What is the Target Price in the Share Market? -Trading Fuel

- As the name suggests, a target means a goal that we need to achieve.

- It is the best-estimated price for a stock that is based on the earnings forecasts as well as assumed valuation multiples.

What is the meaning of “target price”?

- A price target is an estimated value of a security that is based on an individual investor or professional analyst’s assessment.

- The price target is the representation of what the investor or the analyst believes the security to be worth.

- When the target price is reached, the investors will simply sell their stocks with the belief that they have received the most likely reward from any particular stock.

What is the consensus price target?

- It is the average of the analyst’s individual price targets.

- This is the price target that investors will most often view quoted in the financial press.

Examples of the price target:

- A price target is also considered to be an intrinsic value of security.

- This price is often considered to be different from the current market price and is meant to convey whether the analyst believes the security to be under-valued or over-valued.

- The analyst can incorporate both fundamental and non-fundamental, or technical, information into their assessment to arrive at a particular level of price target.

- For example, for a stock that is trading at RS. 450, the analyst may assign the price target for the same to be at RS. 520.

Also Read:How to Start Intraday Trading?

Evaluating the price targets:

There are two types of analysis that will help us evaluate the price targets.

The following are the same:

Fundamental analysis:

- The use of financial ratios such as the price-to-earnings ratio is the key component of fundamental analysis.

- Fundamental factors are also attached to it.

- They are used to evaluate the value of the security and will also include economic data as well as financial information about the company.

Technical analysis:

- They will rely on the pattern in stock price movements that will also gauge future price movements.

- Technical indicators will help the analyst define whether the price will rise or fall to a certain level.

How does the price target work?

- The analyst will review securities so as to determine their value and then make recommendations to buy, sell, or hold them.

- An analyst will typically generate the price target and publish it alongside their recommendations as part of that process.

- The price target is basically the price that a stock is expected to reach within 12 months.

- An investor will follow the analyst’s recommendations and will then decide to trade based on the relationship between the current price and the target price.

The scenario of the price target works in a very systematic manner in the following way:

If we look at the above example, where our stock is currently trading at RS. 450 with a price target of RS. 520, an investor would make a decision based on the price target and would more likely buy the stock.

Also Read:How to Make Profit in Intraday Trading?

Do I need to know the price targets?

- You will have to consider the price targets as a part of your own investment analysis as well as the decision-making process, which is not necessary.

- Price targets are not necessarily relevant for long-term investors, such as for those who follow a buy and hold strategy, because they are typically for a period of about a year.

- Price targets are not meant for index investors because they tend to hold what is in the index regardless of an individual stock’s price target.

How are the price targets calculated?

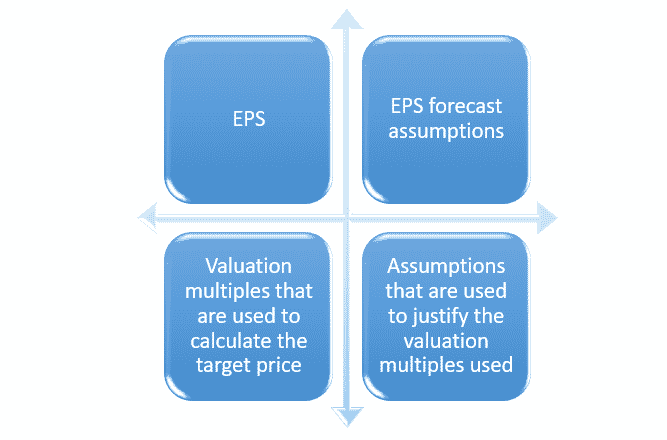

A price target takes into account four major factors.

The main factors are as follows:

The main formula for calculating the price target is (Price/Estimated EPS) = Trailing EPS.

Understanding the EPS Estimates for the Price Target:

- Analysts will have to use various methods for projecting the EPS of the company.

- The analyst will typically look at where the earnings have been historically and then assess the growth of the company.

- The other key factors for developing the EPS estimates can include forecasted changes in the gross margin, interest expenses, tax rates, operating expenses, and many other factors.

Target price vs. current price:

- The current or market price is what the stock is currently trading at in the open market.

- The same is true for the reflection of the current supply and demand for that particular stock.

- The target price, whereas, is an estimate that an analyst believes will be the current price at some point in the future, which is generally 12 months from now.

| Target Price | Current or Market Price |

| What an analyst thinks that the stock price in the future will be | The current price of the stock in the open market |

Also Read:How to Learn for Starting Trading Intraday?

Pros and Cons of the price targets:

Price targets have their own pros and cons.

The pros of the target price are:

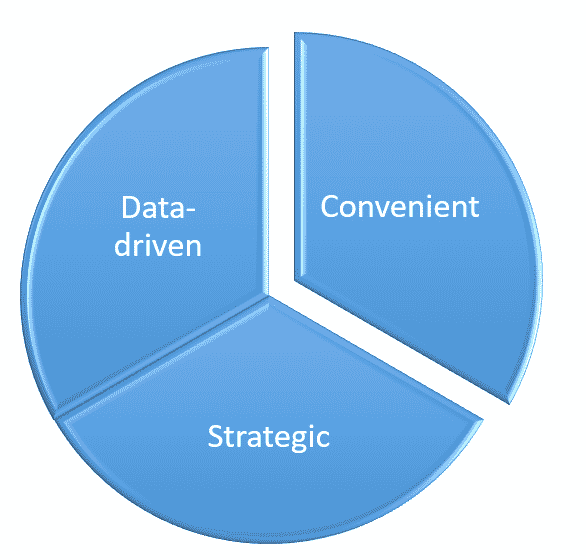

Data-driven:

The price targets are basically data-driven and are carefully based on constructed forecasts as well as valuation multiples.

Convenient:

Many financial media sites will publish the ratings of the analyst as well as the price target of the stocks, especially those that are widely traded.

Strategic:

The target price of the stock will help an investor analyze the risk/reward profile of investing in that company.

This will also help to make a more informed decision before transacting.

The major cons of the target price are as follows:

Inconsistent:

The target price of the stock will change frequently, and these changes are not reliable for predicting the price movement of the stock over time.

Insufficient in isolation:

The target price alone cannot be the guiding factor for an investor to buy, sell, or even hold a particular stock.

Other factors that an investor should consider for a specific stock include whether or not the stock would be a good addition to their own portfolio.

Recent price bias:

Price targets are often considered to be a lagging indicator of the price movement of a stock.

Observers often speculate about the professional analysts’ reluctance to hold the target price that will look like reality.

Know About:Beginner’s Guide to Invest In Share Market

Conclusion:

We hope that the above blog has given you an idea of the price target in detail.

Frequently Asked Questions (FAQs)

About Us:

Trading Fuel is our website for blogs where we help you gain knowledge about finance, the stock market, economics, and intraday trading. Stay tuned with us for more such blogs.