What is NFO in the Stock Market?: If you are a mutual fund investor or you are willing to be one, then you will have to master the art of timing your investments.

Mutual funds rely on equity stocks or debt instruments, so it is also very important to know where to invest.

So, what exactly is NFO?

NFO will provide you with a fantastic opportunity to increase your investment returns.

What is NFO?

- NFO is New Fund Offering.

- When a mutual fund house or an asset management company (AMC) is planning to launch a new mutual fund scheme, they will make a “New Fund Offer.”

- An NFO is an introductory offer of a mutual fund scheme that will provide investors with an opportunity to catch an early fund and also reap rich dividends.

- An NFO will allow the mutual fund house to raise money that is required to purchase stocks or debt instruments.

- AMCs will generally offer a subscription period between 10 and 15 days for customers to buy the units at INR 10 per unit NAV.

- AMCs will issue units to the investors on a first-come, first-serve basis.

Also Read: Important Things to Know Before Opening Demat Account

Types of mutual funds to invest in during an NFO:

There are two types of mutual funds to invest in during an NFO:

1. Open-Ended:

- This mutual fund will allow entry or exit at any time.

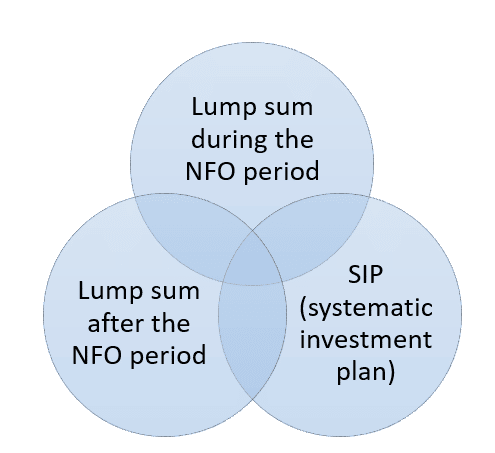

- You can invest in an open-ended mutual fund in three ways:

However, there are a few mutual funds that will charge an exit load on withdrawals made before one, two, or three years from the investment date.

2. Close-Ended:

- This mutual fund will not allow premature withdrawals.

- These funds will not permit SIP investments, except only in ELSS.

- These mutual funds will expire after 3–4 years from the investment date.

Must Know: How to Invest in Mutual Fund?

Parameters to evaluate to identify the best NFO:

The following are some of the main parameters:

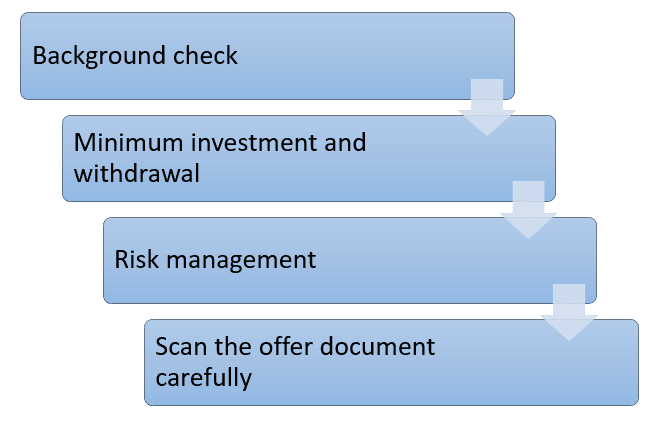

1. Background check:

- Investing in an NFO will give your investments an edge.

- Before investing, you will just have to check the legacy of the fund house as well as the experience of the fund managers.

2. Minimum investment and withdrawal:

- All the mutual fund houses will specify the minimum investment amount for NFO.

- The amount might typically range between INR 500 and INR 5000.

- It is also best to consider the investment amount and exit load before investing.

3. Risk management:

- Mutual fund investments are riskier and are often more rewarding than conventional investment options.

- Hence, it is wise to evaluate your risk-taking capability before investing in an NFO. Since the debt funds will invest in low-volatile government and corporate bonds, then conservative investors will prefer investing in these funds during the NFO period.

4. Scan the offer document carefully:

- Many investors will rely on the available data without even reading the offer document.

- As an informed investor, you will have to scan the offer document entirely to understand the investment rationale, benchmark, and tentative portfolio.

Also Like: Post Office Fixed Deposit Rates

How is the mutual fund NFO different from the company IPO?

NFO and IPO are as different as cheese and chalk:

| IPO | NFO |

| It is in the nature of fresh funds to be issued by the company or in the form of an offer for sale (OFS) | It is for fresh fundraising and also there are no limits to the amount of funds that can be raised |

| They have separate quotas for retail investors and they also offer additional discounts for the same | Here, there are no such special benefits to the retail investors |

| A critical aspect of valuation based on the P/E ratio will go into IPO pricing. | There are no valuations in an NFO because the amount collected is simply divided into units and then invested in the markets. |

| The usage of funds is very important as this will add value to the investor | The level of the market is more important as this will determine at what valuations the fund will be invested |

| The price is indicative of the perceived value since the quality IPO will demand a better valuation | Most of the funds come out with the price of Rs. 10 but what matters is the level at which these funds will enter the market |

| The IPO can be listed at a premium price or at discount but that will depend on the market conditions and flaws | Here, all the marketing, administrative, and other costs are debited to the fund and hence the NFOs will open at a discounted NAV |

| The price is determined by the forces of demand and supply | NFO is not affected by the demand and supply but only has an indicative value |

Also Read: Are Mutual Funds Safe for Investment?

Advantages and Disadvantages of NFO:

The following are the main advantages of an NFO:

- Larger upper side.

- It provides the ability to diversify the portfolio.

- Access to emerging sectors of the economy.

The following are the main disadvantages of an NFO:

- Unproven track record.

- Emerging technology or industry fund tracks may be overvalued.

- Possibly higher expense ratio.

Conclusion:

We hope that the above blog has provided some clarity about what an NFO is.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, economics, the stock market, and intraday trading. Stay tuned with us for more such blogs.