Financial fraud is a type of crime committed by individuals in positions of power that harms the public and has a negative effect on the economy as a whole. These frauds typically involve the improper use or manipulation of public funds by the criminals to generate large profits for themselves. As technology continues to advance, instances of financial fraud are increasing.

We have seen major financial frauds carried out by individuals like Vijay Mallya, Harshad Mehta, and Nirav Modi. Additionally, there are alarming cases of financial fraud taking place in the digital realm. Fraudsters exploit the internet’s anonymity to engage in online scams, such as KYC fraud and identity theft. Technology has recently become the preferred tool for these fraudsters. This article covers important aspects of financial fraud, including its definition, types, penalties, and the ten largest financial frauds in India. Finally, the article provides some tips to help safeguard yourself against these types of fraud.

What is financial fraud?

Financial fraud is a term that encompasses various actions aimed at unlawfully obtaining personal financial benefits.

It involves deliberate acts of deception in financial transactions, where individuals or entities engage in activities such as deceiving others to acquire money or assets.

Financial fraud also includes the illegal and unethical handling of financial resources, such as manipulating, falsifying, or altering accounting records.

This can involve misrepresenting or intentionally omitting amounts, misapplying accounting principles, and providing misleading or false disclosures. Generally, cases of financial fraud involve elements of deceit, subterfuge, or the misuse of a position of trust.

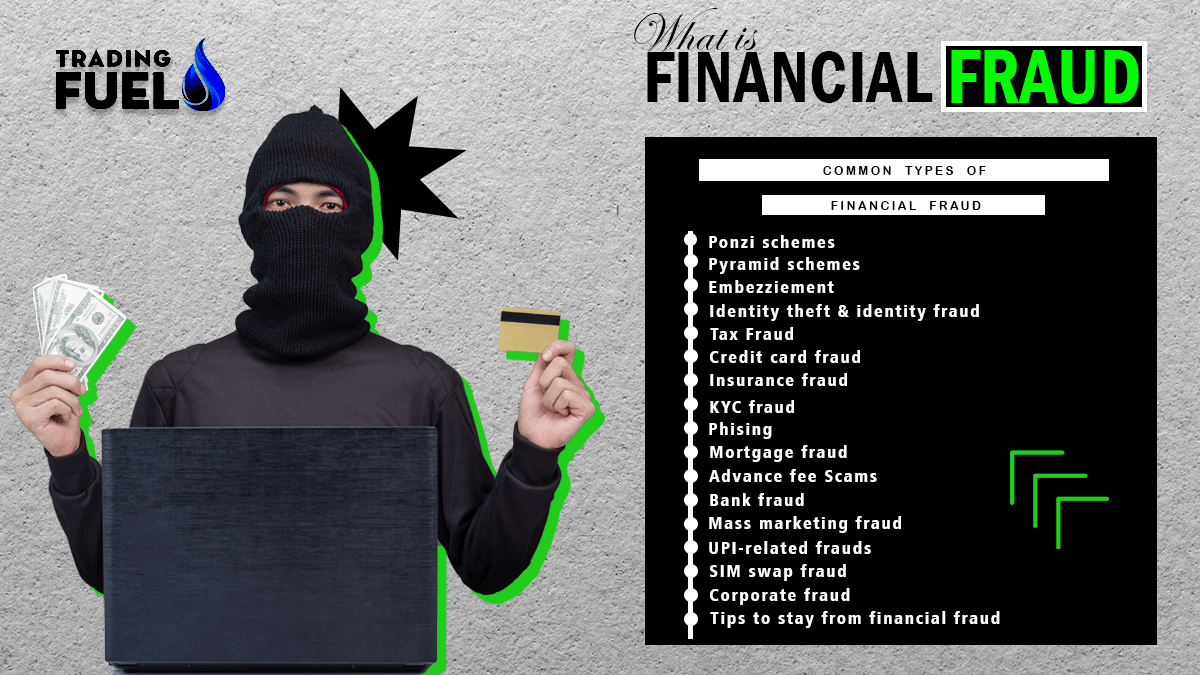

Common types of financial frauds

1. Ponzi schemes

A Ponzi scheme is a fraudulent investment scheme where early investors are paid returns using funds collected from subsequent investors. This type of fraud involves promising clients substantial profits while minimizing or eliminating risk. Fraudulent companies in Ponzi schemes primarily aim to attract new clients, whose investments are used to pay off earlier investors. However, when the flow of money from new investors ceases, the entire scheme collapses.

An example of a Ponzi scheme is the case of Charles Ponzi in the 1920s. Within a span of 8 months, Ponzi managed to accumulate around $15 million by persuading lenders to invest in international postal reply coupons, promising them significant wealth in return. However, his scheme relied on using funds from new investors to pay off earlier ones, ultimately leading to its collapse.

2. Pyramid schemes

A pyramid scheme, also referred to as a chain referral scheme, is a fraudulent business model in which participants are recruited and their payments are dependent on their ability to recruit new members. As the number of members grows, there reaches a point where it becomes increasingly difficult to recruit new participants, resulting in the scheme becoming unsustainable.

While a pyramid scheme may resemble a legitimate multi-level marketing (MLM) practice, it differs in significant ways. Unlike MLM, a pyramid scheme lacks legitimate sales as the profits of earlier investors are derived solely from the funds contributed by new investors. In a pyramid scheme, there is typically no actual product being sold, and the profits generated are not genuine.

The SpeakAsia Scam serves as an illustration of a pyramid scheme fraud. SpeakAsia Online Ltd., a Singapore-based company, enticed investors to pay Rs. 11,000 and participate in online surveys to earn Rs. 52,000 per year. The company also promised additional rewards for recruiting others into the scheme. Ultimately, the fraudsters managed to abscond with Rs. 2,276 crores from 24 lakh investors.

You also like: Top #5 Scam in Indian Stock Market

3. Embezzlement

Embezzlement involves the theft, misappropriation, or withholding of funds by an individual entrusted with them by an employer or organization. It often occurs when a person, such as an employee, has authorized access to someone else’s money or funds. This white-collar crime is considered a form of property theft. Examples of embezzlement include overbilling customers, check forgery, and a conductor collecting fares but refusing to issue tickets to customers.

4. Identity theft and identity fraud

Identity theft is when someone uses another person’s identifying information without their permission. It typically involves stealing personal financial details, like bank account numbers, through deception, and using that information for financial gain. Identity theft can occur in various ways, such as someone observing your actions in a public place to obtain sensitive information or responding to a fraudulent email that requests personal details in exchange for a promised reward. It can be as simple as guessing passwords or accessing information from social media, or it can involve more sophisticated techniques like installing malware.

Once fraudsters acquire your personal data, such as your bank account number or credit card number, they can exploit it to carry out unauthorized withdrawals from your account. They may also use your information to fraudulently open credit accounts, leaving you responsible for the resulting charges. Identity theft escalates to identity fraud when the perpetrator impersonates you using the stolen information, enabling them to access your accounts and obtain financial services in your name.

5. Tax fraud

Tax fraud involves the deliberate manipulation of tax returns to avoid paying the required taxes to the government. This can include actions such as falsely claiming deductions by misrepresenting personal expenses as business expenses, or failing to disclose income. Tax fraud occurs when an individual pays less tax than they are obligated to by concealing, understating, or providing false information about their income.

6. Credit card fraud

Credit card fraud involves the unauthorized usage of someone’s credit card. Credit card numbers can be obtained through various means, including credit card theft, exploiting unsecured internet connections, or hacking into systems. If you lose your credit card or debit card, it is advisable to have it canceled immediately. Examples of credit card fraud include counterfeit and skimming fraud, fraudulent use of cards not received, fraud related to lost or stolen credit cards, and fraudulent applications for credit cards.

7. Insurance fraud

Insurance fraud refers to the deceptive actions taken by a claimant or an insurance company in order to unlawfully obtain benefits or deny legitimate claims. It can take various forms, including a claimant dishonestly seeking compensation from the insurance company to which they are not entitled, or the insurance company deliberately rejecting a valid claim. Other instances of insurance fraud include selling policies from fraudulent insurance companies, falsifying medical histories, impersonating individuals for claims, and altering the cause of death for accidental claims, among others.

8. KYC fraud

In this type of fraud, scammers often send unsolicited SMS messages claiming that your card or account is at risk of being blocked. When customers panic, they may respond to the message without verifying its legitimacy. Upon calling the provided number, the fraudster pretends to be a representative from your bank and tricks you into revealing personal details like debit card information, bank account details, and OTP (one-time password) under the guise of conducting KYC verification. In some cases, the fraudster may ask you to install a specific app on your phone, which grants them complete access to your device. Unbeknownst to you, unauthorized withdrawals are made from your account, and you receive a notification stating that a certain amount has been debited from your account.

You also read: Top 3 Most Effective Trading Strategies

9. Phishing

This is an online scam known as phishing, where users or customers receive deceptive emails or pop-ups that appear to be from trusted sources such as banks, insurance companies, or internet service providers. The fraudster tricks individuals into providing their personal information through these emails, which is then used for illegal purposes. Phishing attacks can take various forms, including phishing emails, link manipulation, session hijacking, smishing (phishing via text messages), vishing (phishing via phone calls), and installing malware on devices.

10. Mortgage fraud

Mortgage fraud refers to any significant false statement, misrepresentation, or omission concerning the property or mortgage information that is relied upon by a lender or underwriter for the purpose of funding, purchasing, or insuring a loan. This can include intentionally providing false or misleading information on mortgage applications.

11. Advance fee scams

Advance fee scams involve fraudsters requesting upfront payments from victims for goods or services that never materialize. These scams can take different forms, such as career opportunity fraud, loan scams, lottery scams, work-from-home opportunity scams, and more. The common element is that victims are enticed to make an advance payment with the false promise of receiving something in return, but they ultimately end up losing their money without receiving the promised goods or services.

12. Bank fraud

Banking fraud refers to the intentional act of siphoning or misappropriating funds or assets from a financial institution. The Reserve Bank of India (RBI) defines fraud as a deliberate act of omission or commission that occurs during a banking transaction or in the books of accounts maintained by banks, resulting in wrongful gain for a temporary or permanent period by any person, with or without causing monetary loss to the bank. Some notable examples of bank fraud cases include the PNB-Nirav Modi Scam, ABG Shipyard Fraud, and Vijay Mallya scam.

13. Mass marketing fraud

Mass marketing fraud involves using mass mailing, phone calls, and spam emails to obtain personal financial information from unsuspecting individuals. This type of fraud targets multiple victims across different jurisdictions. Mass marketing fraud schemes can be categorized into two classes: those that defraud numerous victims out of relatively small amounts of money, and those that defraud a smaller number of victims out of larger amounts. An example of mass marketing fraud is “too good to be true payment schemes,” where victims are lured into false promises of easy and lucrative payments.

14. UPI-related frauds

In India, approximately 80,000 UPI frauds occur every month. Fraudsters employ various tactics, such as sending “request money” links, which, when clicked and authorized, result in deductions from the victim’s account. Additionally, they may send fake URLs that infect the recipient’s phone with malware designed to steal financial information.

15. SIM swap fraud

Sim swapping involves requesting a service provider to replace your existing sim card with a new one. Legitimate sim swaps occur when you want to upgrade or replace your sim card.

However, in sim swap frauds, fraudsters use fake documentation to request a sim swap from the service provider, pretending to be the genuine cardholder. The service provider deactivates the victim’s old sim card and issues a new one to the fraudster.

With the new sim card, the fraudster gains access to the victim’s financial information, including OTPs (one-time passwords), card alerts, and more, allowing them to manipulate the information for fraudulent purposes.

16. Corporate fraud

Corporate fraud refers to the deliberate falsification, misrepresentation, or concealment of a company’s financial information and accounts for the purpose of illegal profit-making and misleading the public. Examples of corporate fraud include insider trading, manipulating accounts to present a favourable financial position to attract lenders and investors, and misappropriation of company assets. The aim of corporate fraud is to deceive stakeholders and gain unlawful advantages.

According to Section 447 of the Companies Act, 2013, fraud in relation to a company refers to any act, omission, concealment of facts, or abuse of position committed by a person or in collusion with another person with the intention to deceive, gains undue advantage, or cause harm to the company, its shareholders, creditors, or any other person. It is important to note that fraud can be deemed as such regardless of whether there is any wrongful gain or loss involved.

Must know: 12 Steps to avoid fraud in the stock market

Tips to stay safe from financial fraud

- Be aware of different types of scams as mentioned above.

- Set transaction limits for online shopping, debit card and credit cards.

- Get SMS alerts on your registered phone number. For that keep your mobile banking service up to date.

- Avoid changing passwords frequently. Instead of that use a strong password.

- Frequently check your balance through the net banking system.

- Don’t share your personal information/ OTP/ personal documents with anyone.

- Avoid using public Wi-Fi

- Don’t receive doubt full international calls.

- If you receive any fraud call and inform your bank.

- Keep updated with government guidelines, where you can get the latest information regarding the latest frauds and how to stay safe.

- Don’t take a loan from online firms that provides fund without any verification.

In conclusion,

To protect ourselves from fraud, we must stay vigilant, keep our systems updated, avoid sharing financial information on social media, and be cautious of unsolicited requests. By taking these precautions and staying informed, we can protect our personal and financial well-being in an increasingly digital world.