How to Calculate Turnover for Intraday Trading?: When you are planning to file an income tax return for your trading business, you will first need to calculate the turnover for the entire year.

The main requirement for calculating the turnover will arise only when we treat the trading P&L account as a business income.

How to calculate the business turnover for intraday trading?

- The method for calculating the turnover for intraday trading is the most tiresome thing.

- The other grey part of the same is that there are no guidelines as such from the IT department.

- The only disclosure for the same is provided by ICAI (Institute of Chartered Accountants of India) under section 44AB.

- The section says that the calculation of the turnover can be done in the following ways:

Also Read:What is Intraday Equity and Delivery Equity?

#1. Delivery-based transactions:

- For all the delivery-based transactions, you buy the stocks and hold them for more than 1 day before selling them.

- Hence, the total value of the sales is considered to be the turnover.

- So, for an example, if you buy 100 shares of Reliance Company for RS. 2700 and sell them at RS. 2740, then the selling value of RS. 274,000 (2740*100) is considered as your turnover.

- The most important point to note here is that the calculation of turnover of delivery trades, it will only be applicable if you are declaring equity delivery-based trades as business income.

- If you declare the same as capital gains or investments, then there is no need to calculate turnover on such transactions.

#2. Speculative transactions (intraday equity trading):

- For speculative transactions, the aggregate, or the absolute sum of both positive and negative differences from the trades, is considered to be your turnover.

- So for example, if you buy 100 shares of Reliance Company for RS. 2700 and sell them at RS. 2740 by afternoon you will make a profit or positive difference of RS. 4000.

- Hence, this RS. 4000 will be considered as your turnover for your trade.

#3. Non-speculative transactions (Futures and Options):

The turnover for all the non-speculative transactions will be determined as follows:

Also Like: BSE India | Bombay Stock Exchange

- So, for example, if you buy 25 units or 1 lot of Nifty Futures at 16,500 and sell at 16,000, RS. 12,500 (25*500), the negative difference or the loss on the trade is your turnover.

- In options, if you buy 100 units or 4 lots of Nifty at 16,500 at RS. 100 and sell them at RS. 200, then the favorable difference or profit of RS. 10,000 (100*100) is your turnover.

- There are also other ways through which you can determine the turnover.

- They are as follows:

1. Scrip wise:

- This is when you will calculate the turnover by collating all the trades on a particular contract/scrip for the financial year.

- Firstly, you will find the average buy/sell value, and then determine the turnover using the above 3 rules with the total profit/loss or the favorable/unfavorable differences on this average price.

2. Trade wise:

- This is when you will calculate the turnover after summing up the absolute value of profit and loss of every trade that was made during the year.

- The same has to be calculated after following the above rules.

- Let us understand both of these with the help of examples:

1. 1000 Nifty Jan Future bought at 16000 and sold at 16500 on 1st

Another was 1500 Nifty Jan Future was bought at 17000 and sold at 16900 on January 10th. Determine the turnover:

- Using scrip wise:

Average Nifty Jan Future buy: 2500 buy at 16500

Average Nifty Jan Future sell: 2500 sell at 16700

Total profit/loss: 2500*RS. 200 = Profit of RS. 500,000 which is the turnover of Nifty Jan Futures.

- Using trade-wise:

1000 Nifty buy at 16000, sell at 16500, profit = RS. 500,000

1500 Nifty buy at 17000, sell at 16900, loss = RS. 150,000

Turnover of Nifty Jan Futures = RS. 500,000+150,000 (absolute sum of loss) = RS. 650,000.

2. 1000 Nifty Dec 16000 put bought at 2000 and sold at 1500 on December 3.

Another 1000 Nifty Dec put 16000 put bought at 1500 and sold at 1000. Determine the turnover:

- Using scrip wise:

Average of Nifty Dec 16000 puts buy 2000 at RS. 1750

Average Nifty Dec 16000 puts sold: 2000 at RS. 1250

Total profit/loss = 2000*500 = Loss of RS. 1,000,000

Hence, the total turnover of Dec 16000 put is RS. 1,000,000.

- Using trade-wise:

1000 Nifty buy at 2000, sell at 1500, loss = RS. 500,000

1000 Nifty buy at 1500, sell at 1000, loss = RS. 500,000

Total turnover = turnover of both the trades, which comes to RS. 1,000,000 (500,000+500,000).

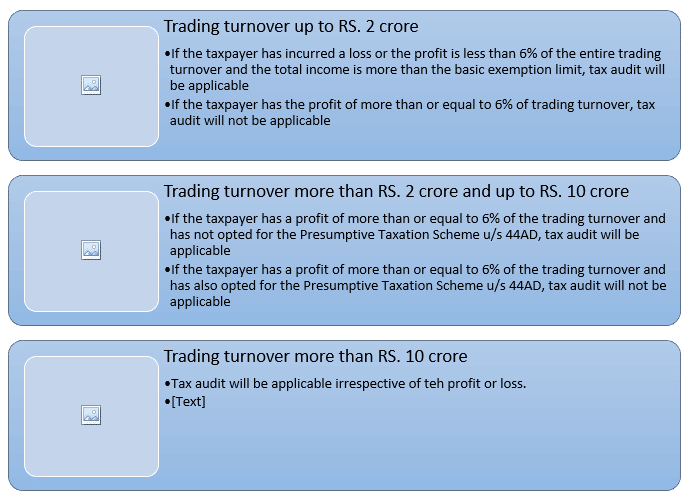

Tax Audit for Intraday Trading:

Also Like:How are Gains from Intraday Trading Taxed?

The tax audit on intraday trading is disclosed u/s 44AD.

The section states the following:

Who performs tax audits for intraday trading?

If an intraday trader is subject to a tax audit for intraday trading, then the trader needs to hire the services of a professional chartered accountant so as to carry on a range of services, including the following:

Conclusion:

We hope that the above blog gives you clarity about how to calculate turnover for intraday trading.

Frequently Asked Questions (FAQs)

Must Read:Is It Safe to do Intraday Trading?

About Us:

Trading Fuel is our website for blogs where we give you training about finance, economics, the stock market, and intraday trading. We hope that you like our blog “How to Calculate Turnover for Intraday Trading?”

~ Stay tuned with us for more such blogs ~