Top 10 Warren Buffet Quotes on Investing: Warren Buffet is the world’s most renowned tycoon, investor, philanthropist, and chairman as well as CEO of Berkshire Hathaway.

He is also known as the “Oracle of Omaha“, “Sage of Omaha“, and “Wizard of Omaha” as well.

Who is Warren Buffet?

- When anyone thinks of investing, people generally think of Warren Buffet.

- People usually get a lot of inspiration from him for the stock market.

- He purchased his first shares at the age of 11 years.

- He then went on to use the savings so that he could install pinball machines in shops in his local area, which could fetch him some money for his own machines.

- According to Forbes 2022, the now 92-year-old CEO of Berkshire Hathaway has a net worth of $9590 crores.

Don’t Forget to Check: Top 5 Investors in the World

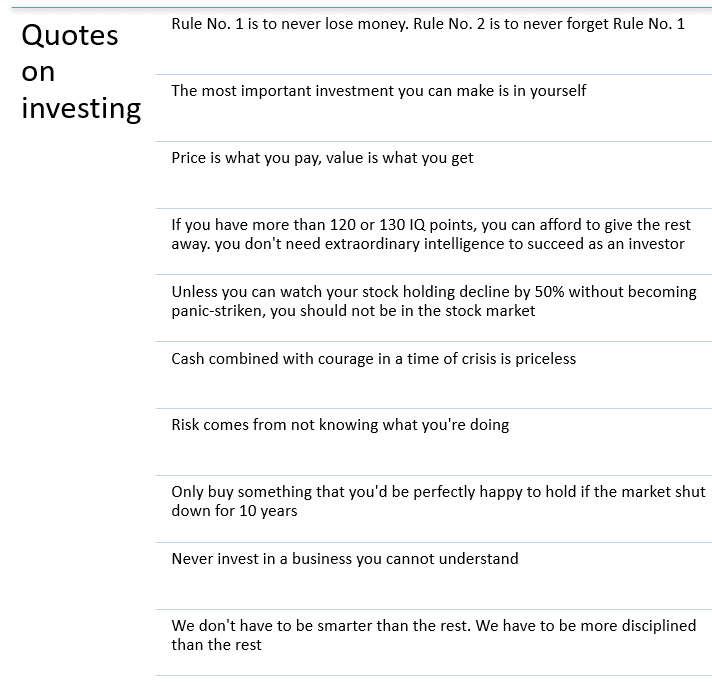

Top 10 Warren Buffet Quotes on Investing:

Warren Buffet is also well-known for his quotes on investing.

The following are the top 10 quotes from Warren Buffet for investing in the stock market:

1. “Rule No. 1 is to never lose money. Rule No. 2 is to never forget Rule No. 1”:

- This quote is our favorite one, but the same is only slyly true.

- Even though Buffet has made some losing investments in his life, from his quote, we can imply that we can protect our downside.

- The most significant rule for success in the stock market is to never lose money.

- You will need money to make more money.

- If you lose money, then it will take double effort to reach your highs.

Also Read: Top 30 Trading Quotes For Success

| Drawdown | Gain required to Break Even |

| 5% | 5% |

| 10% | 11% |

| 15% | 18% |

| 20% | 25% |

| 25% | 33% |

| 30% | 43% |

| 35% | 54% |

| 40% | 67% |

| 45% | 82% |

| 50% | 100% |

| 75% | 300% |

| 90% | 900% |

2. “The most important investment you can make is in yourself”:

- Whatever the industry, you should never underestimate the importance of self-evolution.

- Learning and becoming better at your own trade will allow you to have more respect, increase your reputation, and ultimately increase your income as well.

- You will have to strive to constantly educate yourself and ensure that your money continues to work for you even when you have crossed your retirement age.

Also Like: Trading Success from WARREN BUFFETT

3. “Price is what you pay, value is what you get”:

- According to Warren Buffet, price and value are two very different things.

- You can overpay to buy a product, or underpay to buy that same product (value investing).

- You will always have to look at the value that you will get before paying a price for it.

4. “If you have more than 120 or 130 IQ points, you can afford to give the rest away. You don’t need extraordinary intelligence to succeed as an investor”:

- Investing in the stock market is not rocket science.

- This quote clarifies that you don’t need to be super smart to invest in and make money from the stock market.

- Anyone will be able to do the same if they are willing to learn and are also disciplined.

5. “Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market”:

- This quote addresses the risk that is involved in stock market investing.

- There are several factors that will govern the movement of the stock price.

- At times, there are situations where your holdings might decline by even 50% due to some bad or unexpected news.

- Hence, if you are investing in the stock market, then you should have the best risk-bearing appetite and should also be panic-stricken.

Also Like: Top 9 Golden Intraday Trading Rules

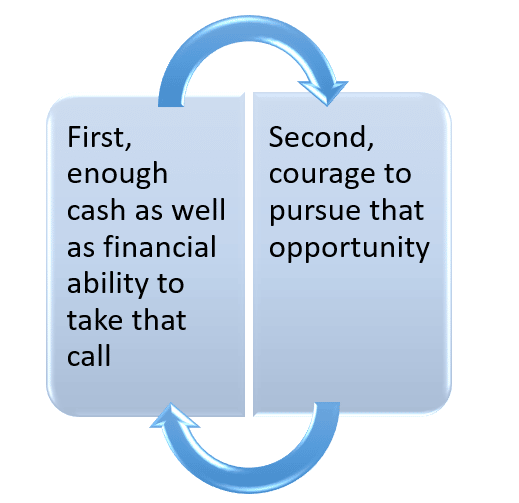

6. “Cash combined with courage in a time of crisis is priceless”:

When the market is giving you several opportunities, then you will need to do two things:

This quote will, in short, advocate that a combination of good financial ability and courage can do wonders in the stock market.

7. “Risk comes from not knowing what you are doing”:

- This quote by Warren Buffet is about risk-taking.

- As per Buffet, if you are investing in stocks, get at least some sort of basic financial education.

- You will be at your highest risk if you blindly invest in a stock without knowing anything about it.

8. “Only buy something that you’d be perfect to hold if the market shut down for 10 years”:

- Here, he is addressing long-term investing.

- Here, Buffet tries to explain that when you buy a particular stock for the long term, you should not be affected by the market or some minor short-term fluctuations.

- You will have to look for a longer view.

9. “Never invest in a business you cannot understand”:

- This quote will help you invest your money in the safest possible manner.

- According to Buffet, investors should know where they are putting their money.

- You should never put your money into a business you don’t understand.

- All you can do is take the time to understand the company, analyze its financials, study the management team, and learn about the unique advantages of the company as well.

10. “We don’t have to be smarter than the rest. We have to be more disciplined than the rest”:

- The stock market is as tempting as greed, and eventually fear might take over.

- This quote by Buffet will teach us to be more disciplined in the stock market than just being smart.

- Consistency in the stock market will require discipline.

Must Know: How to Invest in Share Market in India?

Conclusion:

We hope that the above quotes by Warren Buffet teach you a lot about investing as well as risk-bearing in the stock market.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, economics, stock markets, intraday trading, and technical analysis. Stay tuned with us for more such blogs.