ICICI Direct is termed as one of the best online broker service website for buying or selling a particular stock in the stock market. Using ICICI direct, you can buy or sell with convenient timings and faster using your laptops/Phone/Pc. The brokerage charge for the ICICI Direct is nominal and the interface of the application is very user-friendly to easily understand how to trade in ICICI direct. Through this article, we will share the details about the steps that are necessary for trading in ICICI direct.

Step by Step Guidance for How to Trade in ICICI Direct

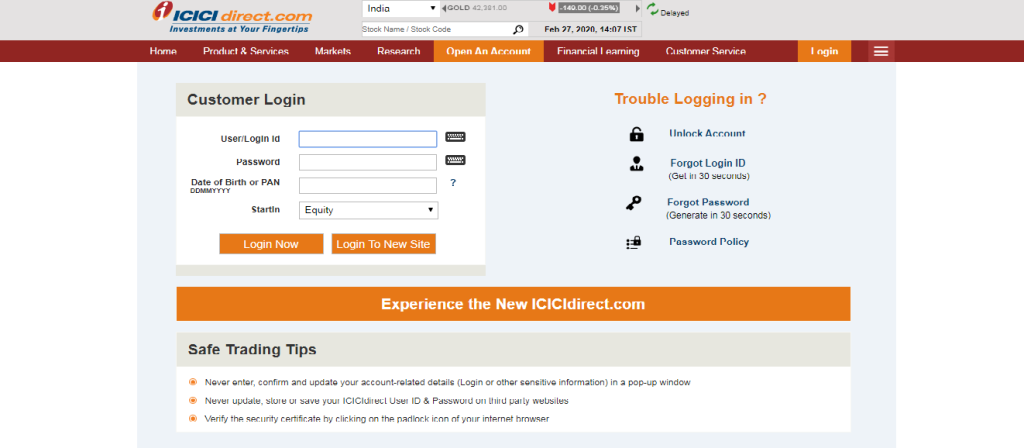

1. Login to the ICICI Direct Account

There is a need that your account needs to get login in the ICICI direct. You need to open a 3 in 1 account that is Savings-Demat-Trading in ICICI direct, you can get the access to buy/sell and hold on the particular stocks using the same account. After that you opened your account in the ICICI direct, you will get the username and the password to log in.

The first step is to go to Google and to search “ICICI Direct”. Open the first link that comes in the search bar and you can also write the website name directly in the search bar www.icicidirect.com. On the top right-hand side corner, you need to click for login and then the website will be needing the credentials like filling your username, password, and date of birth/ pan card. After filling up the credentials with correct details, you can enter inside the ICICI direct account.

2. Allocate the Funds for buying the stocks

After getting to login in the ICICI direct account, another step is to allocate the funds in the trading account. Let’s assume that you are having a saving account in ICICI Bank for 30000 rs and you want to buy shares worth of rs 3000. Then you need to transfer that amount from the saving account to the trading account and after that, you can place the order for the stock that is worth Rs 3000.

This the procedure that is done for allocating the fund. You can find the option for allocating the fund on the home page after logging in the website.

This step of allocating funds can be done within a minute if you have all the three account of ICICI Direct:

- Go to the Options bar and then go to the Secondary, Market Equity, (ETF).

- Choose “Add” option and enter the amount that you need to add.

- After that, click on the “Submit” button.

- Then you can see the allocated fund in the “Current Allocation” after clicking the Submit button.

3. Place Order for the Stock

The final step for buying the stocks that are using the ICICI direct, after the procedure of allocating the fund then you need to select the option “Place Order” that is presented in the equity option.

After selecting the place order, you need to follow the following steps. Below are the steps that are simple and can be completed within a minute:

- At starting, you need to select the “Cash” option in the product.

- Then you need to select the option of the stock exchange. You have two types of Stock exchange that is the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE). You can choose any one of the exchange and it doesn’t make any price differences as almost both of the exchanges and also follow the same trend.

- In that, you can view the limit on how much money is needed to buy the stocks. This is the amount that is allocated and added by an individual in point 2. In case you need extra money then you can add the money by allocating the extra funds.

- Now enter the stock that you want to buy and to write the name on the stock option and select the stock from the list.

- After that, you need to add the quantity and the number of stocks you want to buy.

- Then you need to choose the option for the order validity. Three options are DAY/IOC/VTC from this you need to select any one option.

- You also need to select the Order type. There are two options of an order type that is Market and Limit.

- If you had selected the “limit option” in the order type, then you need to enter the “limit price” in the further step.

- The final step is the stop-loss trigger price. You can leave this option blank as it is not mandatory to complete.

- At last, select the “Buy Now” option.

After clicking the button of “Buy now” you will be redirected to the confirmation page on which you will need to confirm the details and then click on the proceed button and after that, the order will be placed.

About Us

Our Blog on “How to do Intraday Trading in ICICI Direct” is particularly based on the steps or the procedure that is required for purchasing stock from the ICICI Direct. We tried to convey this article in an easy and simple manner and the steps are explained in simple words. Trading Fuel gives the learners or traders who want to learn from the live events of the stock market. We provide them with the education for free of cost. This will help them to stay updated with the market. For any doubts, you can contact us through e-mails and read more from our blog site.

~ Happy Learning ~