What is the 2% Rule in Trading & why should know about it?: Trading is a very risky business, but the traders of Wall Street have got a very different fortune.

Economists and trading strategists have developed multiple trading strategies to try and combat losses and manage the risks in trading.

One such trading strategy that has been developed is the 2% rule.

You Also Like: How to Use Moving Average in Intraday?

What is the 2% rule?

- The 2% rule is a trading strategy.

- This strategy has its main focus on risk management.

- In this strategy, an investor will limit themselves to only investing 2% of their available capital in any one particular trade.

- With this, the investor will only lose 2% of their capital in a trade, which in turn will minimize their risk as well as the losses.

- However, if the market goes up, it will mean that the investor has gained 2% of the invested capital through a trade.

- Thus, it means that multiple trades can be conducted with 2% capital in each as a means to diversify the portfolio with the minimum risk.

- The simple reason for this diversification is that if one trade goes down, then the other trade will compensate for the same.

- However, if any of the trades fail, you will only lose a maximum of 2% of your capital.

You Also Read:How Much Can We Earn in Intraday Trading?

How will you calculate 2% risk per trade?

- Before investing, you will have to calculate how much 2% capital is available.

- Let us take an example: if an investor has RS. 100,000 to invest, then 2% of the same comes to RS. 2000 in each trade.

- However, the reality is just the other way around.

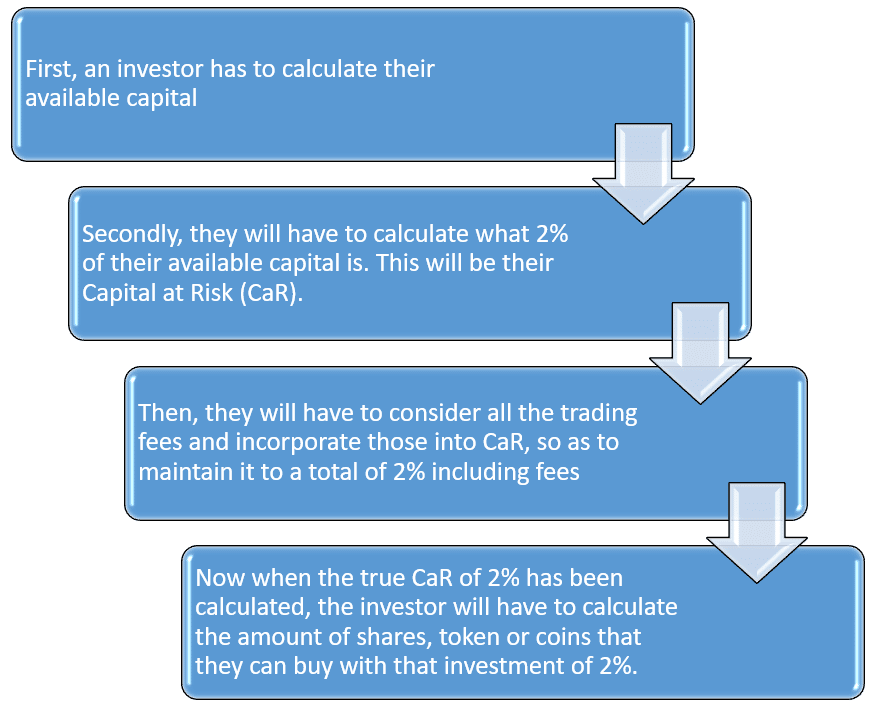

You will have to follow the below steps to calculate the 2% risk per trade:

Even after calculating the 2% CaR, there is no guarantee that you will only be risking 2% per trade.

How do you risk only 2% per trade?

Some of the traders might end up risking more than 2% per trade.

You will have to consider the following factors to limit your risk:

#1. Mitigate potential losses with the buy and sell orders:

- If a trader puts an order to buy 10 shares, which will represent 2% of their available capital including fees, the value increases after the placement of the order but before the transaction is even finalized.

- This will mean that the value of each share has increased with time.

- To mitigate this, traders can use the certain buy and sell orders.

- Stop orders are the automated orders that are set by the traders, which can be used to protect ourselves against heavy losses.

- In such a case, traders can lock in their profits when the value increases, and if the value decreases, the sell will be automatically triggered to combat heavy losses.

#2. Use trailing stop-order:

- With the trailing stop order, the investor can sell at a pre-specified percentage below the share’s live value.

- This set percentage will immediately trigger a buy or sell order once the asset value hits the desired price.

“What are the Rules for Intraday Trading?“

Conclusion:

We hope that the above blog has given you clarity about the 2% rule in trading.

About Us:

Trading Fuel is our blog website where we give you knowledge about economics, finance, stock markets, technical analysis, ways of trading, and intraday trading.

~Stay tuned for more such trading-related blogs~