Everyone files an income tax return, but when it comes to the stock market, things are different.

The first step here is to identify yourself as an investor or a trader.

Investors benefit from the lower tax rates on capital gains, while traders have the advantage of claiming business expenses that will reduce their income.

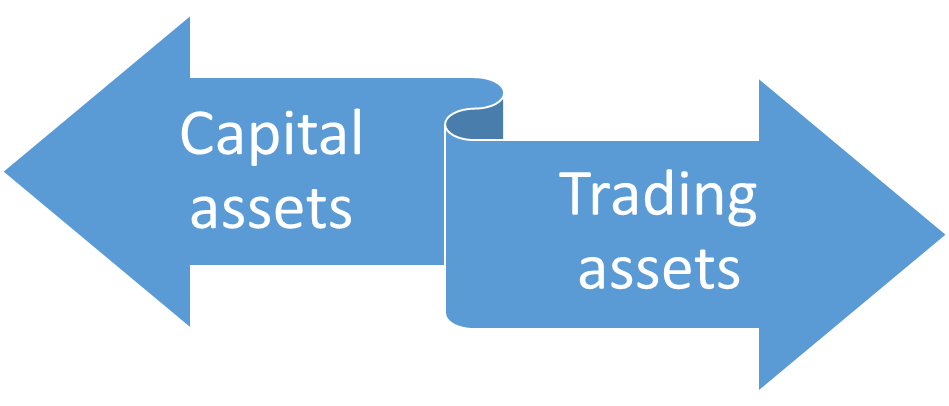

Understanding Capital Assets and Trading Assets:

- A share can be a capital asset or a trading asset, depending on whether you are an investor or a trader.

- Investors are those who invest in stocks or other securities in the market for the long term with the mere intention of holding them for a considerable period of time.

- Investors aim to earn returns through capital appreciation and dividends as well.

- For investors, the income generated from the sale of shares can be termed ‘capital gains’.

- Traders are the ones who will buy and sell the shares frequently with the intention of making a profit through short-term price movement.

- This income for the traders is treated as business income, and hence, they are required to file their return under the heading ‘profits and gains from business and profession’.

- Thus, we can say that investors are taxed on their capital gains, whereas traders are taxed on their business income.

Based on this, your income will be divided into the following:

Capital assets:

Capital assets are further classified as:

Trading assets:

Trading assets are further classified as:

Speculative business income:

- Intraday trading is speculative; hence, the income from these trades is termed speculative business income.

- Income tax on intraday trading in India falls into this category.

Non-speculative business income:

- All the share transactions that are not speculative in nature fall under this heading.

The list of such transactions is:

- The income from all the above transactions is known as non-speculative business income.

What is intraday trading?

- Intraday trading is the buying and selling of shares and other securities in a single day.

- Here, the main aim of the traders is not to own equity shares but to make profits out of them.

Income tax rules on intraday trading:

The income tax rules on intraday trading are sub-classified as follows:

Income head:

- Intraday trading falls under the heading of ‘profits and gains from business and profession’.

- It is considered a speculative business because you are trading not with the intention to invest but to make profits out of the trades.

ITR Form:

- You will have to file ITR-3 because intraday trading is business income, and hence, accordingly, prepare financial statements.

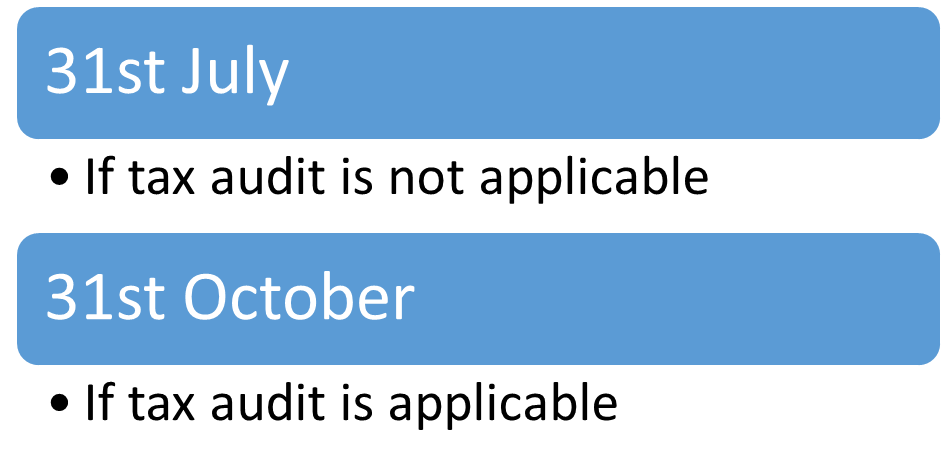

Due date:

The due date for filing the return is as follows:

Is tax audit applicable for intraday trading?

For the tax audit scheme, let us consider the following criteria:

Turnover up to Rs. 2 crore (if you opt for presumptive taxation):

- If you have made profits of at least 6% of your trading turnover, then a tax audit will not be applicable.

- If you have incurred losses or your profit is less than 6% of your trading turnover, then a tax audit will be applicable, provided that your total income is more than Rs. 2.5 lakh.

Turnover of more than Rs. 2 crore but up to Rs. 10 crore (if you opt to pay tax normally):

- If you have made profits of at least 6% of the trading turnover and you do not choose a presumptive scheme under Section 44AD, then a tax audit will be applicable.

Turnover greater than Rs. 10 crore:

- Regardless of your profit or loss, a tax audit will be applicable if your turnover is more than Rs. 10 crore.

- 95% of the transactions are digital, and trading is 100% digital.

What is the turnover for intraday trading?

- Turnover is the absolute amount of profit or loss.

- Absolute turnover means the sum total of all the positive as well as negative differences.

Trading turnover can also be calculated as:

Tax calculation for intraday trading:

- Income tax on intraday trading can be calculated as per slab rates.

- The slab rates are as below:

- The below rates will be increased by the applicable surcharge rate plus 4%.

Old tax regime:

| Slab | Rates |

| Upto Rs. 250,000 | Nil |

| Rs. 250,000- Rs. 500,000 | 5% |

| Rs. 500,000- Rs. 1,000,000 | 20% |

| More than Rs. 1,000,000 | 30% |

New tax regime:

| Slab | Rates |

| Upto Rs. 300,000 | Nil |

| Rs. 300,000- Rs. 600,000 | 5% |

| Rs. 600,000- Rs. 900,000 | 10% |

| Rs. 900,000- Rs. 1,200,000 | 15% |

| Rs. 1,200,000- Rs. 1,500,000 | 20% |

| More than Rs. 1,500,000 | 30% |

Advance tax for intraday trading:

If your tax payable is more than Rs. 10,000, then you will have to pay advanced tax on specified dates.

Advance tax for intraday traders who have not opted for presumptive taxation under Section 44AD:

If intraday traders do not opt for the presumptive scheme, then they will have to pay advance tax in the following four instalments:

| Advance tax | Due date |

| 15% of total tax liability | By 15th June |

| 45% of total tax liability | By 15th September |

| 75% of total tax liability | By 15th December |

| 100% of total tax liability | By 15th March |

Conclusion:

Intraday trading is a very profitable activity, but it is also important to consider all the tax implications.

Frequently Asked Questions (FAQs):

About Us:

Trading Fuel is our website for blogs where we give information about taxation, legal compliance, the market, and technical analysis. Feel free to read our blogs and comment.