Important Stock Market Terms: You may have come across some unusual words and phrases like ‘bird dog’, ‘barrel roll’, ‘panic rack’, ‘five by five’, and ‘touchdown’ before. However, if you’re not part of the aviation industry, there’s no need to fret about them. These terms are commonly used by pilots in the aviation industry.

Similarly, the stock market also has its own distinct set of phrases and jargon. If you are planning to invest in the market, it’s important to familiarize yourself with the different terms used. This will enable you to better understand and communicate with other investors and traders. Some of the commonly used terms in the stock market include bid, ask, face value, dividend, and many more.

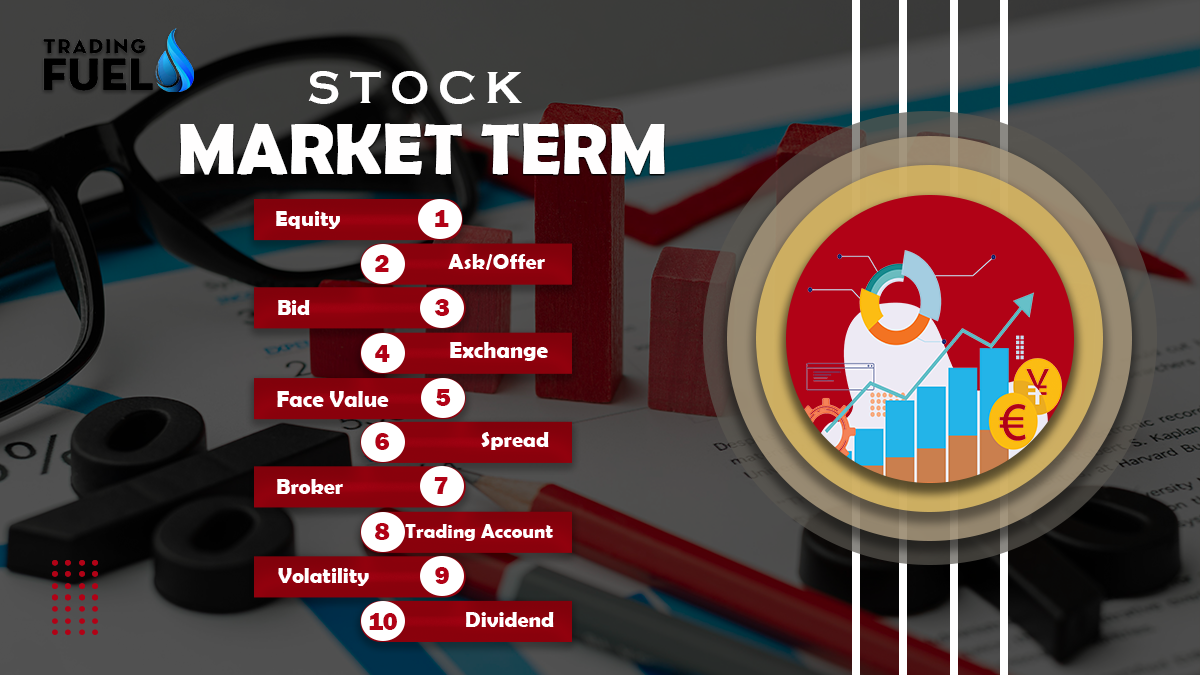

Let’s have look at some important stock market terms

1. Equity:

The place where you can buy and Sell Company’s shares (i.e. equity) is called the stock market. In fact, the terms ‘stock’ and ‘equity’ are often used interchangeably to refer to the same thing. When it comes to the stock market, equity is all about the number of shares that you own in a particular company.

So, if you’re an investor and you buy shares in a company, you’re essentially buying a piece of ownership in that company.

2. Ask/Offer

In the stock market, the term ‘ask price’ or ‘offer’ represents the minimum price that a seller of a stock is willing to accept in exchange for one share of that stock. This means that if you’re a buyer and you want to purchase that stock, you will have to pay at least the amount of the ask price or higher if you want to make a profitable trade.

In other words, the ask price sets the baseline for the lowest possible price at which a stock can be traded between a buyer and a seller in the market.

3. Bid

In terms of stocks, a ‘bid’ refers to the maximum amount of money that a prospective buyer is willing to pay for one share of a particular stock.

In case there are multiple buyers interested in the same stock, a bid taken between them usually ends when one buyer places a bid that is either too high or which the other buyers do not want to match. Essentially, the bid price represents the highest price that a buyer is willing to pay for the stock at that point in time, and it’s usually based on various factors such as the current market trends, the company’s financial performance, and other relevant information.

More Detail: What is Offer Price and Bid Price in Share Market?

4. Exchange

An exchange is a marketplace or an electronic platform where different types of securities are traded. For example, a stock exchange is one such exchange where shares of stocks are bought and sold.

There are many stock exchanges across the world where individuals and businesses can trade these securities. In India, two of the prominent stock exchanges are the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).

These exchanges act as a platform for buyers and sellers to trade stocks, bonds, and other financial instruments in a transparent and regulated manner.

5. Face Value

When a company decides to issue shares, each share is assigned a face value, which represents the value of the stock at the time of issuance. The company itself determines the face value of the stock, and this value remains fixed and does not change over time.

In some cases, you may hear the term ‘par value’ used interchangeably with ‘face value’, but both terms refer to the same concept – the initial value of the stock when the company issued it the first time.

It’s worth noting that the face value of a stock is different from its market value, which can fluctuate based on a variety of factors such as supply and demand, economic conditions, and company performance.

6. Spread

Whenever an item is being bought or sold, there tends to be a difference between the asking price of the seller and the price that the buyer is willing to pay.

Similarly, in the stock market, there exists a difference between the bid and ask price, with the bid typically being lower than the ask price. This difference is known as the ask-bid spread or simply the spread, and it is primarily determined by the forces of demand and supply.

7. Broker

When it comes to trading stocks, investors require an intermediary to connect them to the exchange, and this intermediary is commonly known as a broker. Brokers do not actually own any securities themselves; rather, they buy and sell stocks on behalf of investors in exchange for a small commission or fee.

8. Trading Account

In today’s world, the stock market has shifted to an electronic platform, and as a result, traders are required to open an online trading account with a registered broker to conduct trades electronically. With a trading account, you can place buy or sell orders.

The trading platform provides real-time updates on the stock market, allowing investors to make informed decisions and take advantage of market opportunities.

9. Volatility

Volatility is the term used to describe the rate of price fluctuations of a share. When a stock is highly volatile, it experiences daily up-and-down movements in its price. Some traders are drawn to the risks associated with highly volatile stocks and try to profit from them, while others prefer to invest in less volatile stocks for the long term.

10. Dividend

A dividend is a payment that a company makes to its shareholders using a portion of its profits. These payments can take many forms, including cash, stocks, or other options chosen by the company. While some companies choose to issue dividends to their shareholders, it is not mandatory, even if the company has made a profit.

Having Knowledge of these terms can be helpful to start your trading/investing journey. These terms are useful to understand stock market news and business language easily. By understanding common terms like dividends, you’ll easily participate in conversations about investing and make more informed decisions about your own investments.