“BSE India | Bombay Stock Exchange” established in year 1875.

As you know that in India, there are major two stock exchanges where all the trading or investing purpose are fulfilled.

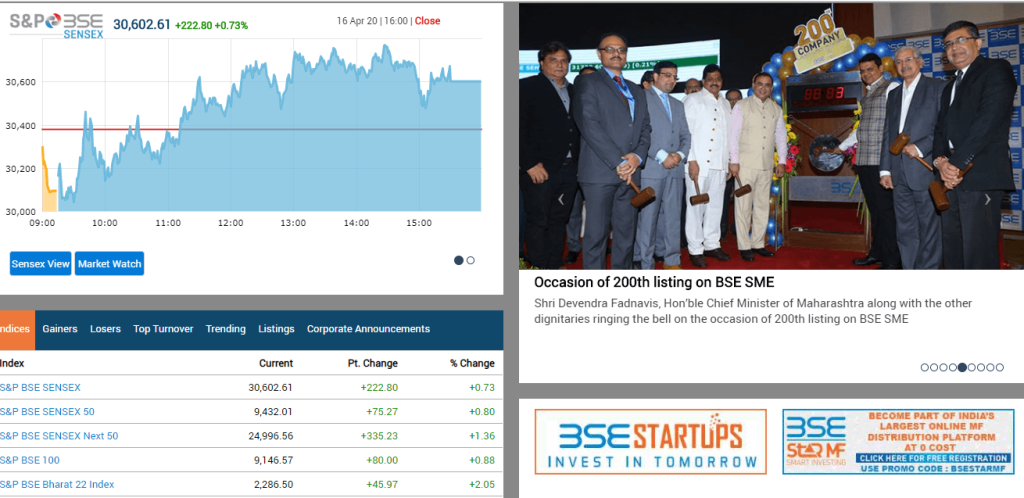

They are National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Major of the equity, futures and many securities are traded on these major stock exchange in India.

So, you know that BSE stands for Bombay Stock Exchange and through this article on “Bombay Stock Exchange (BSE India) ” you will get to know about history and many more details.

And if you want to know more about National Stock Exchange (NSE) then you can our blog on “NSE India”.

Okay, so now let’s directly into the article.

BSE India|Bombay Stock Exchange

The Bombay Stock Exchange was the first stock exchange in Asian and was established in year 1875.

This stock exchange has maintained the growth of the Indian Corporate sector by providing them to make it efficient for the platform of capital-raising.

Now, let us check the history of the Bombay Stock Exchange (BSE India)

BSE India History

BSE India (Bombay Stock Exchange) is the first stock exchange that was established in 1875 and the country took the permission from the recognition under the Securities Contract Regulation Act, 1956.

From the past 143 years, this stock exchange is making the capital market efficient and more number of investors are all also part of it.

Let us see the milestone BSE india has achieved from the past 143 years in the Indian Securities Market.

BSE India – Milestone

| YEAR | MILESTONES |

| 9TH July, 1875 | The Bombay Stock Exchange was established previously known as “The Native Share & Stock Broker’s Association” |

| 2nd Feb, 1921 | Clearing House started by the Bank of Nation |

| 3st Aug, 1957 | BSE granted the permanent recognition under the Securities Contracts (Regulation) Act (SCRA) |

| 2ND Jan, 1986 | S&P BSE SENSEX, country’s first equity index launched |

| 10th Jul, 1987 | Investor’s Protection Fund (IPF) was introduced |

| 3rd Jan, 1989 | BSE Training Institute (BTI) was inaugurated |

| 25th Jul, 1990 | S&P BSE SENSEX closes above 1000 |

| 15th Jan, 1992 | S&P BSE SENSEX closes above 2000 |

| 30th Mar, 1992 | S&P BSE SENSEX closes above 4000 |

| 1st May, 1992 | SEBI Act established |

| 29th May, 1992 | Capital Issues (Control) Act repealed |

| 1992 | Securities Appellate Tribunal (SAT) was established |

| 14th Mar, 1995 | BSE On-Line Trading (BOLT) system was introduced |

| 19th Aug, 1996 | First Major S&P BSE SENSEX was revamp |

| 12th May, 1997 | Trade Guarantee Fund (TGF) was introduced |

| 21st Jul, 1997 | Brokers Contingency Fund (BCF) was introduced |

| 1997 | BSE On-Line Trading (BOLT) system was expanded nation wide |

| 22nd Mar, 1999 | Central Depository Services Ltd. (CDSL) was set up with the other financial institutions |

| 1st Jun, 1999 | Interest Rate Swaps (IRS)/ Forward Rate Agreements (FRA) was allowed |

| 15th Jul, 1999 | CDSL commences work |

| 11th Oct, 1999 | S&P BSE SENSEX closed above 5000 |

| 11th Feb, 2000 | S&P BSE SENSEX crosses 6000 in intraday |

| 9th Jun, 2000 | Equity Derivatives were introduced |

| 1st Mar, 2001 | Corporatisation of Exchanges proposed by the Union Govt. |

| 1st Feb, 2001 | BSE India Webx Launched |

| 1st Jun, 2001 | Index Options Launched |

| 4th Jun, 2001 | S&P BSE PSU index was introduced |

| 15th Jun, 2001 | WDM operations were commenced |

| 2nd Jul, 2001 | VaR model was introduced for margin requirement calculation |

| 9th Jul, 2001 | Stock Options was Launched |

| 11th Jul, 2001 | BSE Teck was launched and India’s first free float index also |

| 25th Jul, 2001 | S&P BSE Dollar 30 was launched |

| 1st Nov, 2001 | Stock Futures was launched |

| 29th Nov, 2001 | 100% book building was launched |

| 31st Dec, 2001 | All the securities turned to T+5 |

| 1st Feb, 2002 | Two way fungibility for ADR/ GDR |

| 15th Feb, 2002 | Negotiated Dealing System (NDS) was established |

| 1st Apr, 2002 | T+3 settlement was introduced |

| 1st Jan, 2003 | India’s First ETF on S&P BSE SENSEX –“SPICE” was introduced |

| 16th Jan, 2003 | Retail trading in G Sec |

| 1st Apr, 2003 | T+2 settlement was introduced |

| 1st Jun, 2003 | Bankex was started |

| 1st Sep, 2003 | S&P BSE SENSEX shifted to free-float methodology |

| 1st Dec, 2003 | T group was introduced |

| 2nd Jun, 2004 | S&P BSE SENSEX closes above 6000 for the first time |

| 17th May, 2004 | Second biggest fall of all the time, Circuit filters were used twice in a day |

| 20th May, 2005 | The BSE India Scheme, 2005 was announced by SEBI |

| 8th Aug, 2005 | Incorporation of the Bombay Stock Exchange Limited |

| 12th Aug, 2005 | Certificate of Commencement of Business |

| 19th Aug, 2005 | BSE becomes a corporate Entity |

| 7th Feb, 2006 | S&P BSE SENSEX closed above 10000 |

| 7th Jul, 2006 | BSE Gujarati website was launched |

| 21st Oct, 2006 | BSE Hindi website was started |

| 2nd Nov, 2006 | iShares S&P BSE SENSEX India Tracker listed at Hong Kong Stock Exchange |

| 2nd Jan, 2007 | Launch of Unified Corporate Bond Reporting platform: Indian Corporate Debt Market (ICDM) |

| 7th Mar, 2007 | Singapore Exchange Limited entered into an agreement to invest in a 5% stake in BSE |

| 16th May, 2007 | Appointed Date under the Scheme as notified by SEBI |

| 10th Jan, 2008 | S&P BSE SENSEX touch the All-time High at 21,206.77 |

| 1st Oct, 2008 | Currency Derivatives was introduced |

| 18th May, 2009 | The S&P BSE SENSEX raised 2110.70 points and the index wide upper circuit breaker was applied |

| 7th Aug, 2009 | BSE-USE Form Alliance to develop Currency & Interest Rate Derivatives Markets |

| 24th Aug, 2009 | S&P BSE IPO Index was launched |

| 1st Oct, 2009 | Bombay Stock Exchange was introduce for trade details facility for the investors |

| 5th Oct, 2009 | BSE Introduces New Transaction Fee Structure for the cash Equity segment |

| 25th Nov, 2009 | BSE launched the FASTRADE, this was the new market access platform |

| 4th Dec, 2009 | BSE launches the BSE STAR MF, that was mutual fund trading platform |

| 7th Dec, 2009 | Launch of clearing and settlement of corporate bonds through the Indian Clearing Corporation Ltd. |

| 14th Dec, 2009 | Marathi Website was started |

| 18th Dec, 2009 | BSE’s new derivatives rates to lower transaction costs for all |

| 4th Jan, 2010 | Market time was changed to 9:00 AM to 3:30 PM |

| 20th Jan, 2010 | S&P BSE PSU website was launched |

| 22nd Apr, 2010 | New DBM framework from RS 10 Lakhs – 90% reduction in membership deposit |

| 12th May, 2010 | Dissemination of Corporate Action information via SWIFT platform |

| 23rd Jul, 2010 | Options on BOLT |

| 21st Sep, 2010 | First to introduce the mobile-based trading |

| 29th Sep, 2010 | Introduction of Smart Order Routing (SOR) |

| 4th Oct, 2010 | EUREX – S&P BSE SENSEX Futures was launched |

| 11th Oct, 2010 | Launch of Fastrade on Web (FoW) – Exchange hosted platform |

| 12th Nov, 2010 | Commencemet of S&P BSE Voilatility Index |

| 22nd Nov, 2010 | Launch of SLB |

| 10th Dec, 2010 | Launch of SIP |

| 27th Dec, 2010 | Commencement of S&P BSE Shariah Index |

| 17th Nov, 2011 | Maharashtra and United Kingdom Environment Ministers launched Concept Note for S&P BSE Carbon Index |

| 7th Jan, 2011 | BSE Training Institute Ltd. With IGNOU launched India’s first 2 year full time MBA program specializing in Financial Market |

| 15th Jan, 2011 | Co-location facility at BSE – tie up with Netmagic |

| 22nd Feb, 2012 | Launch of S&P BSE- GREENEX to promote investments in Green India |

| 13th Mar, 2012 | Launch of BSE- SME Exchange Platform |

| 30th Mar, 2012 | BSE launched trading in BRICSMART indices derivatives |

| 19th Feb, 2013 | BSE enters into Strategic Partnership with S&P Dow Jones Indices |

| 28th Nov, 2013 | Launch of Currency Derivatives (BSE CDX) |

| 28th Jan, 2014 | Launch of Interest Rate Futures (BSE – IRF) |

| 11th Feb, 2014 | Launch of Institutional Trading Platform on BSE SME |

| 20th Mar, 2014 | BSE Launches New Debt Segment |

| 4th Apr, 2014 | BSE SME exceeds USD 1 billion market capitalization |

| 7th Apr, 2014 | Launched the equity segment on BOLT plus with the median response time of 200 |

| 27th May, 2014 | BSE felicitated at the Asian Banker Summit 2014- BSE Best Managed Financial Derivatives Exchange in the Asia Pacific |

| 26th Sept, 2014 | BSE inks MoU with BNY Mellon |

| 22nd Oct, 2014 | BSE inks strategic partnership with YES BANK |

| 28th Nov, 2014 | BSE listed cos market cap crosses landmark 100 lakh crore |

| 12th Dec, 2014 | Market Cap of BSE SME listed companies crosses landmark 10,000 crore |

| 8th Jan, 2015 | BSE Commensed live trading from the disaster recovery site in Hyderabad |

| 16th Apr, 2015 | Asia Index Private Limited launches S&P BSE AllCap, S&P BSE SENSEX Leverage and inverse indices |

| 18th May, 2015 | BSE introduces overnight investment product |

| 28th May, 2015 | BSE exceeds 1 billion derivatives contracts on its new Deutsche Borse T7 powered trading platform |

| 9th Jul, 2015 | BSE celebrated its 140th Foundation Day |

| 16th Jul, 2015 | BSE SME platform successfully completes listing of 100 SMS’e under its SMC umbrella |

| 13th Oct, 2015 | BSE becomes the fastest exchange in the world with a median response speed of 6 microseconds |

| 9th Dec. 2015 | BSE partners with CII and IICA to launch a one of its kind CSR platform ‘Sammaan’ – The CSR Exchange |

| 28th Mar, 2016 | BSE STAR Mutual Fund Processes 81,000 orders worth Rs. 270 Crore- Record Order in single day |

| 5th Apr, 2016 | BSE & CMIE launch world’s first high-frequency data on unemployment and consumer sentiments |

| 9th Jun, 2016 | BSE announces commencement of trading of Sovereign Gold Bonds |

| 3rd Feb, 2017 | BSE India becomes India’s 1st listed Stock Exchange |

| 16th Mar, 2017 | BSE partners with Sentifi for analyzing and reporting social media updates |

| 22nd Aug, 2017 | Asia Index Private Limited launches the S&P BSE Bharat 22 Index |

| 19th Jan, 2018 | BSE STAR Mutual Fund introduce e-mandate facility |

| 30th Jun, 2018 | BSE signs MoU with Bombay Metal Exchange |

| 17th Jul, 2018 | BSE building received trademark |

For knowing the timings and holidays of the stock exchange you can read the blog on “What Time Does Market Open?”

About Us

Through this article on “Bombay Stock Exchange – BSE India” we had tried to sum up the history and milestone achieved by the exchange so far. Hope that you find it informative for you and also you can shares with your mates the articles. Trading Fuel is just leading pioneer for making many of the learners to know about the different topics of the stock market in an easy way. You can also read previously article on our blog site. Till then, Happy Learning.