Best Intraday Trading Techniques, Strategies & Formula to Earn Good Profit in Stock Market

Now, it’s very easy to maximize the daily profit using Intraday Trading Techniques / Strategies in NSE India. Stock market fluctuations every time gives trader surprises and therefore trader should be ready to accept and challenge the unexpected. With the proper Intraday Trading Tricks and knowledge, the trader can have the road to intraday trading success in the long run. As the name suggests, intraday trading is a type of trading when the shares are bought and sold on the same day. The risk associated with Intraday trading is very high than another trading. But, if the trader plays safely with the right trading rules, he/ she can have success in Intraday.

Here are some simple, easy intraday techniques that can help traders to win the stock market and plan their profitable trade.

Let’s have your eyeballs on some of the Simple & Best Intraday Trading Techniques & Strategies by the experts of Trading Fuel. Trading Fuel- pioneer Institute in providing live market practical training to budding intraday traders. In this regard, fresher should learn from the experts then put their shoe into Trading.

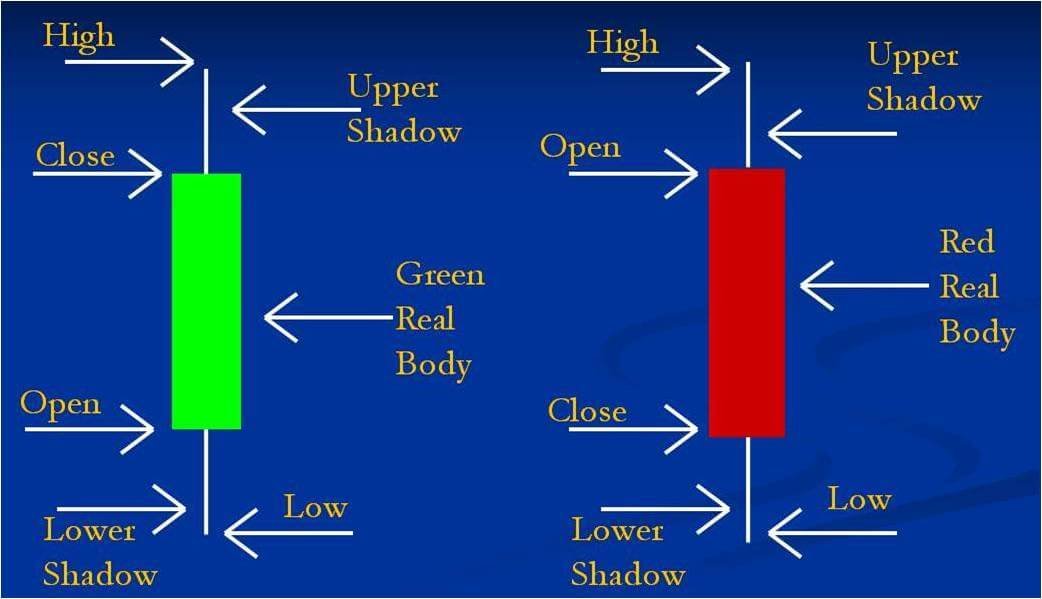

BASIC CANDLESTICK KNOW-HOW :

Green Candle and Red candle.

There are four prices in the candle.

1.Open

2.High

3.Low

4.Close.

If Open to close is high it is a green candle.

If open to close Below it is a Red candle.

Learn Intraday Trading Formula Of Break Out :

- If Close is Above the previous Candle High.

- It calls as a Closing Basis Break Out.

- This Break Out is Useful for BUY.

- If Close is Below the previous candle Low

- It calls as a Closing Basis Break Out.

- This Break Out is Useful for Sell Short.

Follow this Technical Intraday Rules :

- Useful for Nifty & Bank nifty ( Read More about – What is Nifty )

- Accuracy more than 75 % to 80 % in Intraday (Day Trading)

- Input 5 min chart (Need min to min chart)

- Focus on day first candle High and Low (DFC)

- Chance to earn every month minimum of 20,000 Rs. (Fix Income In Intraday Trading)

Intraday Trading Break Out Formula :

Sell Trade Success Intraday Trading Techniques

- When the day first candle (DFC) gives closing below the low, the trader should punch the sell trade. The trader should focus on the close & close below low. The trader can get closing on any no of candle i.e 3, 4 or 5 candle. The next candle to closing candle will be a qualified candle to go for sell-side.

- Day first candle high and low difference will be first target for the trader to book profit.

- DFC high be where you should put stop loss

- you need to look for the second target at 3:25 pm

Also Read:10 Price Action Candlestick Patterns

Buy Trade Success Intraday Trading Techniques

- When the day first candle (DFC) gives closing above the high, a trader should punch the buy trade. The trader should focus on the close & close above High. The trader can get closing on any no of candle i.e 3, 4 or 5 candles. The next candle to closing candle will be a qualified candle to go for buy-side.

- Day first candle high and low difference will be first target for the trader to book profit.

- DFC low be where you should put stop loss

- You need to look for the second target at 3:25 pm

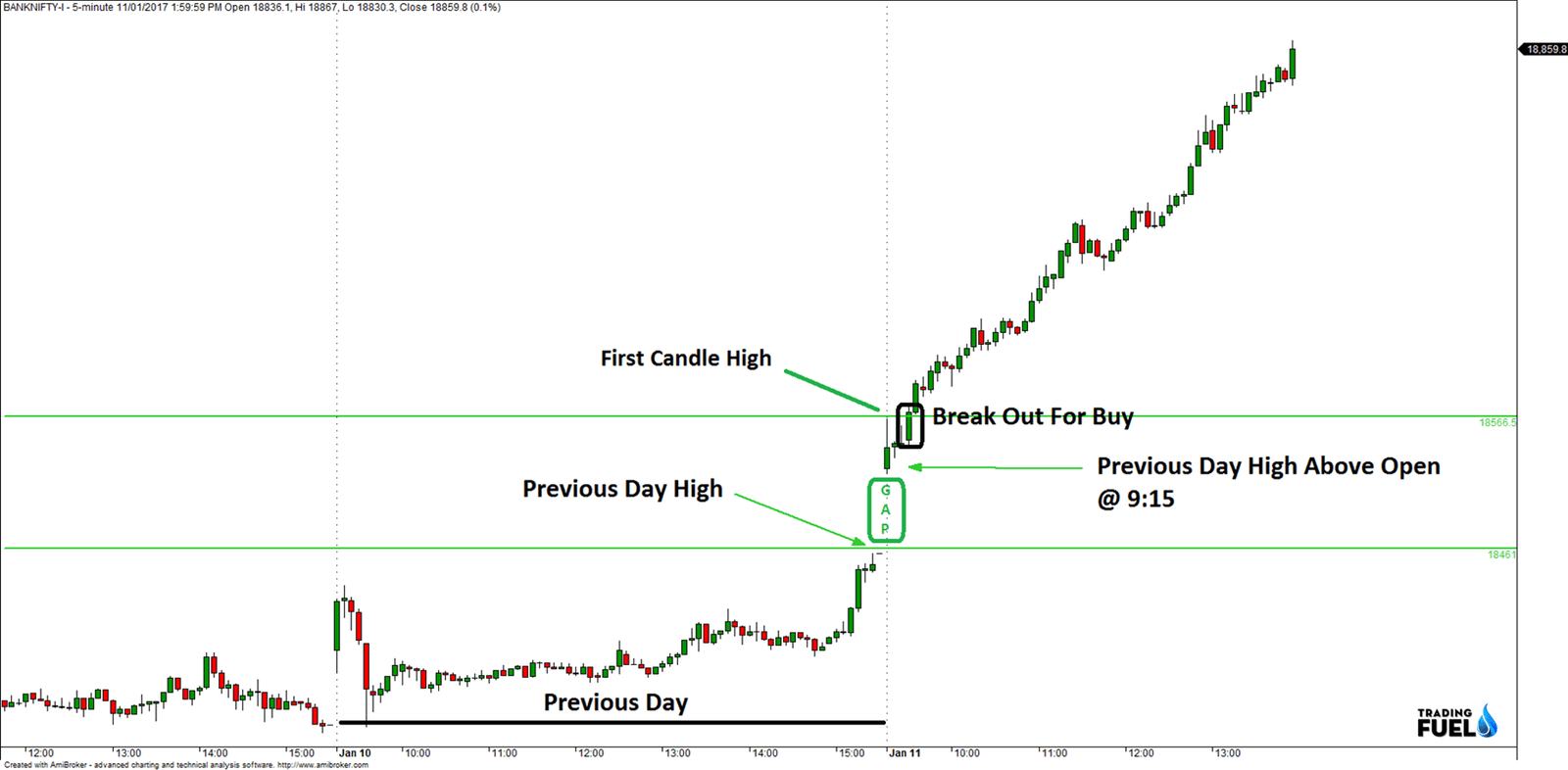

Gap Up or Down Open – Good News Or Bad News?

1. Previous Day High Above Open = Out Side Gap Up

2. Previous Day Low Below Open = Out Side Gap Down

INTRADAY BREAKOUT FORMULA WITHOUT GAP-UP OPEN:

INTERPRETATION:

If the market opens at price higher than the previous day’s high it’s said to be Out Side Gap Up Open. If the DFC candle (9:15 Am) with the gap up open price gives closing above high, go for a buy trade. Here the close above high is on 4 candles. 5 candle is a qualified candle to punch buy trade.

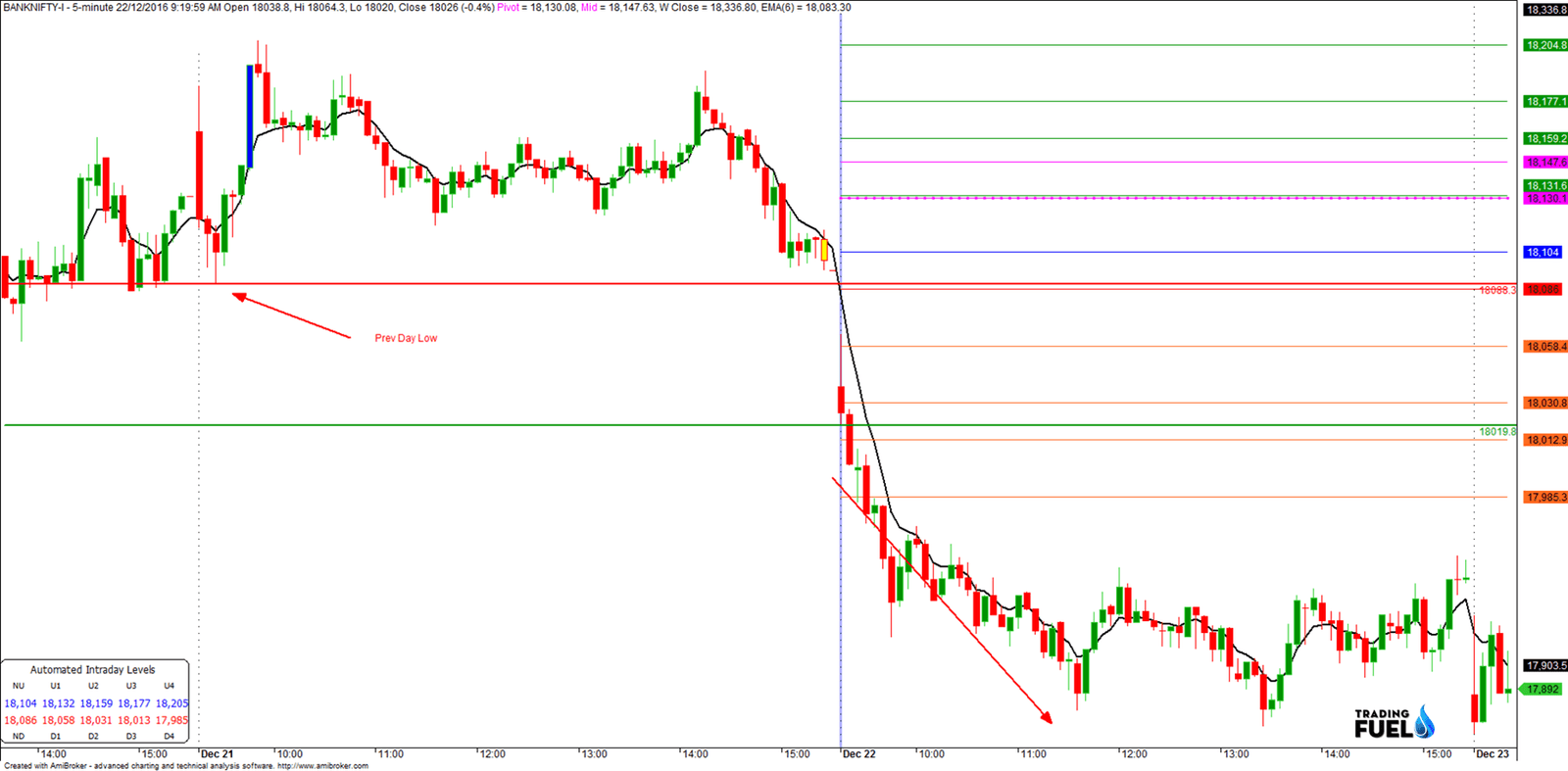

BREAKOUT FORMULA WITHOUT GAP – DOWN OPEN:

INTERPRETATION:

If the DFC candle (9:15 AM) opens below the previous day’s low, it is said to be Candle with Gap down open price. If The Candle with Gap down price gives closing below the low, go for a sell trade. Here the close below low is on 2 candles. 3 candle is a qualified candle to punch sell trade.

Beginners Guide:How to Trade in Nifty(Intraday)?

More Latest Chart Banknifty :

Now Learn, New The Best #10 Intraday Trading Techniques, Strategies & Techniques & Formula

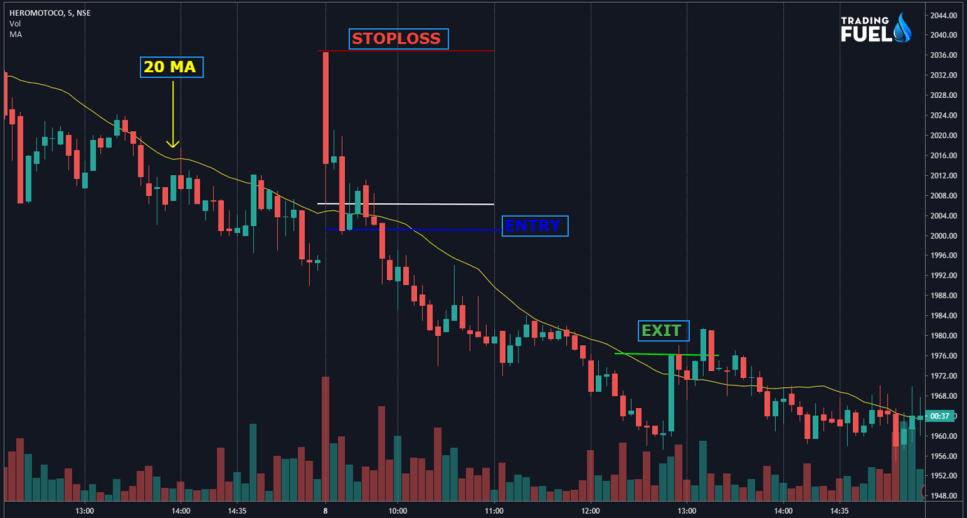

1) Open High & Open Low | Best Intraday Trading Techniques

In this article, we are going to discuss the OHL strategy.

After the market has opened at 9:15 am, we have to identify the share which is opening at high or opening at low.

- If share open at high, then we will look for a short entry.

- If share open at low, then we will look for a long entry.

Time frame: 5 minutes.

A. Open high strategy for a long entry.

- Wait for 1st candle to complete, it should be a bullish candle.

- The volume must be high at 1st candle.

- Wait for price to close above the high of the 1st candle.

- Entry after the price close above the 1st candle high.

- Keep stop loss at the day low the opening price.

- Target at 3:15 pm or when price close below 20 MA in a 5-minute time frame.

Learn More About:Guide To Read Price Action

What 1st candle told me?

- A big green candle

- Open= low

- The first candle closes around high

- Volume very high

B. Open high strategy for a short entry.

- Wait for 1st candle to complete, it should be a bearish candle.

- The volume must be high at 1st candle.

- Wait for price to close below the low of the 1st candle.

- Entry after the price close below the 1st candle low.

- Keep stop loss at the day high the opening price.

- Target at 3:15 pm or when price close above 20 MA in a 5-minute time frame.

What 1st candle told me?

- A big red candle

- Open = high

- First candle close around low

- Volume very high

Note

- Open at high or open at low forming after a gap up or gap down move are more reliable signals.

- If the open at low or open at high candle occurs after a breakout from a consolidation zone it is a must stronger signal.

- If the 1st candle breaks the previous day high or low, it is indicating the stronger momentum of a trend.

- For buying it is preferable to trade open at low occurring above the 20-day MA at a daily time frame.

- For selling it is preferable to trade open at high occurring below the 20-day MA at a daily time frame.

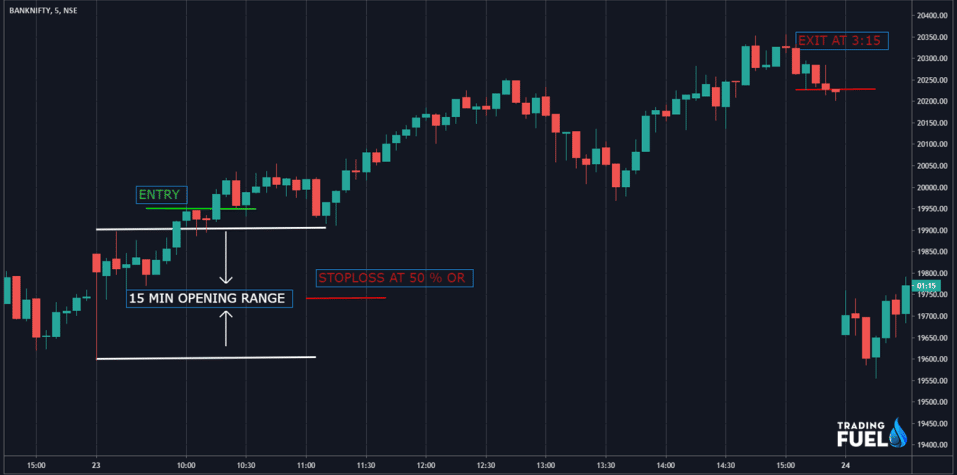

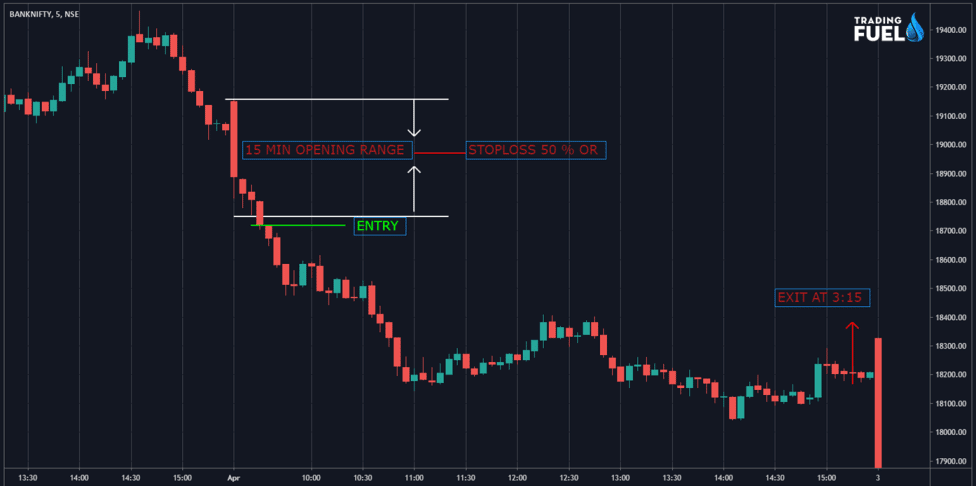

2) ORB Strategy | Intraday Trading Techniques

- ORB means opening range breakout.

- Time frame for opening range: 15 minutes.

- Time frame for trade entry: 5 minutes.

- The high and low of this opening range are taken as support and resistance.

Basic rules are very simple.

- Buy when price breaks the opening range high and close below it.

- Sell when price breaks the opening range low and close below it.

Rules for buy

- Buy after the 5-minute candle close above the opening range high.

- Stop-loss: the initial stop loss should be kept at 50% of the opening range.

- Target at 3:15 pm.

Rules for Sell

- Sell after the 5-minute candle close below the opening range low.

- Stop-loss: the initial stop loss should be kept at 50% of the opening range.

- Target at 3:15 pm.

Note

- If the opening range is too wide better do not trade ORB, since the stop loss will be very far.

- Avoid orb trades in case of heavy news flow day.

- Trade in the direction of higher time frame like 1 hr

- Opening range breakout happen after a brief period of consolidation are better.

- Always exit at the end time of the day.

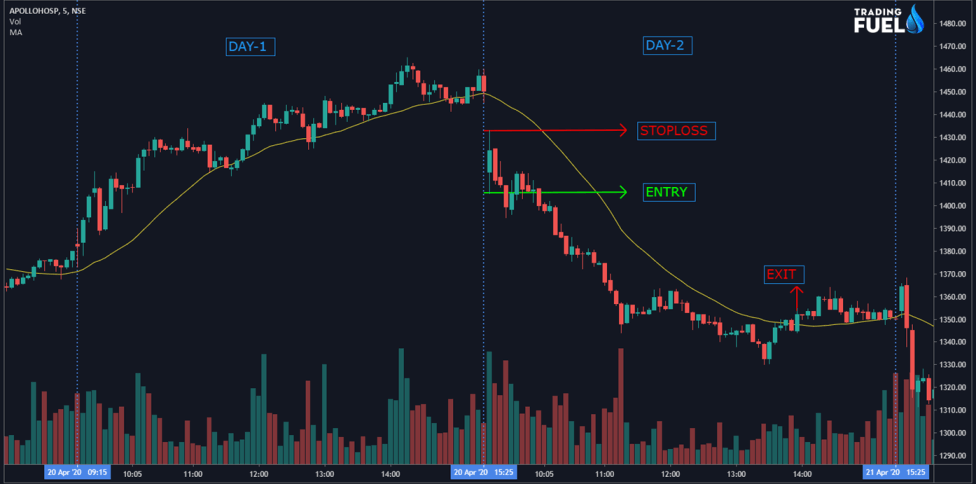

3) Morning Reversal Intraday Strategy 1

Buy condition:

- Previous day candle should be minute 3% down.

- The next day open above the previous day closing.

- Time frame: 5 minutes.

Buy entry:

- Entry at opening.

- You can enter after a close above the 1st5-minutecandle high.

- Stoploss at current day low.

- Target at3:15 pm or when price close below 20 MA in a 5-minutetime frame.

Sell condition:

- Previous day candle should be a minimum of 3 % up.

- The next day open below previous day closing.

Sell entry:

- Entry at opening.

- You can enter after a close below 1st 5-minute candle low.

- Stoploss at yesterday high.

- Target at 3:15 pm or when price close above 20 MA in a 5-minute time frame.

Must Know:How to do Banknifty Intraday Option Trading?

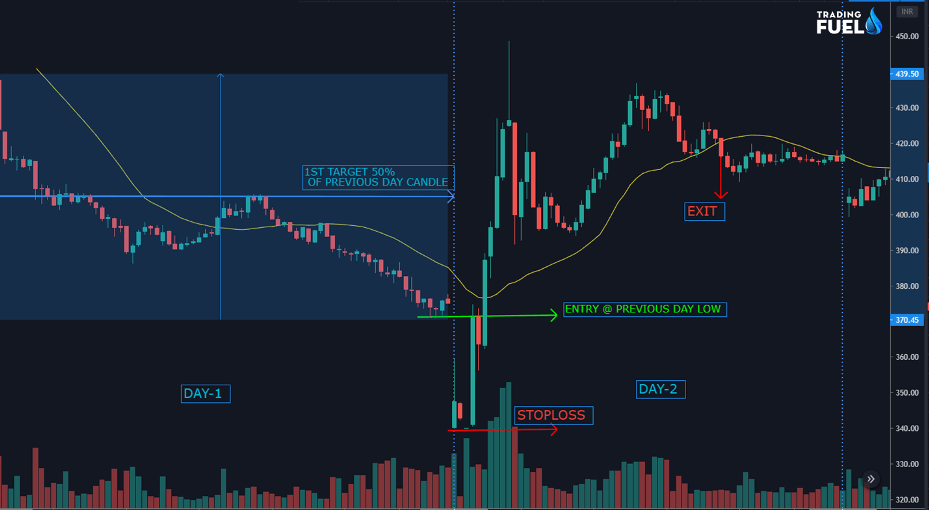

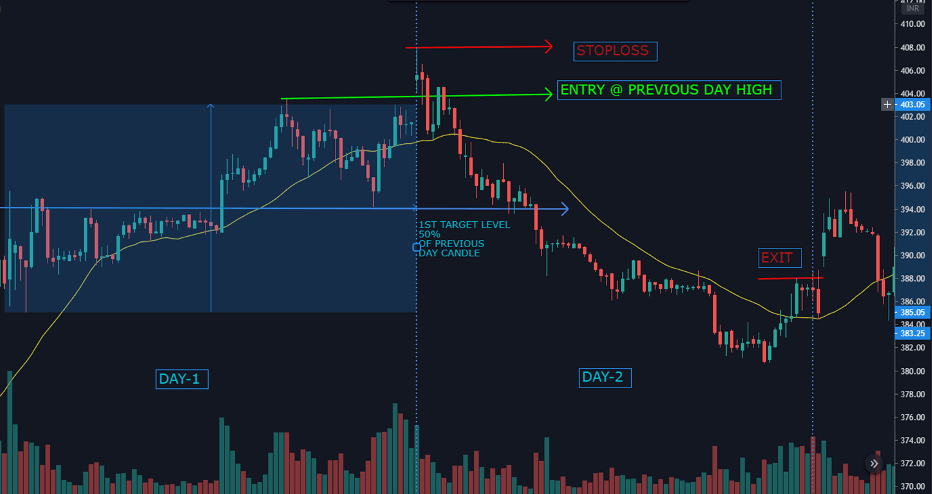

4) Morning Reversal Intraday Strategy 2

Buy condition:

- Previous day candle should be a minimum of 3% down.

- Next day price open gap down.

Buy entry:

- Entry at previous day low break.

- Stoploss at current day low.

- Target at 50 % of previous day candle or 3:15 pm or when price close below 20 MA in a 5-minute time frame.

Sell condition:

- Previous day candle should be a minimum of 5 % up.

- Next day price open gap up.

Sell entry:

- Entry at the previous day high.

- Stoploss at current day high.

- Target at 50 % of previous day candle or 3:15 pm or when price close above 20 MA in a 5-minute time frame.

5) Nifty 50 Trend Trading Strategies

Trade only nifty 50 shares.

Buy condition:

- Nifty 1st 5-minutecandle should be bullish.

- Find the stocks which are at a 1-2 % gap down opening from the previous day close.

- If the stock 1st 5-minute candle is bullish the go for a long trade.

Buy entry:

- Buy after a candle close above the 1st 5-minute candle high.

- Stoploss at same-day low or previous day close.

- Target at 3:15 pm or when price close below 20 MA in a 5-minute time frame.

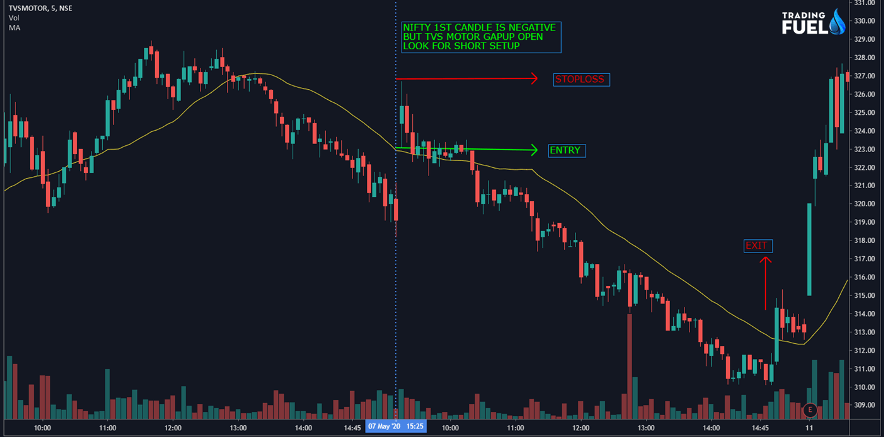

Sell condition:

- Nifty 1st 5-minute candle should bearish.

- Find the stocks which are at a 1-2 % gap up opening from the previous day close.

- If the stock 1st 5-minute candle is bearish the go for a short trade.

Sell entry:

- Sell after a candle close below the 1st 5-minute candle low.

- Stoploss at same-day high or previous day close.

- Target at 3:15 pm or when price close above 20 MA in a 5-minute time frame.

Know About Candle:Bullish Engulfing Pattern Trading Strategy

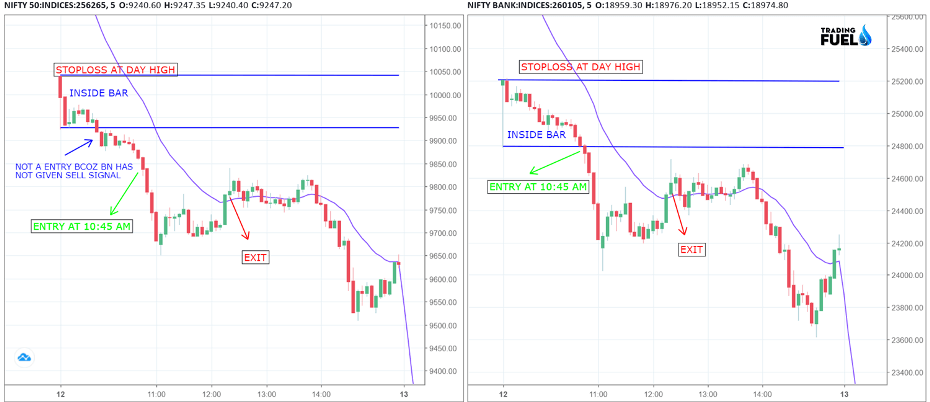

6) Index Combo Intraday Trading Techniques

Time frame: 5 minutes.

Trading asset index: nifty and bank nifty

In this combo strategy, we will enter a trade only if both the index are simultaneously giving either buy or sell entry

- We will buy only if we get to buy entry in both nifty and bank nifty.

- We will sell only if we get sell entry in both nifty and bank nifty.

- Formation of an inside candle within the 1st candle of nifty and bank nifty.

- High of the morning 1st candle is broken in both nifty and bank nifty.

Buy entry:

- Entry after a 5-minute candle is closed above the high of 1st5-minute candle in nifty and bank nifty.

- Stoploss at current day low.

- Target at 3:15 pm or 5-minute candle close below the 20 MA.

Sell condition:

- Formation of an inside candle within the 1st candle of nifty and bank nifty.

- low of the morning 1st candle is broken in both nifty and bank nifty.

Sell entry:

- Entry after a 5-minute candle is closed below the low of 1st 15-minute candle in nifty and bank nifty.

- Stoploss at current day high.

- Target at 3:15 pm or 5-minute candle close above the 20 MA.

Note:

- If one index is giving entry but another index doest then we will not take such trade.

- We will buy only if both the index is giving a breakout of high.

- We will sell only if both the index is giving a breakout of low.

- After the break out in both index we can trade in any one or both index.

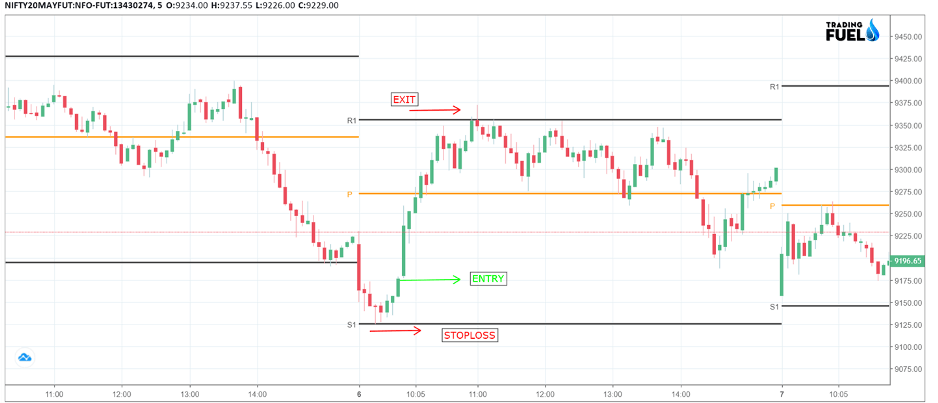

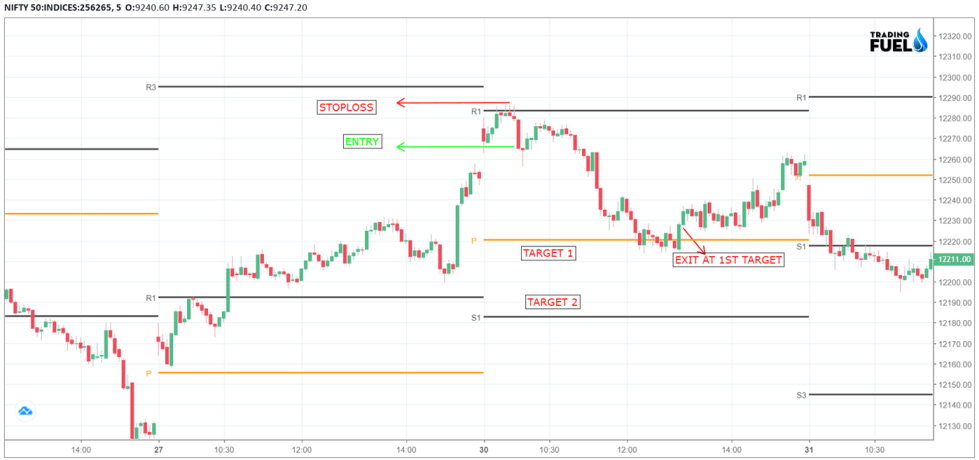

7) Pivot Reversal Intraday Trading Techniques

Pivot indicator consists of a pivot line “p” in the middle and multiple support and resistance line names as S1, S2, S3, S4 and R1, R2, R3, R4.

Time frame: 5 minutes

Buy condition:

- Previous day Market close at low.

- Ignore the first 3 candle completely.

- When a bullish candle form after the 3rd candle near S1.

Buy entry:

- Entry when a 5-minute candle close above the 1st bullish candle high that form after 3rd candle near S1.

- Stop loss: below S1.

Target

- Pivot line

- R1, R2, and so on.

Sell condition:

- Previous day Market close at high.

- Ignore the first 3 candle completely.

- When a bearish candle form after the 3rd candle near R1.

Sell entry:

- Entry when a 5-minute candle close below the 1st bearish candle low that form after 3rd candle near R1.

- Stop loss: above R1.

Target

- Pivot line

- S1, S2, and so on.

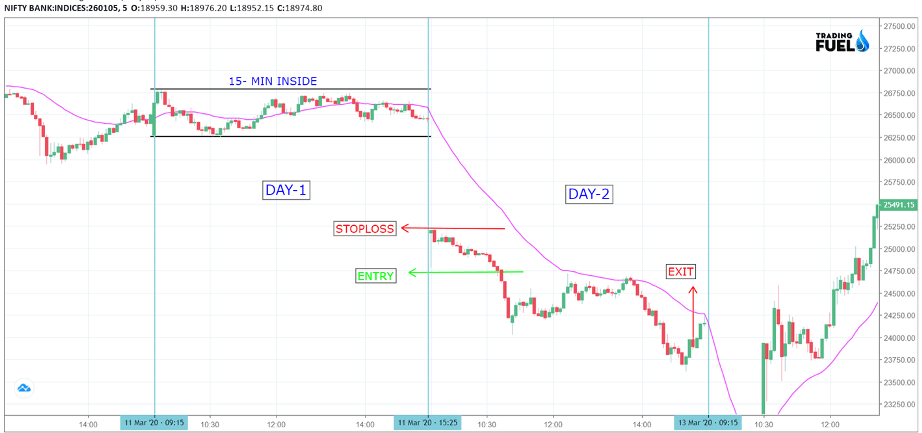

8) 15 Minute Sleep Strategies

It is a two-day strategy, we expect that in day 1 the index to remain in a sideways market without breaking the high or low the 1st 15-minute candle and on day 2 when the high or low of the 1st 15-minute candle broke we will trade in that direction.

Buy condition:

- Day 1: 1st 15 minute high and low are not broken throughout the day.

- Day 2: 1st 5-minute candle high break.

Buy entry:

- 5-minutecandle close above the high of 1st candle.

- Stoploss at current day low.

- Target at 3.15 pm or 5-minutecandle close below 20 MA.

Sell condition:

- Day 1: 1st 15 minute high and low are not broken throughout the day.

- Day 2: 1st5-minutecandle low break.

Sell entry:

- 5-minute candle closes below the low of 1st candle.

- Stoploss at current day high.

- Target at 3.15 pm or 5-minute candle close above 20 MA.

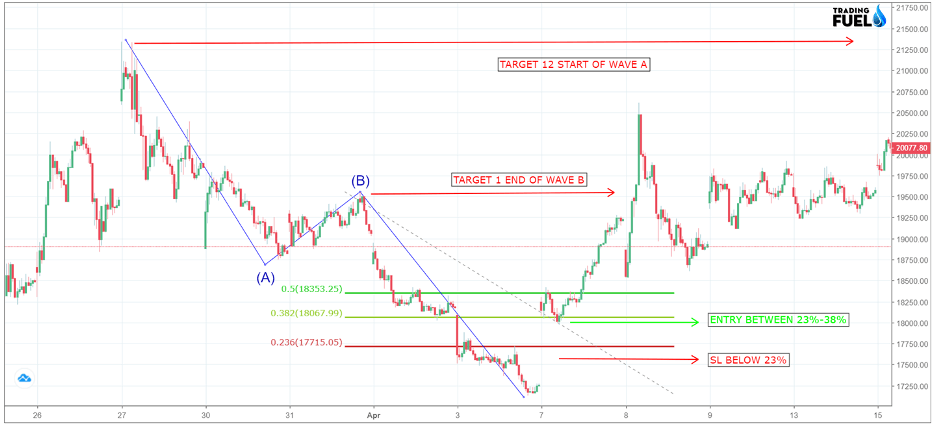

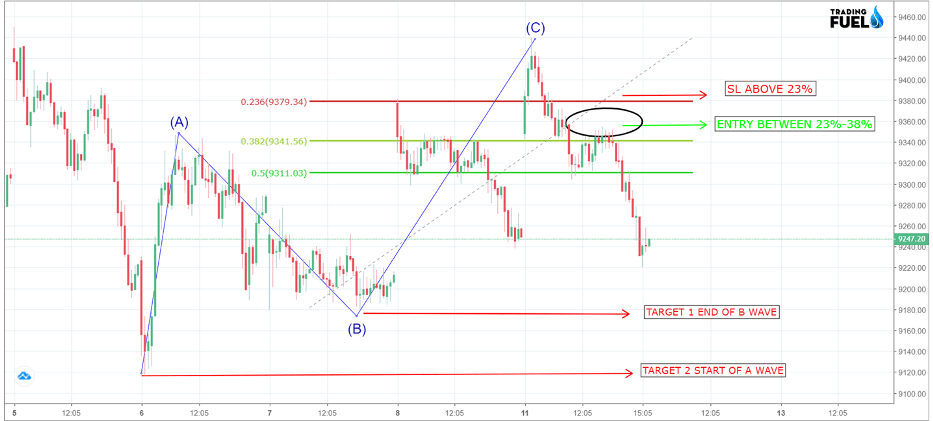

9) Elliot Wave ABC 38% Retracement | Intraday Trading Strategies

This strategy is for those to know the basics of Elliot wave and the Fibonacci level.

Correction in Elliot wave are labeled as ABC, as they are complex structure its difficult to predict their direction and trade them, but a corrective structure has a tendency to get retraced more than 100%, in this article we will provide you a simple method to trade ABC structure.

Here we will use 38% retracement level of Fibonacci, in Elliot wave theory when the price break and sustain below the 38.2% level for more than 15 minutes it is considered the trend is changed.

38% is a trend reversal and intermediate support level.

Buy condition:

- First of all you must be able to spot a complete ABC corrective structure.

- Draw a Fibonacci level of 23%,38% and 50 %. From B point.

- Price must break 38% level and sustain above it for more than 15 minutes or price touch 50 % retracement then the same 23%-38% become support zone.

Buy entry:

- After the break of a 38% level, the price will reach to 50 % level.

- Any decline from a 50% level to 23%-38% region will provide us an entry point.

- Stoploss at must be placed below the 23 % level.

Target Are:

- Minimum target point B.

- Probable target point O.

Sell condition:

- First of all you must be able to spot a complete ABC corrective structure.

- Draw a Fibonacci level of 23%,38% and 50 %. From B point.

- Price must break 38% level and sustain below it for more than 15 minutes or price touch 50 % retracement then the same 23%-38% become resistance zone.

Sell entry:

- After the break of a 38% level, the price will reach to 50 % level.

- Any bounce from a 50% level to 23%-38% region will provide us an entry point.

- Stoploss at must be place Stoploss at must be placed above the 23 % level.

Target Are:

- Minimum target point B.

- Probable target point O.

Note:

it is not advisable to blindly trade or label any structure ABC, one must have a basic knowledge of Elliot wave theory.

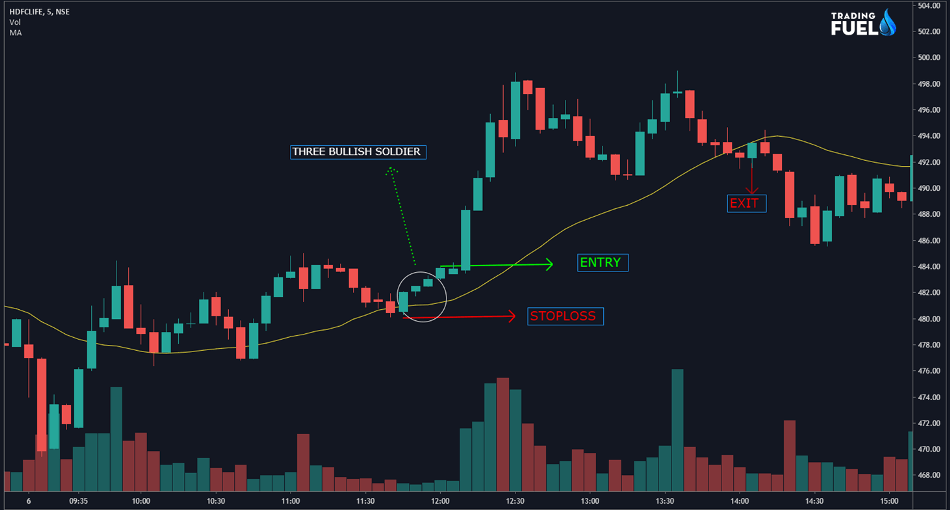

10) Three Soldier Intraday Trading Strategies

Time frame: 5 minutes

Buy condition:

- Three small bullish candles each making a new high.

Buy entry:

- After a 5 minute candle close above the high of the 3rd candle.

- Stoploss at above low of the 1st candle.

- Target at 3:15 pm or price closing below 20 MA.

Sell condition:

- Three small bearish candles each making a new low.

Sell entry:

- After a 5 minute candle close below the low of the 3rd candle.

- Stoploss at above high of the 1st candle.

- Target at 3:15 pm or price closing above 20 MA.

CONCLUSION ABOUT ABOVE ALL INTRADAY TRADING STRATEGIES

There is no doubt about the fact that stock market trading can be a good carrier and you can earn a high income, but before jumping into the water you must learn to swim, what I mean is ” trading is a game of survival” there is no strategy which will work all the time. you must focus on managing your loss.

According to one of the most popular Indian traders Ashwani Gujral, there are “3-M” which trade must have if he considering trading as a carrier, there three M are Method, Money management, Mindset.

The trading strategy is alone not powerful, one must invest his time in understanding the different market conditions, and use proper risk management.

Now Learn Some Day Trading Rules

Intraday trading is not as simple as it is made out to be. Before you get into the act of intraday trading, you need to learn the secret formula for intraday trading. Let us look at this formula that can help you to become a successful intraday trader.

Trading Rules to become a successful intraday trader:

- Intraday trading is about focusing on and protecting your capital. Do not trade with big profits in your mind, instead of that focus on how much risk you are willing to take per trade. Once you learned about protecting your capital from depleting beyond a point, profits from day trading will automatically follow.

- Don’t trade during the volatile market. Always trade with the trend. Intraday trading gives the best result when the momentum and direction of the market are predictable.

- Never forget to keep stop loss. It is one of the keys to achieve success in day trading. Without a stop loss, you may end up holding positions with the unmanageable market to market loss.

- Whatever trade setup you use for day trading, as an intraday trader you must know about right entry and exit point. You have to take three key decisions about when to buy, when to sell and when to sit tight.

- Don’t panic when you are doing intraday trading, that leads you to take wrong and hasty decisions in the market.

- Never try to recover your losses by overtrading. It is the golden rule for intraday trading. Overtrading will lead you to lose money in both ways.

- Keep a record of your daily trade. It will help you to find your mistakes and really useful for you to become a better trader.

- Whatever Intraday Formula you use for Intraday trading, first do backtest with past data and also in the live market. Once you are ready with backtesting, as per your risk management strategy you can use your intraday trading formula.

- There is no golden key to become a successful trader, only practice makes you a good intraday trader. Practice, Discipline and Risk management is the key formula for successful intraday trader.

Lastly, We at Trading Fuel don’t use simple intraday trading techniques because they are good. We use them because they work. If you are looking for Intraday Trading Techniques, Strategies, formulas, Tricks & Rules then your search ends here!

Our trading methods are based on simple rules which anyone can easily adopt. They help us to act in time with perfect information and give the best results. Our trading methods are tested and confirmed that are accurate and profitable.

We impart training to investors and traders using our trading methods that can help you to become an independent profitable trader.

FAQs

For Free Live Chart

Contain & Image ©️ Copyright By, Trading Fuel Research Lab