Best Penny Stocks to buy in India:

- One of the good reasons for investing in the stock market is that it opens up a plethora of opportunities for your money to grow.

- The year 2022 has till date been very gloomy as well as moody for investors.

- The main indices like the BSE Sensex and Nifty 50 have fallen by more than 8%.

- The blue-chip stocks are running closely to their 52-week low index.

- For the blue-chip stocks to be running low, imagine the condition of the penny stocks in the country.

What are Penny Stocks?

- Penny stocks are generally low-value stocks as they are normally below Rs. 50.

- These stocks have a very low market capitalization and are generally very illiquid.

- Some of the stocks seem to be very illiquid, but some of them can instantly hit their circuit limits.

- Typically, these stocks are less preferred by investors due to a lack of fundamental information, or information that is less reliable.

- There is also a chance of artificial inflation reflecting on the stocks so as to attract retail investors.

List of Top 10 Best Penny Stocks to buy in India

Sometimes, penny stocks are fundamentally strong and have a decent track record.

The following is the list of the Top 10 best penny stocks to buy in India:

| Sr. No | Stock Name | Stock Price | Industry |

| 1 | HFCL | 53.60 | Telecom Cables |

| 2 | Morepen Laboratories Limited | 35.70 | Pharmaceuticals |

| 3 | MMTC Limited | 33.95 | Commercial trading and distribution |

| 4 | GMR Infrastructure Limited | 33.20 | Infrastructure |

| 5 | Pudumjee Paper | 32.25 | Manufacturing of specialty paper |

| 6 | Jammu & Kashmir Bank Limited | 24.60 | Banking sector |

| 7 | Alok Industries Limited | 19.95 | Textile |

| 8 | Indian Overseas Bank | 16.50 | Banking sector |

| 9 | Bank of Maharashtra Limited | 16.10 | Banking sector |

| 10 | Dish TV India Limited | 10.90 | Broadcast and Cable TV |

#1. Himachal Futuristic Communications Limited (HFCL):

Don’t Forget to Check: Penny Stocks Share Prices between Rs 1 to Rs 10

- HFCL is one of the leading Indian telecom companies, which started in 1987.

- The company serves a vast range of industries like telecommunications, railways, security, textiles, and cable fiber.

- The company has diversified itself into various segments like IT manufacturing, turnkey solutions, and research and development.

| Revenue | 4330.27 |

| Net Profit | 282.78 |

| Basic EPS | 2.15 |

Latest Share Price: Himachal Futuristic Communications Limited (HFCL)

#2. Morepen Laboratories Limited:

- Morepen Laboratories is an Indian pharmaceutical company.

- They have been formulating products for categories like antibiotics, anti-allergic, etc.

- The company was established in 1984 and has filed around 14 patents, including 6 new international PCT applications.

- The company has been sticking to brands like Saltum Saltumax, Rabipen-DSR, Montelast, etc.

| Revenue | 1459.50 |

| Net Profit | 101.06 |

| Basic EPS | 2.25 |

Latest Share Price: Morepen Laboratories Limited

#3. Metals and Minerals Trading Corporation Limited (MMTC Ltd):

Don’t Forget to Check: Best Stocks to buy below RS 10 in India 2022

- MMTC Ltd is one of the two highest earners of foreign exchange for the country and is also India’s largest public-sector trading body.

- They are constantly into imports and exports of their products.

- The main products of the company include ferrous and non-ferrous metals like coal, iron ore, agro, and other industrial products.

- There are also products for agricultural fertilizers.

| Revenue | 26,423.80 |

| Net Profit | (769.69) |

| Basic EPS | (5.13) |

Latest Share Price: Metals and Minerals Trading Corporation Limited (MMTC Ltd)

#4. GMR Infrastructure Limited:

- MR. Grandhi Mallikarjuna Rao founded the GMR Group in 1978.

- The company is located in New Delhi and is a well-known multi-business conglomerate.

- The company has various sub-companies like GMR Infrastructure, GMR Airports, GMR Energy, GMR Enterprises, etc.

- The company has several infrastructures in India as well as a presence in other countries like Nepal, Singapore, Greece, Indonesia, etc.

- The company is the leading owner, manufacturer, developer, and operator of airports, highways, and other urban infrastructure facilities.

| Revenue | 40.06 |

| Net Profit | (309.78) |

| Basic EPS | (0.51) |

Latest Share Price: GMR Infrastructure Limited

#5. Pudumjee Paper:

Don’t Forget to Check: Nifty Bank Index Stocks List 2022

- The company was incorporated on January 14th, 2015.

- The company is engaged in the manufacturing and processing of specialty papers.

- The company, along with the specialty papers, also produces tissues and facial wipes.

- The company is also present in Europe, the UAE, and Southeast Asia.

| Revenue | 560.72 |

| Net Profit | 34.53 |

| Basic EPS | 3.64 |

Latest Share Price: Pudumjee Paper

#6. Jammu & Kashmir Bank Limited:

- This bank is the oldest private sector bank and was started on October 1, 1938.

- It has its headquarters in Srinagar and has zonal offices in Delhi, Mumbai, J&K, and Ladakh.

- Currently, the bank is under the ownership of the Ministry of Finance, the government of Jammu & Kashmir.

| Revenue | 8794.41 |

| Net Profit | 501.56 |

| Basic EPS | 6.04 |

Latest Share Price: Jammu & Kashmir Bank Limited

#7. Alok Industries Limited:

Don’t Forget to Check: List of 1328 NSE Listed Companies

- Alok Industries is a textile manufacturing company based in Mumbai.

- The main business of the company involves knitting, weaving, and processing home textiles and ready-made garments as well as polyester yarns.

- The company’s 26% of products are exported to the US, Europe, South America, Africa, and Asia.

| Revenue | 7191.24 |

| Net Profit | (184.18) |

| Basic EPS | (0.37) |

Latest Share Price: Alok Industries Limited

#8. Indian Overseas Bank:

- IOB is India’s major nationalized bank.

- The bank was founded in February 1937.

- The main objective of the bank is to specialize in foreign exchange business as well as overseas banking.

- Now the bank has around 3400 domestic branches, 6 foreign branches, and 1 representative office.

- Currently, the bank is under the Ministry of Finance, the government of India based in Tamil Nadu.

| Revenue | 21,632.89 |

| Net Profit | 1709.54 |

| Basic EPS | 0.92 |

#9. Bank of Maharashtra Limited:

Don’t Forget to Check: All About Orders in Stock Market India

- This bank was founded by V.G. Kale and D.K. Sathe in Pune in 1935.

- The bank has the largest network of branches compared to any other nationalized bank in the Maharashtra state.

- With over 15 million customers, the bank is under the control of the Ministry of Finance, the government of India.

| Revenue | 15,671.70 |

| Net Profit | 1203.70 |

| Basic EPS | 1.72 |

Latest Share Price: Bank of Maharashtra Limited

#10. Dish TV India Limited:

- The company is India’s direct broadcast satellite service provider.

- YES Bank and ZEE Group have the biggest stakes in the company.

- The company was started on October 2, 2003, and is ranked 437 and 5th on the list of media companies in the Fortune India 500 in 2011.

- The company has also been voted as the most trusted brand by the Brand Trust Report, 2014.

| Revenue | 1514.03 |

| Net Profit | (2422.42) |

| Basic EPS | (12.59) |

Latest Share Price: Dish TV India Limited

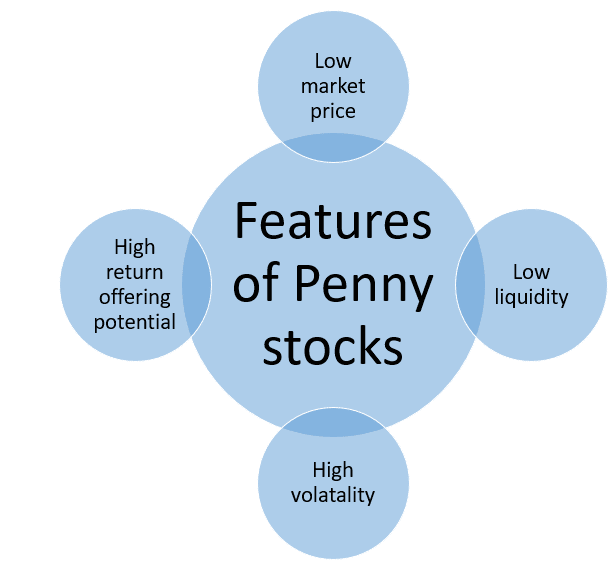

Main features of Penny Stocks:

Every coin has its two sides. Similarly, there are many features of buying penny stocks.

The following are the features of buying penny stocks:-

Low Market Price:

- As the meaning suggests, penny stocks are always low-priced stocks.

- It is not that the price will always remain low, but some penny stocks grow gradually and come out of the category of multi-bagger stocks.

Low Liquidity:

- They are considered low liquid where they push their traders into a situation where either they can’t get enough buyers to sell their holding or enough sellers to square off their short-selling positions.

High Volatility:

- Penny stocks are highly volatile.

- For those looking for short-term profits, penny stocks are usually traded in huge quantities by big traders.

- Due to the above reason, the price of the penny stocks changes sharply, and that too in an unexpected manner.

- They are also considered very risky in terms of investment options.

Must Know: What Is Nifty?

High Return Offering Potential:

- The main reason for trading in penny stocks is that it is someone’s reason behind the rags-to-riches story.

- Penny stocks can provide returns of more than 25% or more than 300% to 400% in a very short period of time.

Why should you invest in Penny Stocks?

The main benefit is higher returns within a short period.

The following are the other benefits of penny stocks:

Ability to turn into a multi-bagger stock:

- There are a number of stocks that have turned into multi-bagger stocks, and they keep coming.

- It might happen that a stock whose value a year ago was RS. 5 is now trading at RS. 500, which is quite normal for penny stocks.

Learn fundamental analysis for free:

- If you want to be the next big bull, all you need to do is pick up 50 penny stock companies, do an in-depth analysis regarding their fundamentals, and then invest in those you think will turn out to be multi-baggers.

- Out of the 50 stocks, even if 1 succeeds, you will start feeling confident with your trades.

An opportunity to earn tomorrow’s favorite at a low price:

- Adani Green is the best suitable example here. The company was initially trading at RS. 50, and within four years, its price went to RS. 3000, which means a nearly 6000% increase in value.

- At times, a particular stock is ignored by investors for a long time, and that stock turns out to be a market favorite in a very short time.

Conclusion:

The above list is an example of a very small number of penny stocks. We need to remember that penny stocks should not be at the center of our investment portfolio.

About Us:

Trading Fuel is our website for blogs that give you financial, economic, and market-related data in one go. We hope that you like our blog “Best Penny Stocks to buy in India”

~ Stay tuned with us for regular updates ~