Best Intraday Trading Tips for Beginners:

- Intraday trading is the buying and selling of stocks on the same trading day.

- Intraday trading is also known as day trading.

What is Intraday Trading?

- Intraday trading refers to the buying and selling of stocks on the same day.

- It is done with the help of online trading platforms.

- Here, the purpose is to earn profits through the movement of the market indices.

- Thus, intraday trading is also referred to as day trading.

- Intraday trading is very much different from delivery-based trading.

- In delivery-based trading, the stocks that we buy are credited to our Demat account.

- We can hold these stocks for as long as we want days, months, or even years.

Intraday Trading Tips for Beginners

Intraday trading is considered the riskiest yet most profitable form of trading.

The three main features of intraday trading are as follows:

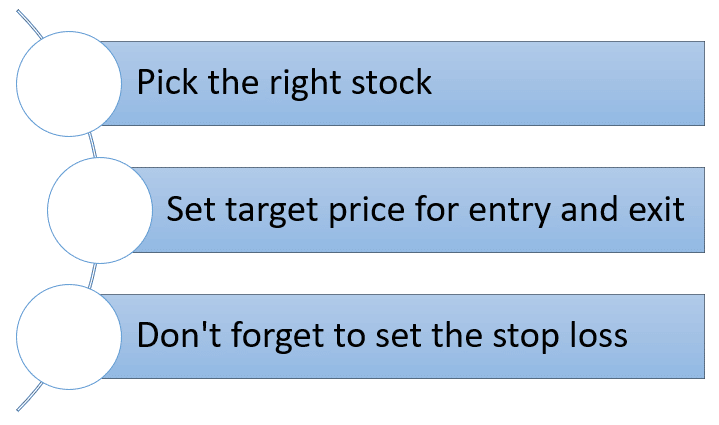

#1. Pick the right stock

- The first and most important thing that you should do while choosing intraday trading is to select the right stock to buy.

- Not all the stocks that are on the stock exchange are considered good stocks for intraday trading.

- As these stocks are chosen for the trading session, we need to check the liquidity of such stocks. That will help the purchasing as well as selling of such stocks be easy.

- We should generally consider large-cap and mid-cap stocks for intraday trading because they are considered to be highly liquid.

#2. Set a target price for the entry and exit

- After choosing the right stock, you will have to set an entry price as well as an exit price.

- You cannot just blindly go for trade because that will eventually result in a disaster.

- You should first set the entry price and then stick to it, otherwise, you may not get a chance to buy the stock.

- Similarly, we have to set the exit price as well, which means the price at which we wish to sell the stock. Here too, you have to let go of the further gains.

#3. Don’t forget to set the stop loss

- After setting the entry as well as the exit points, all you need to do in the next step is to set the stop loss.

- This will help you to prevent a loss if your stock does not move according to your expectations.

- For example, if you buy a stock at RS. 1000 expecting it to rise and you then place the stop loss at RS. 980, then if the stock is in a reverse trend, your stop loss will be triggered and you will have to bear the loss of just RS. 20 even if the price of the stock still falls to RS. 900.

Other Best Intraday Trading Tips for Beginners

- Apart from the above, there are also other tips that are used for intraday trading for beginners.

- This will help to further analyze the market as well as help them with their profit booking.

The following are the other tips for intraday trading:

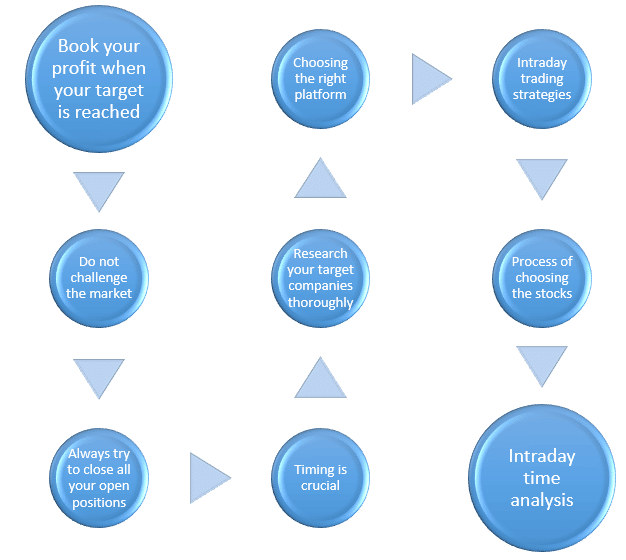

#4. Book your profit when your target is reached

- You will have to put your greed aside if you are into intraday trading.

- High volatility markets will bring you large profits as well as large losses.

- Here, instead of getting greedy, you should sell the stock price if it has reached your target price.

- If you feel that the price of the stock will move as per your wish, then you can adjust your stop loss accordingly.

#5. Do not challenge the market

- Fluctuation is the core of the stock market.

- So, when it comes to intraday trading, keep in mind that the market does not always move in the way you expect it to.

- If you think that today the market will be in a bullish trend, but if there is any sort of reversal, then you will never know when the market will turn bearish.

- Hence, it is said that you should never challenge the market when you are into intraday trading.

#6. Always try to close all your open positions

- The best intraday trading tip is to close all your open positions before the market closes.

- Many intraday traders take delivery of the stocks even if they are doing intraday trading.

- This is not considered good because the stocks that are purchased intraday cannot be kept for delivery.

- Due to this, delivery stocks take a big dig into your portfolio.

- The post market affects your delivery stocks, but that is not the case with intraday traders.

- Intraday trading is done with the help of technical analysis, so you should never convert your day trading stocks into delivery stocks.

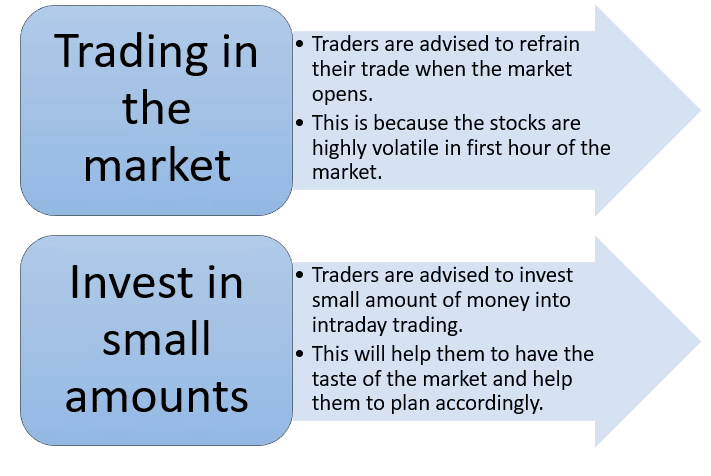

#7. Timing is crucial

- All the profits in intraday trading depend on the time factor.

- To understand the market timings, you must first learn the mood of the market in the morning, noon, and closing sessions.

- Generally, it is advised to not take any trades within the first one hour of the market due to very high volatility.

- The experts of intraday take the trade between noon and 1 P.M.

#8. Research your target companies thoroughly

- After selecting the stock for intraday trading, you have to do complete research on the company.

- First, start with the technical analysis of the company.

- Check the corporate events that are upcoming in the company, like mergers, acquisitions, dividend dates, bonus issues, stock splits, etc.

- These events will be considered as a guiding tool for understanding the momentum of the trade.

#9. Choosing the right platform

- The most important thing for intraday trading is to choose the right platform.

- The right platform is the one that will help us with quick decisions and execution, as well as the one that will charge us minimal brokerage.

- For the trading platform, the intraday trader has to pay the brokerage charges that will include the Securities Transaction Tax (STT), transaction charges, SEBI regulatory fees, stamp duty, GST, etc.

- The desired platform will eat up a small percentage of your intraday profit.

#10. Intraday trading strategies

There are two main important strategies for intraday traders.

The following are the same:

#11. Process of choosing the stocks in intraday trading for beginners

- It is preferred to pick up the stocks when the volume of trading is very high.

- This is because if the trading volume is high, the prices will usually move in the upward direction.

- It is also important to check the resistance levels of the stocks.

- This is because when the stock breaks its resistance, it will move in the reverse direction, which means upward trend stocks after resistance will fall, which is good for short-selling, and downward trend stocks after resistance will rise, which is a good buy option.

#12. Intraday time analysis

- Intraday traders will frequently check the daily charts to understand the performance of the stocks.

- Daily charts will help intraday traders track the short-term stock price movements.

- Some of the most popularly used daily charts are the 5-minute charts, 15-minute charts, hourly charts, daily charts, etc.

- Some of the traders will treat these charts as generic time-based information charts.

Learn Technical Analysis:

- To understand intraday trading, you need to learn about technical analysis.

- You will understand the technical indicators and how they are helpful.

- These indicators will also help you with good stock selection and will also fetch you good profits.

- For example, if you are the RSI (Relative Strength Index) indicator, then if the RSI is above 30, it will give you a buy signal; if the same is above 70, then it suggests that the stock is overbought and it will give you a sell signal.

The benefits and drawbacks of intraday trading:

Intraday trading comes with its own advantages as well as disadvantages.

The following are the advantages of intraday trading:

- The trader can surely avoid the delivery charges.

- If the trader doesn’t close the position, it will be automatically off-set if the same is set in their trading platform.

- A trader can make genuine profits based on the movement of the stock prices.

The following are the disadvantages of intraday trading:

- The trader may incur a loss if the closing rate is not conducive. If the market is not favorable, then you will have to forgo your profit as well.

- The trader will now have the ownership of the shares in which he traded.

Conclusion:

We hope that the above tips about intraday trading will help in trading and will also fetch you huge profits.

Frequently Asked Questions (FAQs)

Answer: no, you cannot hold those shares after the market hours. Even if the same isn’t squared off, your broker will square off your trade.

Answer: There is no such limit on the number or quantum of shares that can be bought. But you have to make sure that trading in more than one share can be very risky at times.

Answer: Intraday trading timings are from 9:15 A.M. to 3:15 P.M.

Answer: No, the same can be done in commodities as well.

Answer; yes, we do need a Demat account for intraday trading as well as for delivery-based trading.

About Us:

Trading Fuel is our website for blogs where we help you to earn knowledge about finance, economics, the stock market, and intraday trading with its strategies. We hope that you like our blog “Best Intraday Trading Tips for Beginners”.

~Stay tuned for more blogs and we wish you a very happy reading~