An AMO is an After Market Order.

It is used to place orders post-market hours for the next trading day.

What is an AMO?

- An AMO, or After Market Order, is used for placing orders for the next trading day.

- As the very name suggests, these orders will have to be placed post the market hours but before the commencement of the next trading day.

- Every investor will have to check with his broker for the timings regarding when this AMO orders can be placed.

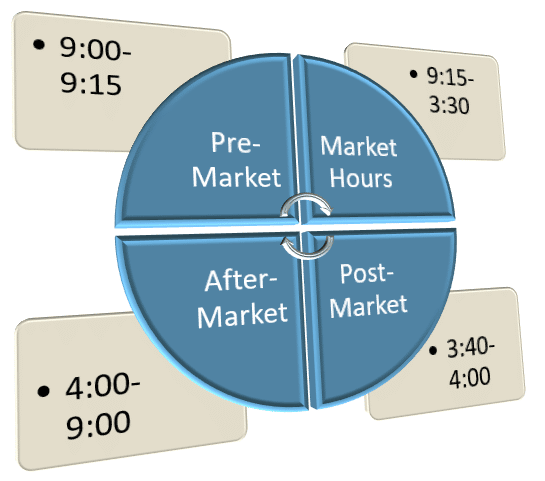

When can an AMO be placed?

AMO orders have to be placed after the market hours.

Don’t Forget to Check: Best Technical Analysis Traning and Courses in India

Why are AMO orders designed?

- After Market Orders (AMO) are designed for busy people.

- The number of people using AMO has increased drastically in recent years.

- The main reason behind this is that now our lives are getting busier and a lot of people are just not available during the regular market hours for some or other reason.

- Let us consider that a person who has meetings all day cannot keep track of the market, or those who have a very busy work schedule cannot just simply keep looking at the market.

- There are many traders at present who are working professionals and watch the market at night and then place their orders.

- Hence, AMO was developed for those who use the stock market as a second source of income.

AMO Order Time:

AMO’s order time is as follows:

| Segment | Order Time |

| Equity | NSE: 3:45PM to 8:57AM BSE: 3:45PM to 8:59AM |

| Equity F&O | 3:45 PM to 9:10 AM |

| Currency | 3:45 PM to 8:59 AM |

| Commodity | Anytime during the day |

How does an AMO work?

- Let’s say you place an AMO at midnight to buy stock.

- Your order will then be sent to your broker’s server, and it will stay there until 8:59 AM, along with thousands of other AMO orders.

- Your broker will send these orders to the stock exchange at 9:00 AM when the pre-market opens.

- Some of these orders, if matched by the exchange, will be filled during the pre-market session itself, i.e., around 9:08 AM.

- The rest of the orders will become similar to a regular order that you place during market hours.

You Also Like: All About Orders in Stock Market India

Pricing policy for AMO:

- When you place an AMO, you will have to consider the closing price.

- But, you will have the flexibility to choose a price that is either 5% more or less than the closing price.

- For example, if the price of the stock that you are buying is Rs. 100 at the end of the day, then you have an option to choose a price range of both Rs. 95 and 105.

- Using this example, if it is a buy order and is placed at +/-5% and your share price opens at Rs. 95, then your order will be executed at Rs. 95.

Benefits of AMO:

The following are the main benefits of AMO:

- AMO is for those who are too busy during market hours but still want to participate.

- AMO’s Margin Trading Facility is available on all trading platforms.

- In AMO, you will not be required to keep track of the price movements of stock during market hours. Here, you can place orders at leisure after doing the research before the market opens on the very next trading day.

- Your very presence is not needed at the stock exchange to execute these orders.

Limitations of AMO:

The following are the main limitations of AMO:

- If the value that you have chosen does not match your succeeding day, then AMO will not be executed.

- Here, you might miss an opportunity to lose potential profit which you might have earned otherwise.

Also Like: What is a Cover Order?

Conclusion:

We hope that the above blog gives you an idea of what an AMO is and how it will work.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, economics, stock markets, intraday trading, and technical analysis. Stay tuned with us for more such blogs, and we now wish you happy reading.

Frequently Asked Questions (FAQs)

Answer: An AMO is an After Market Order.

Answer: No, you will have to place the order with a +/-5% variation of the closing price of the stock.

Answer: A pre-market order has a higher chance of getting executed than an AMO.

Answer: Yes, AMO can be placed on weekends as well as on holidays, and hence, you can place an AMO on Sundays.

Answer: An AMO can get canceled before it is placed on exchange in the absence of sufficient margins at the beginning of the day during the margin calculation process.