Guide

9. Tryout the P/E ratio:

- The price/earnings ratio, or P/E ratio, is the most common tool for stock investing.

- This will help to determine whether the stock’s value is underrated or overrated.

- This ratio will be calculated by dividing the current market price of the stock by the company’s earnings per share.

- A minor increase in the P/E ratio will indicate that more willing investors are ready to pay for those earnings.

- A high P/E ratio will indicate that the stock is overvalued and will experience a pullback.

- A low P/E ratio will indicate that the stock has attractive valuations and has pushed shares below their actual value.

10. Avoid stock value tips:

- You should not be dependent on stock tips to know whether the stock is good or not.

- But you should focus on the debt ratio as well as the current ratio of the company.

- A debt ratio will figure out the number of assets that are linked to financial debt.

- The higher the debt means that more the company might be in a value trap.

- There is also another tool called the current ratio, which is calculated by dividing the current assets of the company by the current liabilities.

- The higher the rates, the more liquid the company becomes.

- By using the debt as well as the current ratio, you can get an idea of whether the stock has got good value or not.

- Always keep some on hand for the long haul.

Conclusion:

We hope that the above blog “Best Share Market Tips for Beginners” has given you some good tips for the stock market.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, the stock market, and intraday trading. Stay tuned with us for more such blogs.