Best EMA Strategy for Intraday Trading: There are many strategies used for intraday trading. One such strategy is the EMA strategy.

What is the EMA Strategy?

EMA stands for Exponential Moving Average.

An Exponential Moving Average (EMA) is a type of moving average (MA) that will place greater weight and significance on the most recent data points.

It is also known as the exponentially weighted moving average.

The EMA is one of the best technical indicators used more frequently by traders as well as investors in the stock market.

The EMA gives more weightage to the recent price data as compared to the Simple Moving Average (SMA).

What is the SMA Strategy?

SMA is a very popular analysis tool.

The SMA is the most commonly used financial indicator and is mainly used to identify trends.

The SMA is a lagging indicator because it is very much based on the data of past prices.

The SMA and EMA work best together to define price trends and momentum in trading.

What time period is best for calculating EMA?

Generally, the EMA is set at 9 by default, which is good for short-term investors.

A price above the moving average gives us a bullish signal, i.e., a reason to buy the stock.

A price below the moving average gives us a bearish signal, i.e., a reason to sell or short-sell the stock.

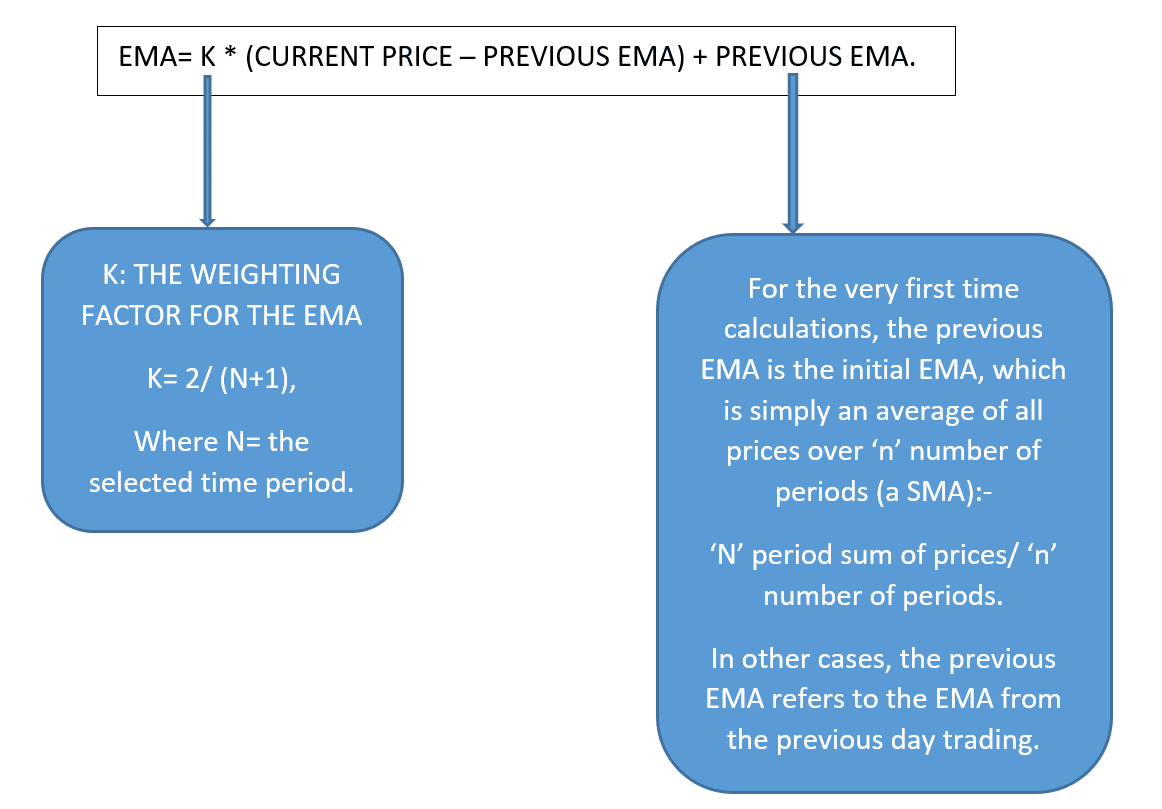

Calculating Exponential Moving Average (EMA):-

How does the EMA indicator work?

- All the rules of SMA apply here in the EMA strategy, but EMA is generally more sensitive to the price movement. It will help you to identify trends earlier than the SMA, but at the same time, it will experience more short-term changes than the corresponding SMA.

- The EMA will assist you in determining the trend direction and will provide you with worthwhile trades. When the EMA rises, go for a buy trade when the prices will dip near or just below the EMA, and when the EMA falls, go for a sell trade when the prices will go towards or just above the EMA.

- The EMA also helps to indicate the support and resistance areas. The rising EMA indicates price action support, and the falling EMA provides resistance to the price action. This will give the trader a hint to buy when the price is near the rising EMA and sell when the price is near the falling EMA.

- Moving Averages will help you to trade in the general direction, but with a delay at the entry and exit points. The EMA average has a shorter delay than the SMA with the same period.

When should you use the Exponential Moving Average (EMA)?

EMAs are used as confirmation measures. Many traders use the EMA along with other indicators to validate major market moves.

The EMA gives added weight to the recent price figures, and so this indicator will be most useful when trying to assess short-term volatility and the other trading opportunities that the price movement will create.

For longer time frames, the best value that the EMA offers is in spreading the weighted average of more volatile stocks over a broader time span.

For traders in the fast-moving market, EMA’s are highly accepted because they do a great job of determining trading bias. Now Let’s See, Best EMA Strategy for Intraday Trading:

Trading Rules or General steps to use Best EMA strategy for Intraday:-

EMA works on the following structure:-

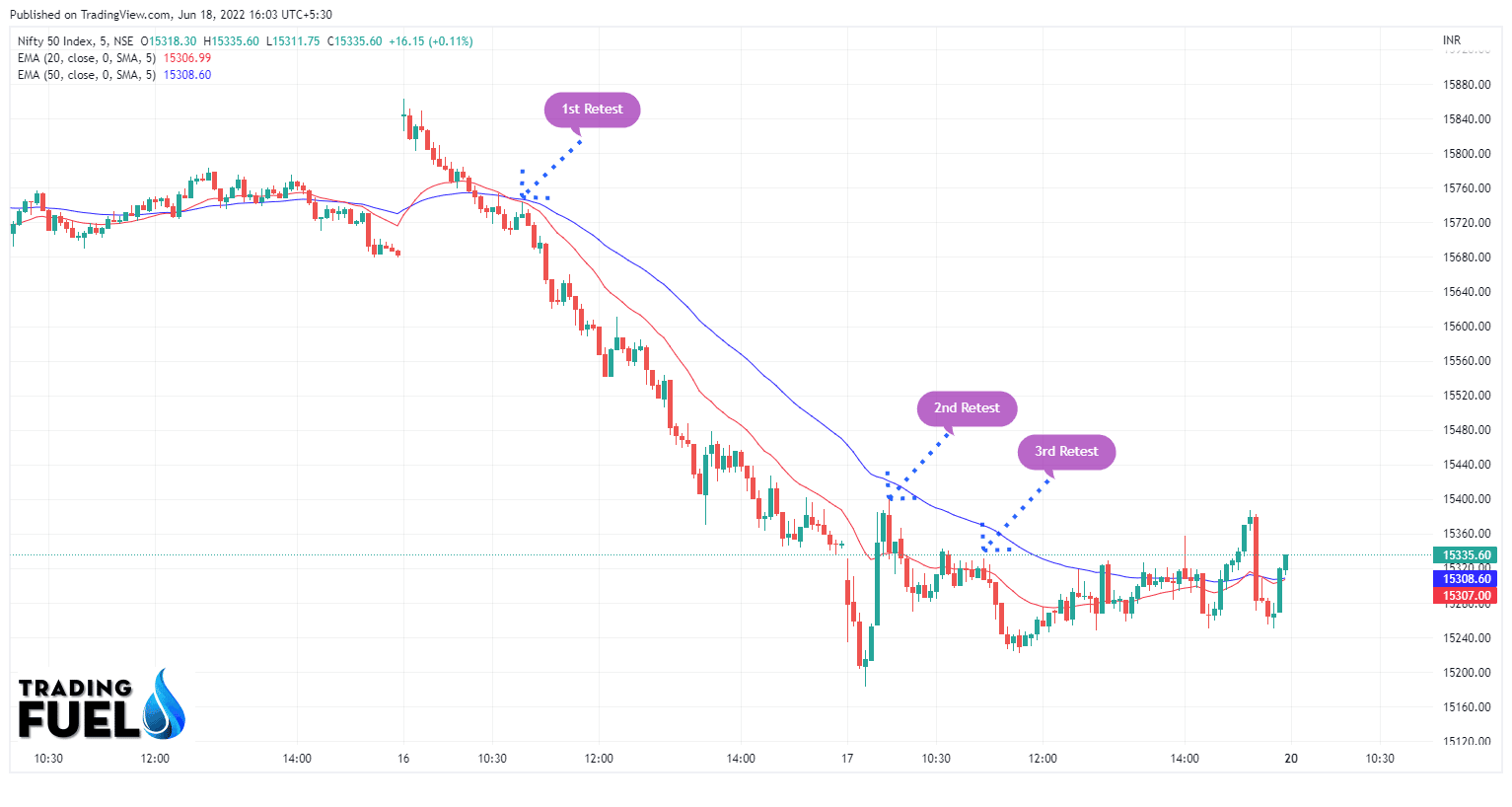

Step 1: Plot 20 and 50 EMA on your chart for Best EMA strategy for Intraday:-

The first and foremost step is to properly set up our charts with the right moving averages.

The EMA strategy uses the 20- and 50-period EMA.

The EMA crossover can be identified at a later stage.

Step 2: Wait for EMA crossover and for the prices to trade above 20 and 50 EMA:-

For this step, there will be a need for the price to trade above both the 20 and 50 EMA.

Later, we have to wait for the EMA crossover that will add weight to the bearish case.

After looking at the crossover, we make up our mind about either buying or selling the trade.

As we know that the market is prone to false breakouts, we need more evidence than simply an EMA crossover.

To avoid this false breakout, we have our next step.

Step 3: Wait for the zone between 20 and 50 EMA to be tested twice, then look for your trade opportunities:-

Simply, after a successful crossover, we need to exercise more patience.

So we need to wait for 2 successful retests of the zone between 20 and 50 EMA.

The market has developed a good trend after the 2 successful retests between the 20 and 50 EMA zones.

Here, we should not forget that no price is too high to buy and no price is too low to sell.

When we say zone between 20 and 50 EMA, we don’t mean that the price should trade between these two averages. We just wish to cover the entire price segment between the two EMAs. This is simply because the price will only touch the shorter moving average.

Step 4: Buy at the market when we retest the 20 and 50 EMA zone for the third time:-

After the successful retest of the 20 and 50 EMA zones for the third time, we can go ahead and sell the trade at the market price.

Here, we are clear that the market is in a bearish trend and is strong enough to continue pushing the market higher.

Step 5: Place your stop loss 20 points below the 50 EMA:-

After the successful retests, we are sure that the trend is down.

The trade remains intact when we keep trading below both the moving averages.

Keeping this in mind, we place our stop loss at 20 points above the 50 EMA.

This stop loss of 20 points below the 50 EMA is for when you have sold the trade.

In case, you are short-selling, your stop loss has to be 20 points above the 50 EMA.

The 20-point buffer is there because we don’t know when the market will reverse.

Step 6: Book your profit once we break and close below the 50 EMA:-

Here, we don’t use the same entry technique for the exit.

If we wait for the EMA crossover to happen again, we tend to lose a good amount of profits.

The EMA formula plotters allow us to book profits at the right time before the market is about to reverse.

Differences between Exponential Moving Average (EMA) and Simple Moving Average (SMA):-

Although both the averages are almost similar, there are still a few differences between the two:-

| Simple Moving Average (SMA) | Exponential Moving Average (EMA) |

| Appropriate in less volatile markets | Appropriate in more volatile markets |

| Mid-term to long-term trading | Short-term trading |

| Focus on overall trend and major support and resistance | Focus on faster response to price movements |

| More lag | Less lag |

| Longer time frames | Shorter time frames |

| Eliminate market fake outs | More prone to market fake outs |

| Slow-moving and smoother average | Quick moving and sensitive to recent price |

Exponential Moving Average (EMA) Advantages and Disadvantages:

Everything has its own pros and cons, and EMA also has its own advantages and disadvantages.

The following are the advantages of the EMA:-

The EMA is quick-moving and is also good at showing recent price swings.

The following are the disadvantages of the EMA:-

Because we all know that the market is volatile and fast-moving, the EMA is more prone to giving the market fake-outs. Along with it, the EMA might end up giving errant signals.

Conclusion:-

Moving averages are the backbone of trading. If used well, moving averages will help you to complete the trade with a minimal loss factor.

About Us:-

Trading Fuel is our blogging website that will provide you with insights about finance, technical analysis, stock market queries, and other intraday tips. We hope that you like our blog “best ema strategy for intraday trading”.

Stay tuned with us and we wish you happy reading.

Contain & Image ©️ Copyright By, Trading Fuel Research Lab