Post Office FD Interest Rate: Post Office FDs are one of the best saving systems developed by the Indian postal service.

It provides depositors with a safe as well as a convenient method to save money if they don’t have access to banks.

What is the Indian Postal Department?

- The Indian Postal Department is also known as India Post.

- It provides its customers with fixed deposit options so as to park their surplus money and then earn interest on it.

- The FD interest rates on fixed deposits are one of the best rates for the FDs that are offered in India.

- There is a very high frequency of people who are opting for post office FDs in rural areas as compared to bank deposit schemes.

- Here, the minimum deposit that is required can be as low as Rs. 200, whereas there is no maximum limit under this scheme.

- This department post offers attractive interest rates with a tenure that will range from 1 year to 5 years.

- This interest is payable annually with the minimum deposit as described and no maximum limit.

Post Office Fixed Deposit Rates:

The following are the FD rates along with the tenure:

| Tenure | Regular Customers | Senior Citizens |

| 1 year | 5.50% | 5.50% |

| 1-2 years | 5.70% | 5.50% |

| 2-3 years | 5.80% | 5.50% |

| 3-5 years | 6.70% | 6.70% |

Rates for Tax-Saving Post Office 5-year Fixed Deposit:

If you are planning to open a fixed deposit with the post office for a tenure of 5 years, then you will be eligible to claim tax benefits under Section 80C of the Income Tax Act, 1961.

| Tenure | Regular Post Office FD rates (p.a.) |

| 60 months | 6.70% |

Post Office Time Deposit Account:

- It is also known as the Post Office Fixed Deposit Account.

- It can be opened with a minimum of Rs. 1000 in multiples of Rs. 100 and with no maximum limit.

How to invest in Post Office FD?

The post office FD can be opened across India using two methods as follows:

Also Read: Post Office Fixed Deposit Rates

Online method:

- The post office FD account can be opened online by using internet banking:

- Here, one will have to visit the official e-banking portal of the Post office at

- To log into the portal, you will have to use your registered ID and password.

- Then, click on “Service Request” under the “General Services” tab.

- Later, follow the directions that are present on-screen and then click on the “New Request” option to start the post office FD opening request.

Offline method:

- For this, one will have to visit the nearest post office and then collect the form for opening a new Post Office FD account.

- After submitting copies of the necessary documents with completely filled-out forms, the administrators at the post office will guide you regarding the additional directions for the process.

Eligibility to open Post Office FD:

- The following people can operate a postal FD:

- Indian residents can manage such investments individually or jointly.

- Minors are also eligible under this scheme, but it should be managed by their legal guardian.

- The following are not allowed to opt for fixed deposit investments through the post office:

Also Check: How to Become Mutual Fund Agent?

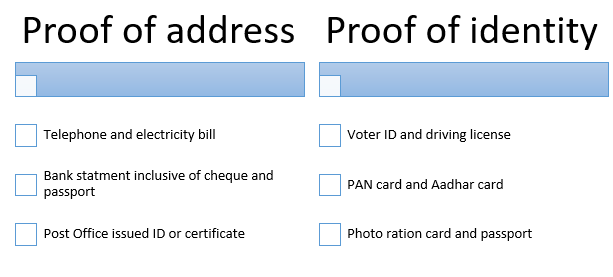

Documents required to open Post Office FD:

The following documents should be furnished for the post office FD scheme:

- Apart from all the above, the investor will also have to provide the details of a nominee for the FD.

- A witness must also be present when the investor is signing the investment papers.

Tax on Post Office FD:

- The 5-year post office FD qualifies for a tax deduction under section 80C.

- It also offers a tax deduction of up to Rs. 150,000 on the entire deposit.

- The interest on the FD is taxable for those taxpayers whose age is less than 60.

- However, interest up to Rs. 50,000 is entirely exempt from tax for senior citizens above the age of 60 years.

Loan against Post Office FD:

- A loan is provided for up to 90–95% of the FD amount.

- The interest charged on the loan against the FDs is low and is around 2-3% higher than the FD interest rate.

Features of a Post Office FD:

The following are the main features of the Post Office FD:

- An account can be easily transferred from one post office to another anywhere in the country.

- Interest is credited to the savings account of the holder.

- Any number of accounts can be opened at any post office anywhere in the country.

- Interest is also payable annually.

- A single account can be converted into a joint account and vice versa.

- The tenure of the deposit can be extended by making an application.

- The nomination facility is available at the time of opening the account and later as well.

- The account of a minor is converted after s/he becomes a major.

- An account can be opened by cheque or cash.

- There is also no maximum limit to the deposit.

- The minimum amount is Rs. 200 to 1000.

Premature closure of Post Office FD:

- An investor can withdraw only after six months from the date of the deposit.

- Before this period of 6 months, no withdrawals can be made.

- If an investor makes a premature withdrawal after the expiry of 6 months but before 12 months, then the interest will be payable only for the completed months.

- If any interest has already been paid to the depositor, it will be recovered from the deposit repayment amount and the interest payable on the withdrawal amount.

Also Read: Difference Between Futures and Options

Conclusion:

We hope that the above blog gives you all the details of the Post Office FD Interest Rate.

About Us:

Trading Fuel is our website for blogs where we give you knowledge about finance, the stock market, intraday trading, and technical analysis. Stay tuned with us for more such blogs.