Gap Trading Strategy:

The gap is one of the most useful tools used in technical analysis to predict the trend change and its direct association with supply and demand. This is often used by the trader in intraday trade using a lower time frame price chart.

Gaps are formed when the price of a stock moves very sharply up or down with no trading in between there is a void created in the chart.at least temporarily in price action. This space is called a gap.

A gap has caught the attention of traders since the start of technical analysis of price action. A gap occurs mostly when a price jumps between two consecutive trading periods or skipping over certain levels. A gap creates a void in a price chart.

Technical analysis has traditionally been very easy to understand visually, so it is easy to understand why early technicians noticed gaps.

What causes the gaps?

There are Lots of things that can cause gaps in the share price, for example, a positive earnings report coming out after the stock market had closed.

If the earning were higher than expected earnings most traders are likely to place an order in next day. This results in the price opening higher than the previous close.

Gaps are evidence that something has changed to the fundamental of the market movement.

Well, most of the time gaps tend to get filled. They can get filled either on the same day or after a week or may not get filled it all depends on the zone in which occur.

Gaps are more likely to appear in the daily chart, where every day is an opportunity to create an opening gap.

Gaps on weekly or monthly charts are very rare.

Significance of Gaps in Gap Trading:

Gaps depending on their location can provide clues about the price movement.

As to all the trader price is supreme. If you read the gaps from the form where price continuity you will find that something important has happened to the fundamentals that have triggered this price movement.

Since, the start of technical analysis, these gaps in price action have always been the highlight of the trader.

There is a common superstition that a gap must be filled. But it is not always true.

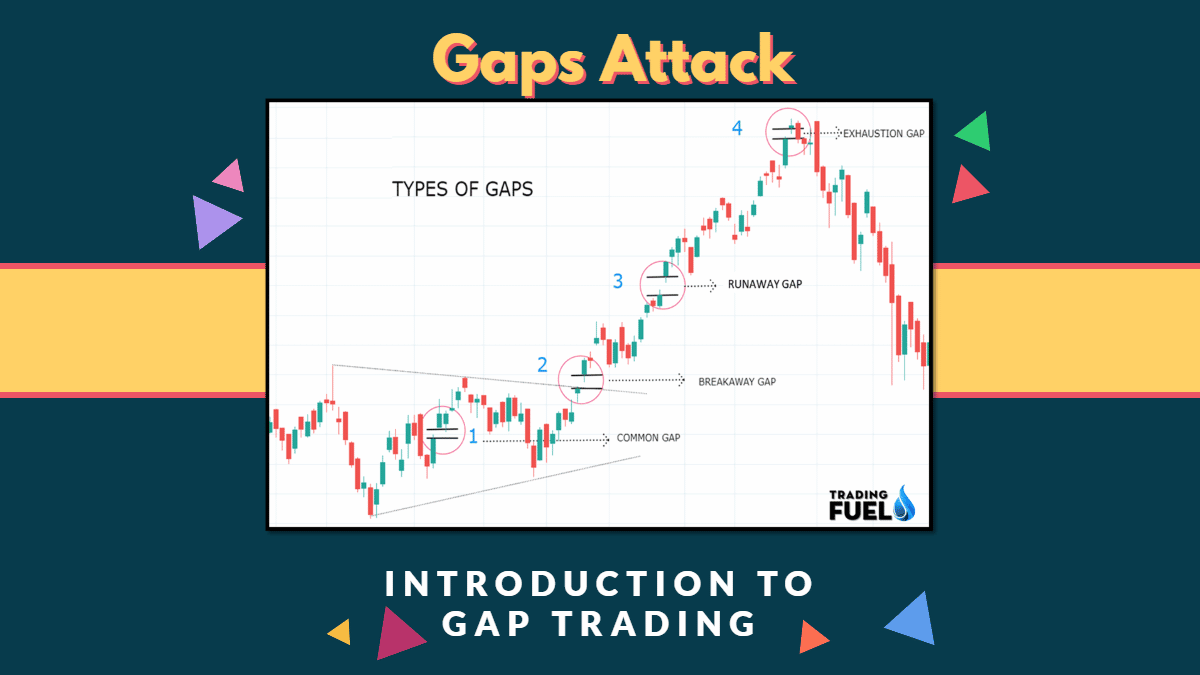

Types of gaps:

Gaps are divided into four basic categories as per our trading strategy.

- Fully gap up

- Partially gap up

- Fully gap down

- Partially gap down

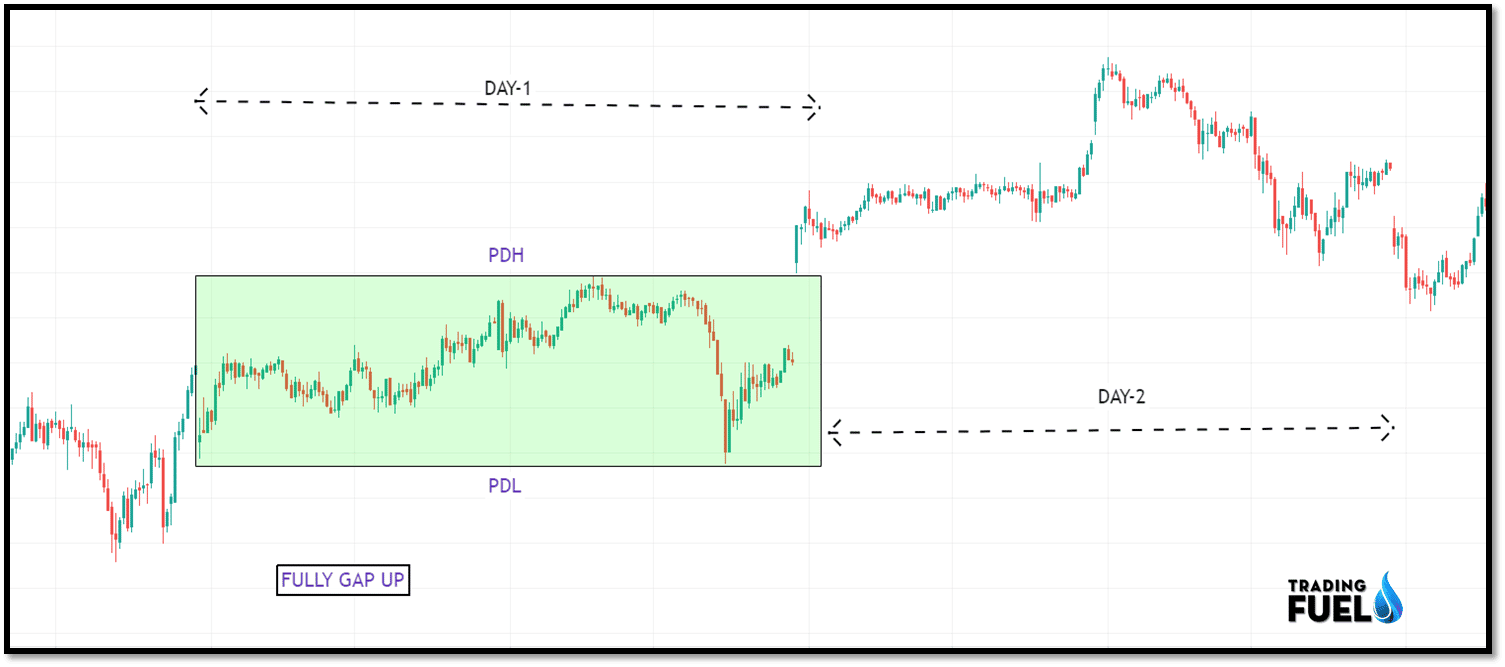

1. Fully Gap Up:

Fully gap-up occurs when the opening price of the stock is higher than the previous day’s high. Fully gaps up are bullish trend continuation signals.

How to trade fully gap up?

As per rules enter a trade at price higher than the previous day high and lower than today’s opening price.

Stop loss will be the price lower than yesterday’s low price.

Target will be today’s opening price the gap length.

Rules for fully gap up:

- Fully gap up is a bull day followed by bull or bear day.

- It is an uptrend continuation indication.

- The closing price of the days preceding the gap will work as an important support for an uptrend.

- On the gaps, day volume needs to be high as compared to its previous days.

2. Partially Gap Up:

If the current opening price is higher than the previous close, but not higher than the previous high then it is partially gapping up.

How to trade partially gap up?

Buy range: Above today’s open and high of the previous day.

Stop loss: Previous day’s low

Target: Previous day’s high.

Rules for partially gap up:

- Trade for intraday only.

- The price will retract back to the previous day’s closing price.

- On gap day each time, the high will be touched or the new high will be created.

- On partially gap-up day demand and supply almost equal. You can say buy and sell force almost equal.

3. Fully Gap Down:

Full gap down occurs when the stock opens at a price lower than the low of the previous day.

This bearish trend continuation patterns. This is bear day having higher supply and lower demand.

How to trade fully gap down?

As per rules enter a trade at price lower than the previous day’s low and higher than today’s opening price.

Stop loss will be the price higher than yesterday’s high price.

Target will be today’s opening price the gap length.

Rules for fully gap down:

- It is a downtrend continuation indication.

- The closing price of the days preceding the gap will work as important resistance for a down.

- On the gaps, day volume needs to be high as compared to its previous days.

4. Partially Gap Down:

- Partially gap down occurs when the opening price of the stock or commodity is lower than the previous day’s close but higher than the previous day’s low.

- It mostly happens in profit booking after a run-up or a consolidation period. But partially gap down is quite good initiating a trade.

- Mostly we do sell calls in a partial gap down condition.

How to trade partially gap down?

Sell range: Above today’s open and lower previous day close.

Stop loss: Previous days high

Target: Previous day’s low-gap length

Rules for partially gap down:

- Trade for intraday only

- The price will retract back to the previous day’s closing price.

- On gap day each time, the low will be touched or the new low will be created.

- On partially gap-down day demand and supply almost equal. You can say buy and sell force almost equal.

Intraday Gap Trading Rules:

- The first 5 min candle opens and closed above the previous day last 5 min candle closes. The trend is bullish. Target previous day high.SL previous day last 5 min candle low on candle closing basis.

- The first 5 min candle opens and closes above the previous day high. The trend is the extremely bullish target is not defined. Trade with the trend. SL closing below the low of the previous day’s high candle on 5 min.

- The First 5 min candle opens and closed below the previous 5 min candle close. The trend is bearish. Target previous day low.SL previous day last 5 min candle high on candle closing bias.

- The first 5 min candle opens and closes below the previous day’s low. The trend is extremely bearish. Target is not defined. Trade with the trend.SL closing above the high of the previous day’s low candle on 5 min.

Different Nature of Gaps:

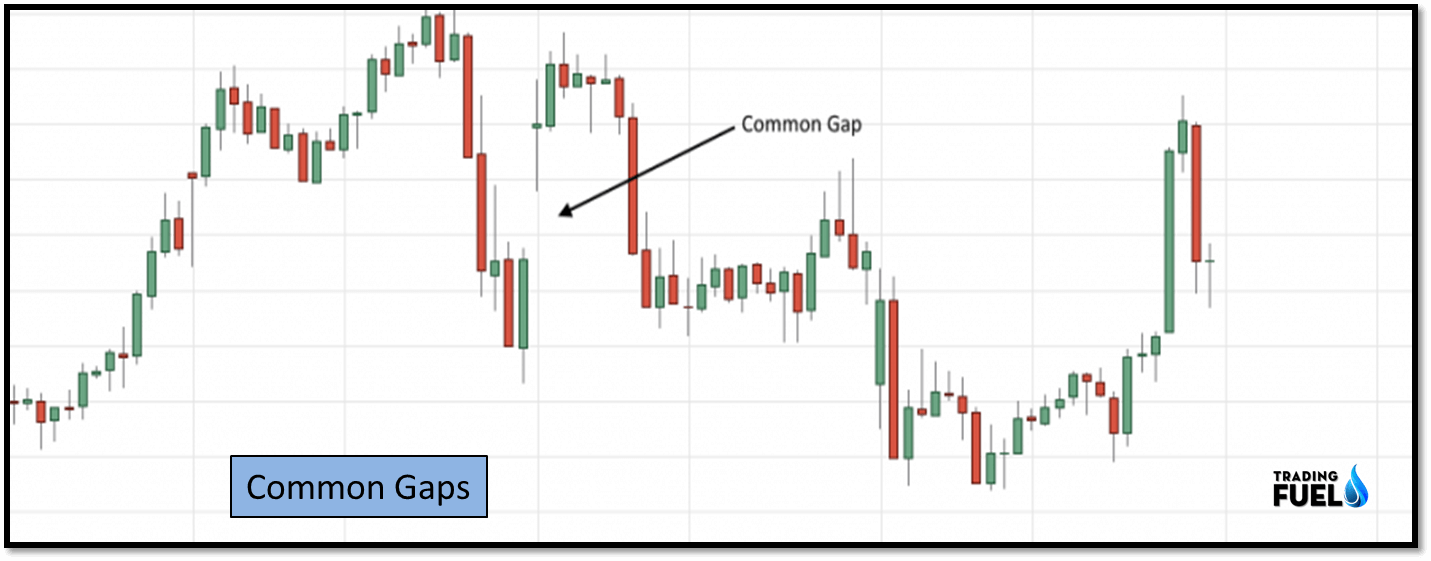

1. Common Gaps:

Common gaps generally occur in calm and quiet markets, rather than trending markets.

Most of the time you will find a slight increase in volume on the day of a common gap which will decrease to average volume in the following days.

After a common gap, there is an absence of new highs and new lows represent the lack of bullish and bearish sentiment respectively.

These gaps tend to occur in a sideways market.

Common gaps tend to close rapidly within a few days after they occur.

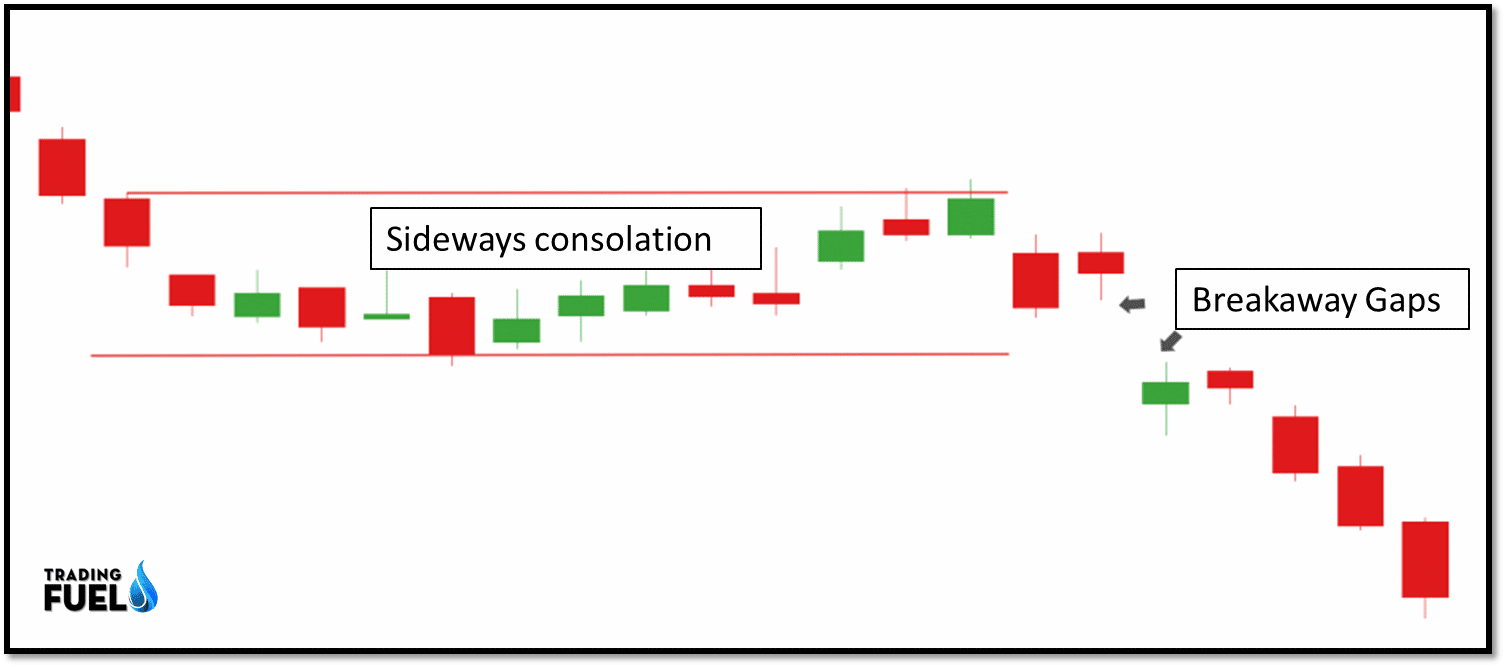

2. Breakaway (or Breakout) Gaps:

These gaps are also related to sideways price action momentum.

Breakaway gaps develop once the price action momentum gets completed in the structure and then the price break the resistance level with heavy volume.

Breakaway gaps signify a major change in crowd psychology.

You should not be expecting these gaps to be closed within a relatively short time.

3. Continuation or Runaway Gaps:

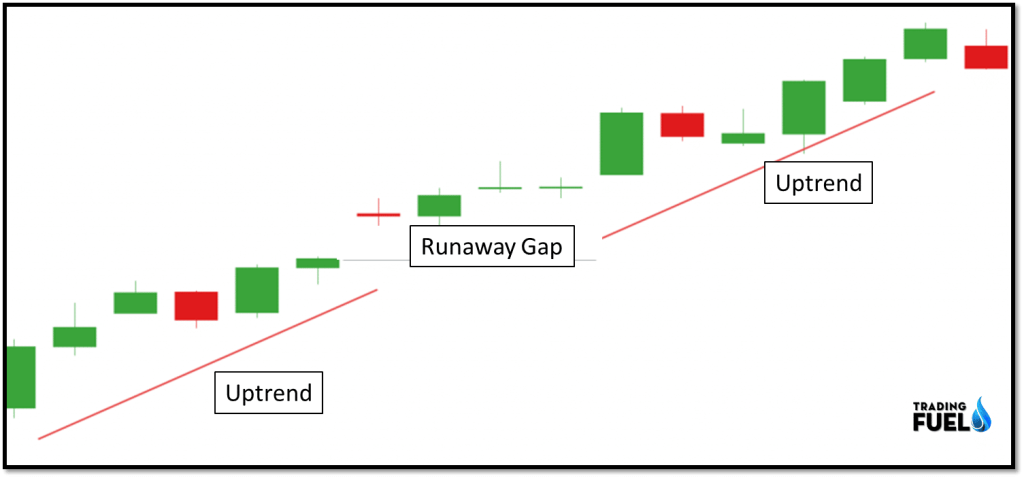

Runaways gaps occur in the middle of a strong trend, which can be an uptrend or downtrend, depend on it is making higher highs or lower lows without filling the gap.

Runaway’s gaps are similar to breakaway gaps; the only difference is in their location.

Most of the time it occurs in the middle of a trend rather than at the start of the trend.

Runaway’s gap signifies a further continuation of the move.

Runaway’s gaps are also called “Measuring Gaps“.

4. Exhaustion Gaps:

These gaps appear at the end of trends just like runaway gaps.

These gaps tend to get filled quickly, as these are associated with quick advances or declines.

During uptrends after makes a new high, then any price gap might exhaust the buying pressure, and new seller came to dominate the market as a result of which such gap set filler very easily. It is confirmed only when prices reverse and close.

Gap Theory Trading Strategies for buy:

- An exhaustion gap — a new high form by price while making a higher high, it’s a sign of a lack of momentum. The downtrend is over: Cover shorts immediately.

- A continuation gap in an uptrend– Go long, with a stop a few ticks below the gap’s upper range.

- A common gap in the middle of a sideways zone closed the next day– No action was recommended.

- A breakaway gap–Go long and place a protective stop a few ticks below the gap’s lower range.

Summary:

- On the gap-up day, the opening price must be higher than the closing of the previous day and higher than the previous day’s high.

- On gap-up day each time price retraced back to the previous day closing price the buying force i.e. the buyer will dominate the seller.

- On gap-up day each time, the high will be touched or the new high will be created the seller will dominate the buyer.

- This action should end positively.

- A similar condition holds good for a gap down. However, this kind of condition is not true in the partial gap up or gap down market.

For Free Live Chart

Contain & Image ©️ Copyright By, Trading Fuel Research Lab