A stop loss trigger price (SLTP) is the price that is entered when a stop-loss is placed.

What is a stop loss order?

- A stop loss order means that you will give instructions to your trading platform where the system should automatically sell your stock when the price starts to drop to or below a pre-specified level.

- When you are trading via a short sell position, the stop loss will be placed when the price increases at a pre-specified level.

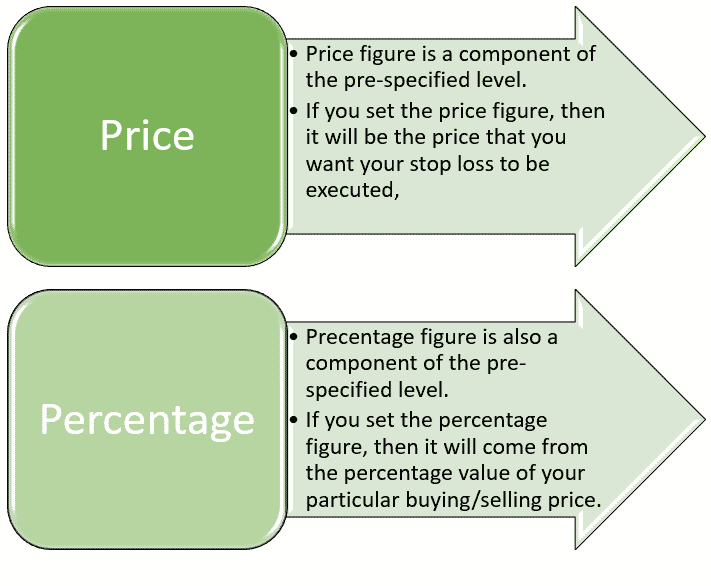

What is the pre-specified level?

A pre-specified level can be any of the following two:

What is the trigger price?

- Basically, the pre-specified level is considered to be the trigger price.

- The trigger price is the price at which you will want your order to be executed.

- When the price of your stock reaches your trigger price, immediately your stop-loss will be activated.

- The most important part of your stop loss order is its trigger price.

Also Read:Best Swing Trading Strategies

Types of the stop loss orders:

Basically, there are two types of stop loss orders.

They are as follows:

Stop loss market order:

- They will consist of the trigger price.

- In this case, once the trigger price is reached, the stop loss order will be converted into the market order.

Stop loss limit order:

- They will consist of both the trigger price and the limit price.

- In this case, when your stock price reaches the trigger price, your stop-loss order will be converted into a limit order.

Know About:Orders In Stock Market In India

Let us understand this concept with the following example:

Case 1: If you have a buy position, you must keep a sell SL.

Case 2: If you have a sell position, you must keep a buy SL.

For Case 1, if you have a buy position at RS. 1000 and you wish to place an SL at RS. 900:

Stop loss market order:

- Here, you will have to place a sell stop loss market order with a trigger price of Rs. 900.

- Now, when the price of RS. 900 is triggered, immediately a sell market order will be sent to the exchange and your position will be squared off at the market price.

Stop loss limit order:

- Here, you will place a sell stop loss order with both the price as well as the trigger price.

- Since your order has to be triggered first, the order type will give you a range of the stop-loss.

- It is important to note that the trigger price >= price.

- Here, you will have to keep the trigger price at RS. 900 and then the price at a range of RS. 50, i.e., RS. 850.

- Now, when the price of RS. 900 is triggered, immediately a sell limit order will be sent to the exchange and your position will be squared off at the next available bid that is above RS. 850.

- Hence, your stop loss limit order can be executed at RS. 900 or RS. 860 but not below RS. 850.

- The biggest disadvantage of this order is that if the market falls steeply, then after 900 is triggered and before the sell limit order of 850 is even sent to the exchange, if the stock price is below 850, then there are chances that your stop loss order will still be open and your losses could be much higher.

- To choose a market or limit order has to be as per your discretion.

For Case 2, if you have a sell position at RS. 1000 and you wish to place an SL at RS. 1100.

Stop loss market order:

- Here, you will place a buy stop loss market order with the trigger price at RS. 1100.

- Now, when the price of RS. 1100 is triggered, immediately a buy market order will be sent to the exchange and your position will be squared off at the market price.

Must Know:Pullback Trading Strategy

Stop loss limit order:

- Here, you will place a buy-stop loss order with both the price as well as the trigger price.

- Since your order has to be triggered first, the order type will give you a range of the stop-loss.

- It is important to note that the trigger price <= price.

- Here, you will have to keep the trigger price at RS. 1100 and then the price at a range of RS. 50, i.e., RS. 1150.

- Now, when the price of RS. 1100 is triggered, immediately a buy limit order will be sent to the exchange and your position will be squared off at the next available bid that is above RS. 1150.

- Hence, your stop loss limit order can be executed at RS. 1100 or RS. 1160 but not above RS. 1150.

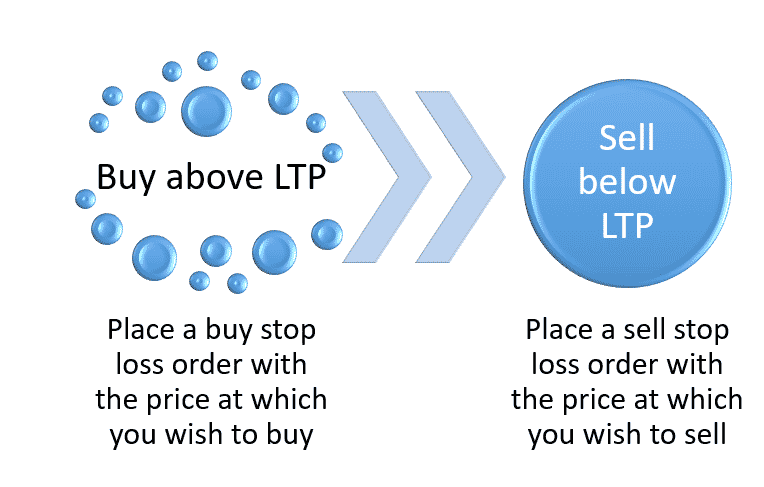

Alternative uses of the stop loss order:

- Sell stop loss orders are used below your buy price and buy stop loss orders are used above your sell price.

- You can also use these order types to buy above the last traded price (LTP) and sell below LTP.

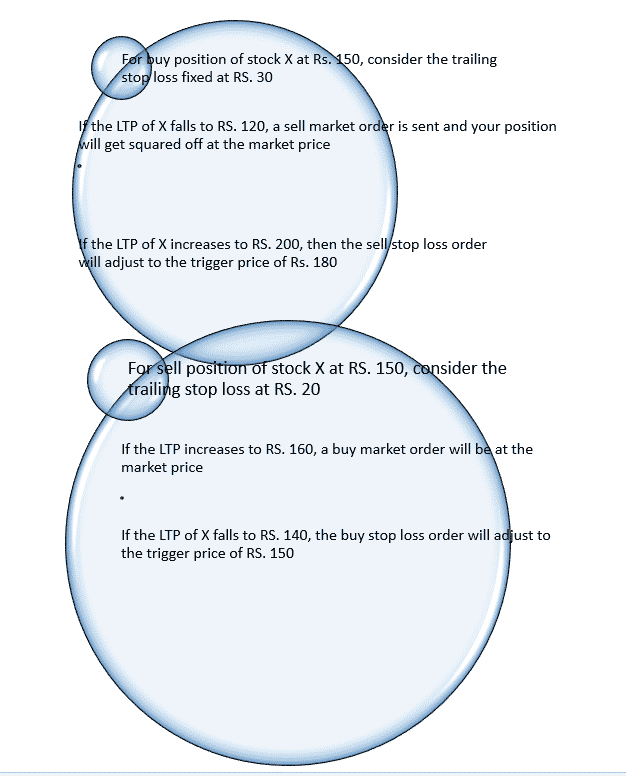

Trailing stop loss order:

- A trailing stop loss is an order that will allow you to set a maximum value or the percentage of the loss you can incur on the trade.

- If the security price rises or falls in your favor, the trigger price will jump with the set value or the percentage.

- If the security price rises or falls against you, the trigger price will stay in place depending on the nature of the order.

- A trailing stop loss will tend to adjust the stop price at a very fixed percent or value below or above the stock market’s price, which will also depend on the nature of the trade.

How does the trailing stop loss order work?

Also Read:How Much Can We Earn in Intraday Trading?

Conclusion:

We hope that the above blog has given you a clear idea about the stop loss trigger price.

Frequently Asked Questions (FAQs)

About Us:

Trading Fuel is our blog website where we provide in-depth information about various industries such as finance, economics, stock markets, and intraday trading. Stay tuned with us for more stock market blogs.