The term consistency gets tossed around a ton and all participants in the share market are continually searching for consistency. Be that as it may, less than 1% of all merchants will ever bring in cash in this business, and pursuing consistency is a major issue.

At the point when traders talk about consistency, they imply that they need to make a steady and continuous profit from their trading system, consistently without much drawdowns and losses.

The issue isn’t that individuals need consistency and it would be great if he can eliminate big drawdown from his trading and have a consistent profit. The principle issue here is the way individuals approach their trading and they fail to see what they are doing vs. what they want.

1. Make it simple:

- This will be an opposite method of how individuals approach their trading however then ask yourself where your present methodology has led you…

- Initially, you need a consistent way to deal with trading and afterward, the result will come. Most novice dealers need a reliable trading system before they are prepared to focus on something. As we have seen above, and as you most likely know for a fact, this isn’t getting you anywhere.

- Thus, the initial step is that you make a response. You pick one trading approach and you commit to yourself that you stay with it, regardless of your outcomes yet it’s the surest method to getting better.

- In trading, we neglect to give importance to this connection. Following half a month on the demo, we support our false trading belief with our life-saving funds and afterward would like to trade simply like a professional trader or a prop broker who has been doing it for a considerable length of time.

- Trading needs a presence of mind. They think that a superior analysis and complexity theory will fix their bad trading behaviors. Better earphones won’t make you a superior DJ and the best pen won’t make you an artist.

- There are trading techniques out there that guarantee profit with complex indicators and analysis. They want to influence you that trading is complex and you need their help to do it. You have to pay them a great deal for it.

- Try not to do that. Sharpen your abilities to get a decent understanding of the market and how it moves. Learn essential and straightforward value perusing skills that you can apply to a different market. Anything less is a waste of time and money.

2. Work on your herd instinct:

- This one requires a significant investment of your time, yet it will help you in the long run while in making a good trading decision. Sharpen your trading skills.

- Odds are you are very acquainted with the herd instinct. Regardless of whether when you understand you’re the only one not viewing the most recent Netflix or eating the most recent prevailing fashion food.

- This herd instinct effect also comes into play because we believe the consensus. If everyone says something is great, they must be on to something.

- The vast majority of us will pick a café with the best surveys. So also, we would pick a bustling café over an unfilled one. We settle on our choices dependent on the choices of others.

- Following the crowd is an old protection mechanism.

- Stone age men were bound to survive when they hunt as a herd and shared the food. That same urge us to remain safe and stick with the group influences every one of us today.

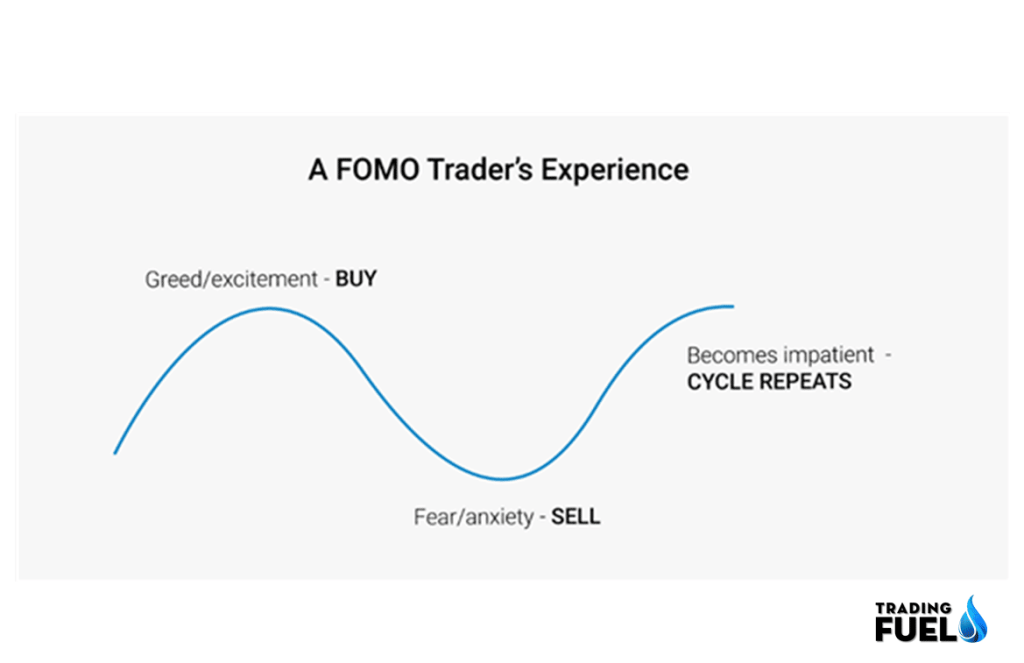

- Herd behaviors in the financial market cause widespread speculation and will result in losses for the majority of the trader.

- Everything is about FOMO – the fear of missing a profitable trade is the cause of much wrong trade.

3. Use of risk management:

- Alongside your trading strategy, your risk management is a basic piece of your trading plan. How you handle risk can make you bankrupt for the time being. It can likewise shield you from the market’s heartless waves.

- In any case, as a reliable trader, you must realize the amount you can risk on each exchange. Watch out for potential exit points, and don’t be reluctant to cut your losses. Choices to cut risks are not hot and are not fascinating to discuss. However, they are basic to your endurance as a valuable activity trader.

- Ensure you don’t risk beyond what you can bear. Discover how to deal with your situations to slice risk through broad re-enactment exchanging.

- Take a look at the trading techniques out there, in books and on the web. They focus intensely on when to enter the market since that is the thing that pulls in an enormous crowd. Individuals need to realize when to buy and sell.

- If you don’t know how to manage risk and its parameters, don’t risk your actual trading capital. First, take proper Stock Market Training and gain some experience then start trading with real money.

4. Dynamic trading strategy:

- The market develops and if your trading plan remains static, your outcomes will endure.

- So ensure you have a procedure for refreshing your trading plan dependent on the criticism you get from the market.

- This is an intense advance. You have to keep a fragile equalization here.

- On one hand, you have to recall that your trading plan is a work-in-progress. It must advance with the market to remain significant.

- Simultaneously, don’t be too on edge to even think about changing your trading plan. A very much structured price action trading strategy doesn’t require gigantic and visits changes. All things considered, you will roll out gradual improvements.

- On the off chance that you expel a profitable angle because of a transitory drawdown, you won’t recognize what you will miss. Accumulate enough perceptions before changing any significant part of your trading plan.

- If you change your trading plan time after time, you won’t recognize what works.

- A speculation bubble happens when the cost of an asset is driven by unrealistic expectations from the trader and investor.

5. Continue the learning process:

- The stock market is certainly not a troublesome subject to comprehend as you may think and anybody can learn how to trade stocks.

- There are numerous choices accessible through which you can learn to share market trading concepts. With genuine and determined effort, you can learn the stock market basic.

- You need not be a specialist in the stock market to begin your journey.

- Through continuous and systematic learning, you can turn into an expected trader in the due course of time.

- As it is said “knowledge is power”, reading a lot about the share market by methods for articles, books, recordings, and so forth will assist you with building up the necessary range of abilities to start your trading journey.

- Numerous online platforms offer you technical analysis courses.

• Take a look at a various possible source of learning:

- Reading book

- Following a mentor

- Taking an online course

- Get expert advice

- Analysis of the market

- Demo trading

- Learn from blogs.

Conclusion:

In this blog, we have discussed five ways to improve consistency in trading. In trading, consistency is the most important thing to maintain. Without it, a trader won’t be able to gain success. If you do not have these types of rules in place before you trade, then your actions will result in loss. Consistency is a habit that must be formed. It requires repetition and deliberate practice to master. It is not something you just decide to do, and it is not something that can be learned. It is something you develop over time from personal experiences, like discipline and confidence. It’s very important to maintain consistency to become a successful trader.